CME: Election Over But What Will Be the Direction of Future Policies?

US - By the time you read this, the voting will be over — the counting may not be but the voting will. Some readers will be happy and others will be disappointed. Regardless of the outcome, it will still be important for our US readers to stay involved in our nation’s decision-making through personal efforts or those of your industry, trade or topical groups, write Steve Meyer and Len Steiner.Four years can change things for the better or

worse but our beloved Republic has endured both extremes before

and will do so again. With all due respect to our readers outside the

U.S., I would still choose to live nowhere else on the planet and thank

God every day for making me an American. We have our warts and

foibles but are still, I believe, a shining city on a hill! SRM

One of the outcomes of this election will be the direction

of fiscal and, to a lesser degree, monetary policy in the years to

come. We say “lesser degree” for monetary policy based on the idea

that the Federal Reserve maintains its independence over matters

such as interest rates, money supply, etc. I think we all recognize that

the Fed’s independence is not complete but Mr. Bernanke and company do have a lot of leeway and have historically used it — sometimes

to the chagrin of the resident of The White House.

Both fiscal and monetary policies will have their most profound impacts on the meat and poultry sectors through their impact on

demand, both domestic and foreign. Last week’s employment report

was encouraging from the standpoint of job growth but disappointing

from the standpoint of the unemployment rate as labor force growth

outpaced job creation. We didn’t hear much talk of it but the mere fact

that the labor force grew strikes us as encouraging as well since it is

only job seekers that get counted in that number and there was evidence that a good number of people had stopped looking for work.

The real challenge will be to get U.S. consumers’ incomes

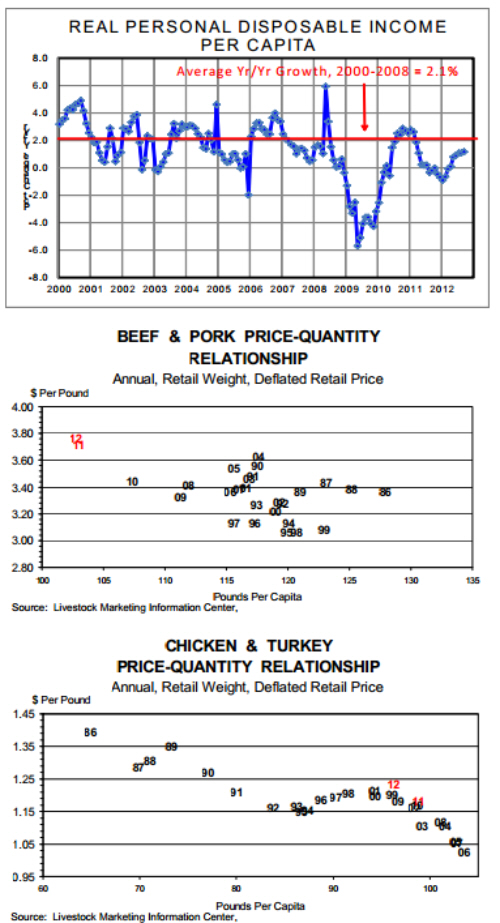

growing at a pace that will sustainably support more consumer spending. The chart below shows the year-on-year change in real per

capita disposable income back to 2000. The significant hit that consumers suffered in the recession is obvious but the real problem is the

anemic recovery that has ensued. Yes, there were some 2% growth

rates in 2010 and early 2011 but those were relative to VERY POOR

results one year earlier. The yr/yr rate has now been over 1% for

three months — thru September. Three months is better but far from

satisfactory. And remember, this is disposable income which means it

is measured AFTER TAXES. Any move to balance public budgets

through higher taxes could quickly offset any total income gains and

leave this growth rate in its yet-anemic state.

As can be seen in the bottom charts, beef/pork and chicken/

turkey demand has been pretty stable so far this year — reductions in

per capita consumption (or “disappearance” or “availability”) have

been accompanied by price increases roughly commensurate with a

steady demand relationship. Per capita product offerings for all species have fallen since 2006 due to the output reductions needed to

cover higher costs and growing exports. Animal protein demands

have really held up pretty well in the face of slowly-growing incomes

but can they continue to do so? We would feel MUCH better about

2013 and beyond if the top graph showed some improvement SOON.