CME: Chicken Supply Projected 9.1 Per Cent Higher Than 2014

US - Competition for the “grilling dollar” will be tougher this year given the significant increase in supplies of all three main proteins, write Steve Meyer and Len Steiner.Feedlot operators are scrambling to accelerate marketings given the discounted forward prices and seasonal demand weakness in July and August.

The large basis is offering a strong incentive to pull cattle forward. Hog producers also appear to have plenty of supply on the ground.

Weekly hog slaughter last week should be above 2.2 million head, quite large for end of April. And yet, large as beef and pork supplies are, their increase dwarfs compares to the amount of chicken currently in the pipeline.

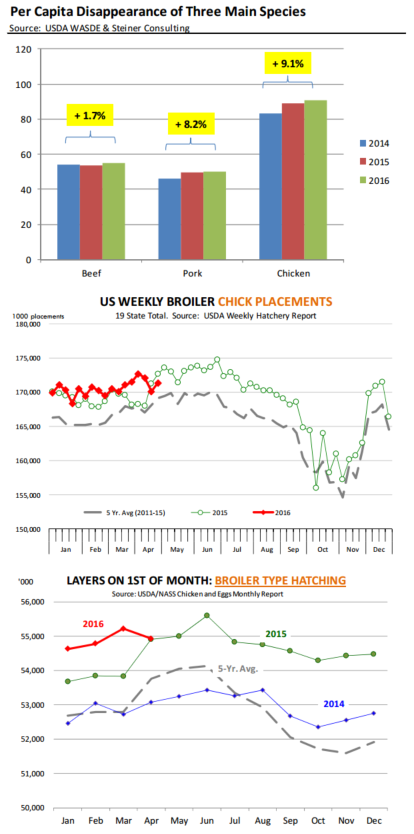

Consider the chart, showing per capita domestic disappearance in 2014, 2015 and projections for 2016.

This year US consumers will have 7.6 pounds more chicken available than in 2014 (+9.1 per cent), 3.8 pounds more pork (+8.2 per cent) and 0.9 pounds more beef (+1.7 per cent).

The increase in chicken supplies is not a surprise, producer margins were excellent in the last two years, fuelling growth.

And at this point there appear to be few threats to the feed price outlook. The benign cost structure may change this summer, with some analysts calling for a dry August in the US.

Speculation aside, in the short to medium term, US chicken supplies are expected to steadily increase.

Broiler chick placements imply that slaughter for the next six weeks will continue to run about 1.5 per cent above year ago levels.

Add to this another 1 per cent increase in broiler weights and chicken output should continue to expand at a 2.5 per cent pace into Memorial Day.

Current USDA forecast is for broiler production this year to increase by a little over 1 billion pounds (+2.6 per cent). So far we are right on track with that projection.

But the supply available in the domestic market is a function not just of total domestic production but also how much we are able to sell to other markets.

The latest USDA forecast calls for 2016 broiler exports to increase by around 421 million pounds (+6.7 per cent). Still, current export projections of 6.7 billion are well short of the 7.3 billion pounds that was exported in 2014.

Why were exports down in 2015 and is there a chance to return to those levels this year? They were down because of Avian Influenza bans and Russia. Exports last year fell almost 1 billion pounds.

Out of this total, about 305 million pounds were due to loss of Russian market. That business is unlikely to return this year.

Exports to Angola were down 202 million pounds and exports to China were down 245 million pounds. Exports to Angola show signs of improving but prospects for more exports to China are dim.

At this point the USDA forecast for higher chicken exports makes is probably as bullish as it can be. Broiler production should continue on a growth path, albeit a slower one, in the coming months.

The inventory of broiler type hatching layers declined as of April 1 but it remains substantially higher than what it was a couple of years ago.

Larger birds also continue to offer efficiency dividends. Some processors are already adding capacity to support expansion. So while chicken production may not grow at a 5 per cent clip, going back to zero growth also does not appear likely.

Getting exports back on track remains critical, otherwise look for chicken patties, chicken sausages and a million other chicken products to further out-muscle beef and pork.