CME: Modest Changes to USDA Chicken Output Forecast

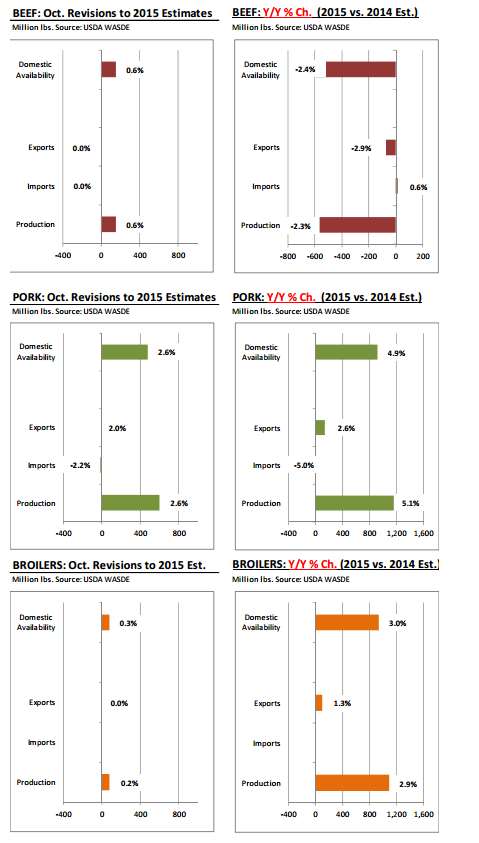

US - The latest WASDE forecasts presented some very modest changes to the USDA outlook for beef and chicken output in 2015, write Steve Meyer and Len Steiner.The latest WASDE forecasts presented some very modest changes to the USDA outlook for beef and chicken output in 2015.

However, USDA did make some very significant changes to its forecast for pork supplies and availability next year, reflecting the results of the September 'Quarterly Hogs and Pigs' survey. Also, so far there has been limited impact from the PEDv virus and grain costs continue to decline, which likely caused USDA analysts to raise their expected production numbers for the second half of 2015.

USDA now pegs total pork production for 2015 at 23.938 billion pounds, a 600-million-pound revision to the September forecast. Changes to the 2014 numbers were minor, with production now pegged at 22.773 billion pounds.

Based on the latest forecast, US pork production in 2015 is now projected to increase by 1.165 billion pounds. It is important to recognise the degree of change in terms of pork supplies in the US market and the effect this could have on pork availability and pricing next year. For all the consternation and record high prices this year, pork supplies for 2014 represent a 414 million pound reduction from a year ago.

Now USDA expects that we will not only recover that lost supply but also add an additional 700 million pounds to it. USDA did revise higher its forecasts for pork exports next year by about 105 million pounds but for the most part the increase in US pork production is expected to be absorbed domestically — hence the lower futures prices.

The last time we had a year/year increase in pork production of this magnitude was in 2007 and 2008 when pork production increased by 888 million pounds (2007) and then 1.4 billion pounds (2008). However, in those two years higher exports helped absorb the big increase in production and per-capita domestic availability was not impacted much.

Indeed, in 2008 US pork production increased by 1.4 billion pounds but pork exports were 1.5 billion pounds or so higher than the previous year. Pork exports for 2015 are pegged at 5.250 billion pounds compared to 3.141 billion pounds in 2007.

It is certainly more challenging to maintain that type of export growth rate and ongoing restrictions regarding ractopamine use in feed serve as a brake on US pork export growth.

As for beef and chicken, USDA changes were less significant.

The revisions in beef production were relatively modest, as USDA now projects total beef production next year to be 23.861 billion pounds, 150 million pounds (+0.6 per cent) higher than the September forecast and still down about 594 million pounds (-2.4 per cent) from 2014 levels. Per-capita beef availability in 2015 is projected at 52.4 pounds per person, compared to 56.3 pounds in 2013, a seven per cent decline in just two years.

Per-capita beef availability is now down almost 20 per cent compared to 2007 levels, which helps explain the current beef price levels in the US market. USDA expects beef imports next year to be 2.7 billion pounds, slightly higher than this year.

This forecast certainly has a lot of risk to it. Australia has shipped a significant amount of beef to the US in 2014 in part because prices were high but also because they had meat to sell. If drought breaks there, then we could see lower Australian imports, further reducing the supply of beef available to the US consumer

Further Reading

You can view the full CME report by clicking here.

You can view the WASDE report by clicking here.