CME: High Demand for Chicken Leg Parts

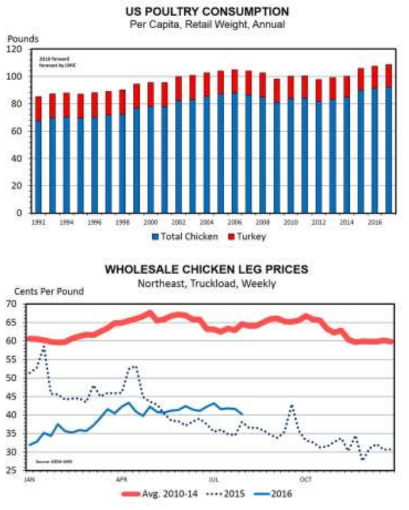

US - Domestic broiler consumption during the April-June quarter increased slightly from the prior quarter, totalling 26.4 pounds per person, up from 26.2 pounds the prior quarter and up from 25.7 pounds a year earlier, write Steve Meyer and Len Steiner.The 3 per cent gain from a year ago was driven by production that was up 2.2 per cent.

Broiler export volumes declined by 107 million pounds from the year earlier quarter, an amount that moved into domestic supply channels to supplement production volumes. In percentage terms, exports came up short of a year earlier for the quarter by 6 per cent.

Domestic demand for chicken dark meat has been a highlight of recent months. Wholesale leg quarters prices moved up 26 per cent (NE US markets reported by USDA-AMS) from the prior quarter, averaging 35 cents per pound versus 32 cents in the same timeframe in 2015.

At the same time, exports of leg quarters declined 154 million pounds. Some of the decline in exports was absorbed into frozen inventories (24 million pounds) leaving an additional 130 million pounds on top of the increase in fresh production to move into the domestic market and it did so at rising prices.

Grocery store meat price relationships have tended to favour chicken in recent years and these effects tend to linger. The average retail price for all chicken during the spring quarter was down 3 per cent from a year earlier.

Retail chicken prices as a percentage of fresh beef prices stood at 33 per cent for the spring quarter, which by itself is not that significant, but the price relationship is the same as the quarter before and the year before.

The improved interest in chicken dark meat at wholesale does not seem to be driven by changes in prices at the retail level. However, it is worth noting that in the spring of 2014, retail chicken prices as a percentage of beef prices were 35 per cent, and 40 per cent in the spring of 2013, raising the issue of lags involved with consumer responses to changes in price relationships.

Traditionally, broiler consumption tends to peak in the summer quarter (July-September), consistent with demand for fried or barbecued chicken. Consumption set a record last summer, at 27.1 pounds per person (retail weight).

The auspicious demand for leg parts during the spring hints of a new record this summer, but that may be difficult to achieve. Broiler production, on a ready-to-cook basis, is expected to only be up 1 per cent from a year ago, compared to the 2.2 per cent gain posted in the spring.

Chicken exports last summer collapsed due to international concerns about avian influenza in the US poultry industry. A steady trend in export volumes from the spring to the summer would produce a year-over-year gain of 11 per cent, which would subtract from the product available for domestic consumption.

The confluence of production and export trends results in a summer chicken consumption forecast of 27.0 pounds, slightly less than a year ago. This is still an ample supply that will keep wholesale chicken prices trending lower, seasonally. Leg quarters prices should be able to average in the low 30 cent range instead of the mid 20’s that were registered in the last half of 2015.