CME: US 2015 Egg, Turkey Production Expected to Fall

US - The House of Representatives has gotten quite busy on a couple of issues important to the livestock and poultry sectors, write Steve Meyer and Len Steiner.After the House Agriculture Committee passed a reauthorisation of the Livestock Mandatory Reporting Act (the law that created the mandatory price reporting systems for cattle, beef, hogs and pork), the entire House gave the reauthorisation unanimous approval this week.

The approved version has two price reporting changes requested by the pork industry and several requested by the sheep/lamb sector.

It also included a provision that would prevent the mandatory price reporting system from being shutdown during any government furlough - basically establishing the system as “essential” to prevent a lapse of reporting such as occurred in October 2013.

The next step will be Senate action but no legislation has been introduced there yet. In addition, the House voted to repeal the livestock, meat and poultry aspects of mandatory country-of-origin labelling (MCOOL).

The size of the margin (300-131) was a bit surprising. Here, too, the next step would be Senate action but, like for MPR, no legislation has yet been introduced in the senior chamber.

MCOOL originally came from the Senate and has long been championed by a number of Northern Plains Senators. Whether there will be enough votes to repeal MCOOL remains to be seen.

It is possible the Senate may try to modify the program instead of repeal it. We have heard no specifics of the nature of any modifications that might be proposed.

Impact of Avian Flu on Poultry Sector Output

As was expected in light of significant losses of birds to high pathogenic avian influenza (HPAI), USDA made some significant changes in its forecasts for turkey and egg production in its World Agricultural Supply and Demand Estimates.

USDA had pegged 2015 turkey production at 6.201 billion pounds ready-to-cook (RTC) weight in May. That figure was 3.9 per cent higher than in 2014.

The agency’s June estimate is 5.826 billion pounds, 6.3 per cent lower than the May estimate and 2.6 per cent lower than one year ago.

The reduction would put 2015 per capita availability/disappearance/ consumption at 15.4 pounds, down 0.4 pounds from last year’s 15.8.

USDA’s estimate for 2016 output is now 6.238 billion pounds RTC weight. That number is 3.2 per cent lower than the May estimate but would be 7.2 per cent higher than USDA’s current forecast for this year.

USDA made only small adjustments to its broiler production forecasts for 2015 and 2016. The 2015 estimate of 40.683 billion pounds, RTC weight is 4.6 per cent higher than last year. The 2016 estimate of 41.625 billion pounds would represent an increase of 2.1 per cent from this year.

These estimates obviously assume that the broiler sector continues to avoid HPAI - about the only assumption that can be made at this time and one that the industry certainly hopes turns out correctly.

HPAI has killed more birds in the egg sector than in any other so far and USDA reduced its estimate of 2015 egg production by 4 per cent this month. The forecast 7.994 million dozen would be 4.1 per cent lower than last year’s 8334.8 million dozen.

The WASDE report also reduced 2016 forecast egg output by 4.5 per cent from the May report level. The larger reduction for 2016 production indicates that USDA expects the impact of HPAI to linger for some time.

Industry sources agree with that expectation given the time it will take to get replacements to productive age.

US broiler production continues to exceed year ago levels by a significant amount. Production for the week that ended June 5 was 8.9 per cent higher than one year ago.

The 624.1 million pounds RTC (that was Memorial Day week) put the 4-week total at 7.9 per cent higher than last year and the year-to-date total to +6.9 per cent.

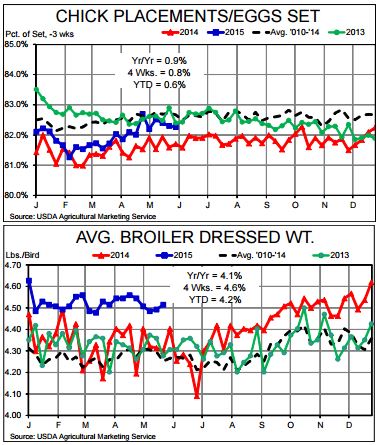

The key factors in this growth have been a return to normal productivity levels and a sharp increase in average bird weights. The top chat below illustrates the productivity improvement as the ratio of chicks place to eggs set three weeks prior has now returned, generally, to the level it had maintained prior to the fall of 2013.

Egg sets are up 2.3 per cent YTD and chick placements are up 2.9 per cent YTD. Those higher sets and placements have quite logically led to higher broiler slaughter.

The week of June 5 saw 142.9 million birds harvested, 4.6 per cent more than one year ago, bringing the year-to-date growth rate to 2.6 per cent.

But the biggest contributor to chicken output growth has been sharply higher average bird weights. After lagging year earlier levels through June 2014, weights began to increase sharply as feed costs moderated. They were 4.1 per cent higher than one year ago the week of June 5 but are up 4.6 per cent, year/year, the past 4 weeks and are up 4.2 per cent over 2014 YTD.