CME: US Bird Flu Return Could Affect Market Re-Openings

US - Bird flu is back - the highly pathogenic H7N8 Avian Influenza was found present in a number of commercial turkey flocks in Dubois County, Indiana, write Steve Meyer and Len Steiner.The virus was confirmed in a 60,000 head turkey farm on Friday but then on Saturday reports indicated that another eight farms around the initial location also were affected.

At this point we do not have total figures for all the turkeys affected by the disease but it would appear that the number is over 100,000 head. The fact that the disease strain found is different from the one that caused so much destruction last spring does not appear to make much difference.

They are both highly pathogenic, which means that aggressive culling of affected flocks is the best way to contain the spread of the disease. Neither of these two strains, H5N2 and H7N8, has in the past been associated with human deaths.

Rather, the primary impact of the virus is economic, causing significant losses for the affected farms. As for the broader markets, we would view the overall impact as somewhat bearish although that is for the most part speculative at this point.

The reason we view this as somewhat bearish for livestock markets is because the supply impact from this outbreak is quite limited, affecting a small number of farms and a very small portion of the turkey supply.

However, the presence of HPAI (highly pathogenic avian influenza) in US poultry flocks could delay the reopening of some export markets for US chicken products.

Chicken supplies are burdensome at this point and the industry needs all the help it can get to normalise export demand.

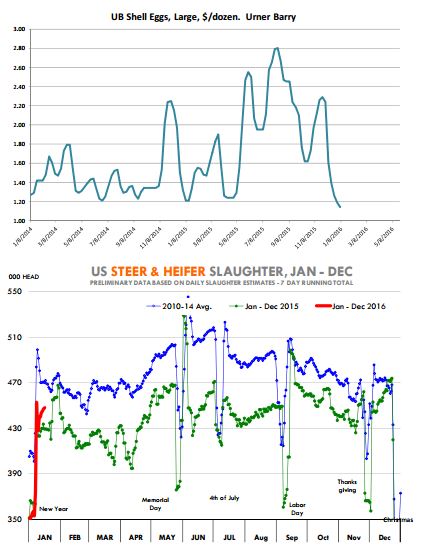

The chart shows egg prices following the outbreak of HPAI last spring and summer. After a dramatic price increase, egg prices have declined sharply. In part this is because egg supplies have normalised.

Also, it shows the demand impact as some end users likely found alternatives or changed some of their product offerings. This is always the risk following disease outbreaks. While initially the price impact is significant, the risk is that prices then collapse once supplies recover and some of the lost demand takes time to return.

Cattle futures were sharply lower on Friday following technical selling and extreme anxiety about the possibility of a global recession in 2016.

There is broad acknowledgement that the collapse in crude oil prices could have significant negative impacts for a number of countries.

What is unknown/unknowable at this point is how the situation may unfold, especially in emerging markets.

US fed cattle and beef prices are lower than a year ago but they still remain quite high from a historical perspective. Recession in countries such as Russia, Venezuela and Brazil was particularly negative for beef demand in 2015.

The risk is that a global recession could further limit US beef exports while at the same time continuing to attract more beef imports into the US.

Brazil is close to gaining access to the US beef market, which could further add to US supply availability. Needless to say, there are plenty of unknowns at this point and futures appear willing to aggressively price a lot of the downside risk, especially in the back end of the futures curve.

In the short term, packer margins are in pretty good shape thanks to still quite strong beef prices and fed supplies that are still somewhat front loaded. It will be interesting to see how the fed cattle market dynamic will develop in the next three months.

Strong packer margins will likely continue to keep cattle moving. USDA steer and heifer slaughter last week is estimated at 448,000 head, 4.3 per cent higher than a year ago.

The choice beef cutout is expected to decline in the next few weeks but if beef prices hold together better than current futures pricing, fed supplies could get current in a hurry, setting the stage for higher spring prices. Keep you eyes on those dressed weights, they should tell the story.