CME: US Broiler Production Higher Despite Avian Flu

US - While the spread of Highly Pathogenic Avian Influenza (HPAI) has been devastating for turkey and egg production, broiler production so far has not been impacted and output is significantly higher than in 2014, write Steve Meyer and Len Steiner.Broiler ready-to-cook production for the four weeks ending June 13 was 3.794 billion pounds, 7.4 per cent higher than a year ago.

Year to date production (based on weekly statistics) was reported at 16.595 billion pounds, 6.9 per cent higher than the same period a year ago.

Chicken is the most consumed meat protein in the US and rapid increases in supply coupled with a slowdown in demand (e.g. poor exports) could impact not just chicken prices but the price of competing proteins. And the increase in chicken production is not likely to slow down anytime soon.

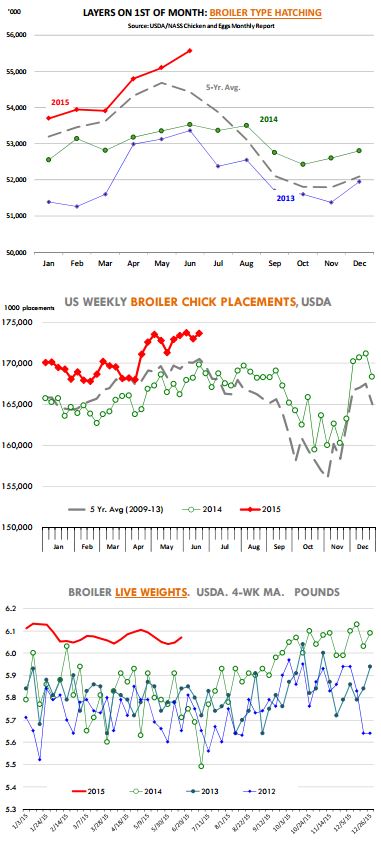

Each month, USDA reports the inventory of chickens that will produce eggs for broiler production (these are different than table eggs).

As of June 1, USDA reported the number of broiler type hatching layers to be 55.569 million head, 3.8 per cent higher than a year ago and the largest supply since May 2011.

Eggs set in incubators in the last four weeks have averaged about 2.3 per cent above year ago levels and, given the number of layers on hand, egg sets should remain well above year ago levels into the fall. But getting more eggs into incubators is only part of the supply picture.

In 2013 and 2014 the broiler industry struggled with a notable decline in overall productivity - basically they were getting fewer viable chicks than normal. As a result, even as egg sets in 2014 were generally higher than the previous year, the number of chick placements was steady or even negative for some weeks.

That situation appears to be changing and the ratio of placements to egg sets has been trending higher for the last few months. We have yet to reach the levels observed in 2011 and 2012 but the improvement means that chick placements in the last four weeks have averaged 3.2 per cent above year ago levels (see chart).

The increase in placements has been driving year over year increases in broiler slaughter, up 2.5 per cent in the last four reported weeks.

Because of the larger hatching flock and improvements in productivity, slaughter numbers should continue to track well above last year in the short term. But how is it that slaughter for the past four weeks is up 2.5 per cent and yet production is up 7.4 per cent?

Lower feed costs and relatively good margins in the past 12 months have given producers an incentive to get birds to much heavier weights.

Live weights in the past four weeks have averaged 6.07 pounds, 4.7 per cent higher than a year ago. And this has been going on all year (see chart). Where does the broiler industry go from here?

There continues to be talk about the possibility of HPAI impacting production in the fall. However, it has been somewhat of a puzzle as to why there have been no broiler farms impacted so far even as some were located relatively close to turkey and egg layer farms devastated by the disease.

There is speculation that maybe this strain of the virus affects only birds that have reached a certain level of maturity. Broilers take only a few weeks to reach market weights and may not be enough time for the virus to impact them. This remains a major wild card.

So far, bird flu impact on broiler production has been zero while the demand effect (lower exports) have been significant.