US Meat Consumption to Grow

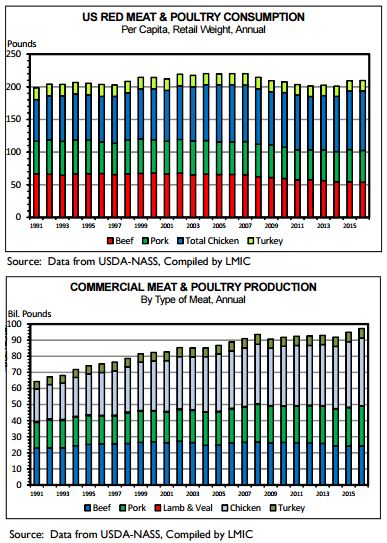

US - Annual US per capita meat consumption will grow by more than 2 pounds this year for the first time since 2004, write Steve Meyer and Len Steiner.As can be seen in the graphs, that increase is expected to be maintained next year according to forecasts by the Livestock Marketing Information Center.

This year’s increase is driven by healthy gains in chicken (+5 lbs./person) and pork (+3 lbs./person).

The slight growth (0.43 lbs./person) forecast for 2016 will be driven by more modest gains for those species and slight growth in turkey consumption.

Domestic per capita beef consumption is forecast to be steady with 2014 levels this year and to actually fall slightly (0.5 lbs/person) in 2016.

Some might mistakenly conclude that higher consumption/usage is indicative of higher “demand”. While true that consumers will in a sense “demand” more meat by buying or consuming more meat, quantity alone does not constitute economic demand.

That is nothing new to readers as you have read it in these pages many times now.

Consumption/quantity is just one piece of that puzzle with the price being the other component. This does not mean that per capita consumption is not important.

Over the long run, growth in the consumption of your product is a very, very desirable thing. And it can be indicative of higher demand - but it may not.

Chicken is the best example of this. Back in the 1980s and ‘90s there was a raging debate about whether chicken demand was actually growing or whether chicken was just growing consumption by reducing its price.

That happened, of course, because the efficiency of chicken production kept getting better. Falling costs allowed prices to fall relative to beef, pork and lamb while still providing handsome returns to chicken companies.

The results of economic studies fell into both camps but the preponderance of those results, we think, said that in those days relative prices were the driving force. But relative chicken prices have, in more recent years until the explosion of beef and pork prices the past three years, been relative steady while chicken consumption has continued to grow.

That indicates some increase in chicken demand over time. Contrast the pattern of per capita consumption in the top chart with that of total US meat production in the bottom chart.

One notable difference is that the production chart includes a practically invisible red bar (it is between the green “pork” bar and the powder blue “chicken” bar) for lamb and veal.

Lamb consumption was never nearly as large as the other species but has declined steadily from 4.5 retail lbs./person in 1962 to around 1 retail lb/person annually since 2008. The decline in veal consumption has been even more dramatic - from 5.2 retail lbs/person in 1960 to just 0.22 lbs./person in 2014.

The long-term change in consumption for those two species reflect long-term demand declines driven by preferences, demographics and lower prices of alternative proteins.

US meat production, though, will hit an all-time high of 94.895 billion pounds carcass weight this year.

Converting that production growth to per capita consumption involves several obvious variables.

First, the US population continues to grow by about 0.7 per cent per year. That rate is slightly slower than before the Great Recession but it takes a short 1 per cent for the US meat/poultry industry to just keep up with out own population growth.

The other big adjustment is exports. Net exports now account for 17 per cent or so of annual pork production.

As recent as 1994, the US was a net IMPORTER of pork. Net exports account for roughly 20 per cent of US broiler production. Beef trade is roughly a net zero factor as we usually import about as much beef as we export.

Lagging exports for all three species are a major contributor to the growth of domestic consumption this year. Forecasts for higher exports in 2016 are one factor that will keep domestic per capita consumption near this year’s level.