CME: Bird Flu a Wild Card for US Chicken, Pork Markets

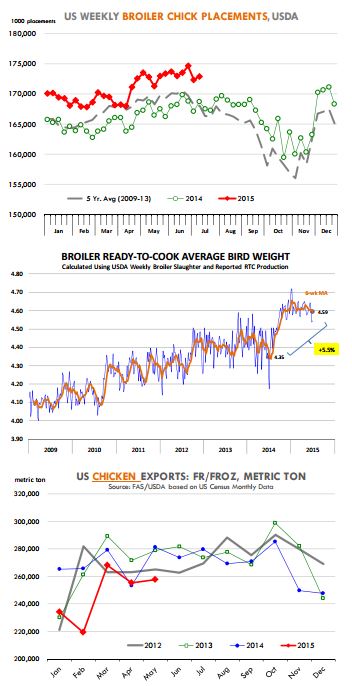

US - While much of the focus in the pork market has been on slaughter levels, weights and fall supplies, we think market participants would do well to also keep an eye on the broiler market.Chick placements are up, the hatching flock is larger than a year ago and producers continue to bring to market birds that are significantly larger than a year ago.

It is the combination of ample chicken supplies and the surge in hog slaughter that has helped contain meat price inflation for these two species so far this year.

Bird flu remains a wild card for the market come fall although it is not entirely clear what the risk profile is for the broiler industry at this point.

There have been broiler farms in areas affected by bird flu but no outbreaks. Is this because broilers are coming to market far too quick to be susceptible to bird flu? Or is it because bird flu has affected areas with heavy concentrations of turkey and egg layer farms.

There have been past cases of highly pathogenic avian influenza in broiler farms (Netherlands 30 MM birds culled in 2003—WATT 7/9) and so the risk of a widespread outbreak remains as infected birds migrate south this fall.

So this is one bullish risk factor for both chicken and pork markets this fall—but it is one that is difficult to quantify and so far futures have not placed much of a risk premium for fall contracts.

In the meantime, the pace of growth in the broiler market shows few signs of slowing down. The ‘Hatchery’ report released by USDA yesterday showed that egg sets in the main 19 states were 208.024 million, 0.5 per cent higher than a year ago.

For the last six reported weeks, egg sets have averaged almost 2 per cent above last year. While egg sets may appear to be slowing down, this is more because of somewhat unusually large numbers last year and the trend for the most part is in line with the seasonal trend.

Indeed, based on the size of the hatching flock, up 3.8 per cent as of June 1, we should continue to see robust year/year increases in the number of broiler type eggs set in incubators.

The ratio of chick placements to egg sets also has been improving. It was hovering near 81 per cent in early 2014 when productivity issues hit breeding farms. Today it is around 82.5 per cent - near the long term trend.

Chick placements last week (19 States) were 172.9 million, 2.5 per cent higher than a year ago. In the last six reported weeks, chick placements have averaged 2.9 per cent above last year.

So broiler slaughter should remain around 2.5 per cent to 3 per cent above year ago levels into the fall but that is only part of the supply expansion in broilers this year. Weights remain dramatically higher and that has been even more significant in terms of supply growth.

The second chart to the right illustrates the shift in terms of broiler weights so far this year.

Ready to cook average weights this year are 4.61 pounds/bird compared to 4.4 pounds during the first six months of 2014—a 4.8 per cent increase.

For the last six weeks, broiler weights are running 5.5 per cent above last year’s levels, thus pushing weekly broiler production 7-8 per cent above year ago. But even as broiler production has increased at a rapid pace, exports have failed to keep pace.

China and South Korea have placed total bans on US exports using “Bird Flu” as an excuse while Russia has blocked US shipments in response to US sanctions.

May chicken shipments were down 8.4 per cent from the previous year - implying a dramatic increase in the supply of chicken that needs to be absorbed in domestic markets.