CME: Egg, Turkey Markets Dramatically Impacted by Avian Flu

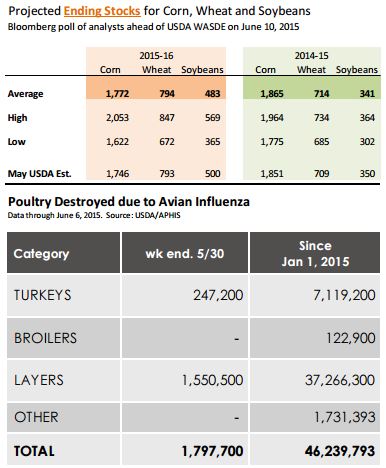

US - Avian influenza continues to dominate the conversation in the poultry sector, write Steve Meyer and Len Steiner.According to APHIS, there were 12 new cases for the week ending June 6, impacting 1.8 million birds. There were 10 cases in turkey farms with a combined flock of 247,000 birds.

Information on the flock size for one turkey farm was pending so it is likely the final number will be larger.

As for chickens, we continue to see new cases in egg layer farms but no cases in broiler farms. One large layer operation in Iowa (1.1MM birds) was hit this week.

Iowa egg production appears to be most affected by the outbreak of HPAI. Since late April, almost 29MM layers in Iowa alone have been affected by the disease.

In its latest ‘Chickens and Eggs’ report, USDA pegged the April inventory of table egg layers in Iowa (flocks of +30k) at 58.226 million.

If losing 50 per cent of the production capacity for an industry in a state does not qualify as an unmitigated disaster, we don’t know what does.

Nebraska has lost about 3.8MM layers out of table egg layer flock of 9.4MM and Minnesota also has lost 3.8MM out 11.3MM. So far, over 37MM table egg layers (out of 296MM) have been affected, most of them after May 1.

This has dramatically impacted egg markets, with the price of large white shell eggs last night quoted by Urner Barry at $2.55/dozen compared to $1.24 a dozen on May 1 (+105 per cent).

Turkey prices also have been dramatically affected. Spot supplies of turkey breast meat remain extremely tight as producers are looking to fill existing orders and there is little left to be traded in the spot market.

Turkey breast meat, a staple of the deli meat case and sandwich shops, now is trading at an all time record high of $4.25/lb, compared to $3.3/lb on May 1.

Seasonally prices for turkey breast move higher into the summer and fall. This year, the extreme shortage is likely to produce some prices that were unfathomable only a few weeks ago.

It is now a bidding war for turkey breast meat and the usual price forecasting models are out the window. Producers are expected to respond and seek to ramp up production. But this will take some time and it may take until next year to normalise the situation.

Grain markets: USDA will publish on Wednesday, June 10, its monthly update of grain, livestock and dairy forecasts for the current and upcoming marketing years (WASDE).

For the most part analysts expect few changes to the USDA projections for the new corn and soybean crops.

On average analysts polled by Bloomberg expect ending stocks for the new corn crop to be 1.772 billion bushels, slightly higher than the USDA May projection.

There is some talk in the market about the number of corn acres that were planted. Some analysts expect a larger shift to beans that USDA forecasts.

Excessive rains in the Southern Plains also may have impacted the corn crop there and could show up in the acreage report that will be published June 30.

Recently EPA released the Renewable Fuel Standard which sets the ethanol mandate at 14 billion gallons, below the 15 billion envisioned by Congress. The mandate would imply a 4.8 billion bushel guaranteed demand for corn.

Use in the past year has exceeded this levels, in part due to exports but also better than anticipated domestic demand.

In May USDA projected corn use for ethanol production at 5.2 billion bushels and analysts appear to agree that this forecast will not change in the June report.

Corn yields also are unlikely to change and USDA usually waits for the acreage survey to make any changes to the planted/harvested number component.