It's time to rethink feed ingredient strategies

For many years, the US animal feed industry has relied on imports when it comes to micro ingredients.

This article summarizes some of these changes, along with providing recommendations as to how businesses need to adapt, writes Andrick Payen, Rabobank Animal Feed Analyst.

Challenges for US Feed Micro Ingredients

At the end of 2019, US imports of vitamins fell by ~8% YOY. Several factors resulted in this lower import volume. Vitamin A prices increased over 2018 and 2019, as production declined in Germany, due to a fire at a major production plant. In the meantime, the spread of African swine fever (ASF) increased concerns of importing micro ingredients from regions that had suffered outbreaks of the virus. Moreover, trade tensions with China further increased the price of critical feed ingredients by ~21% in 2018, compared to 2017. And most recently, Covid-19 further reduced the amount of imports at the beginning of 2020, as China underwent quarantine measures that curbed operations in plants and ports. This resulted in a 20% increase in prices in the first two months of 2020, compared to the same period in 2019. In the US, feed manufacturers and distributors were left with few options, as the collapse of ethanol demand and problems at slaughterhouses reduced the supply of DDGS and feather and bone meal and this forced the industry to re-evaluate its supply chain.

Short- and Long-Term Strategies for Animal Feed

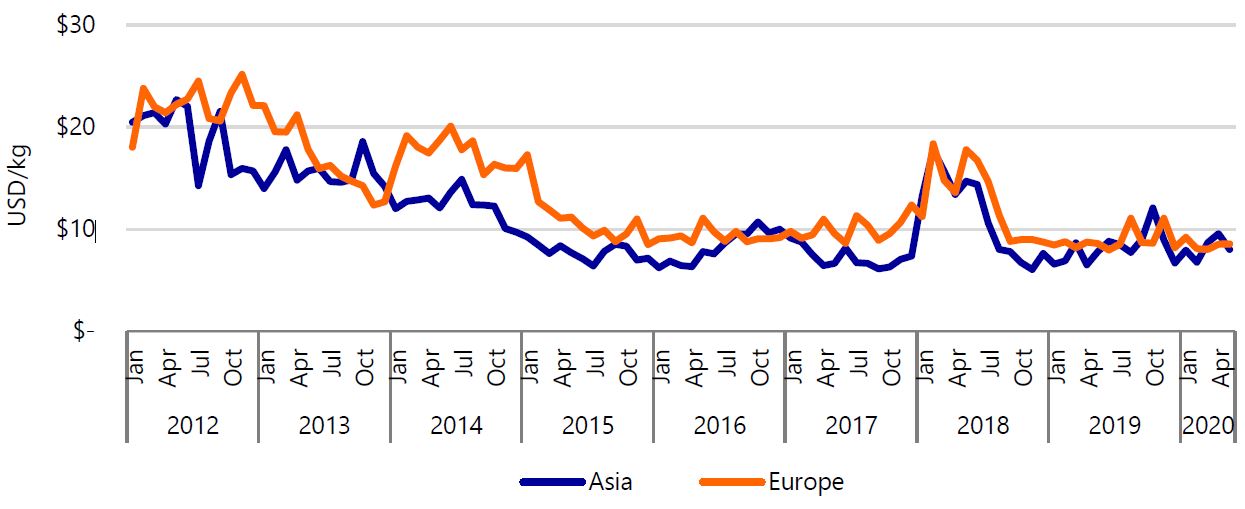

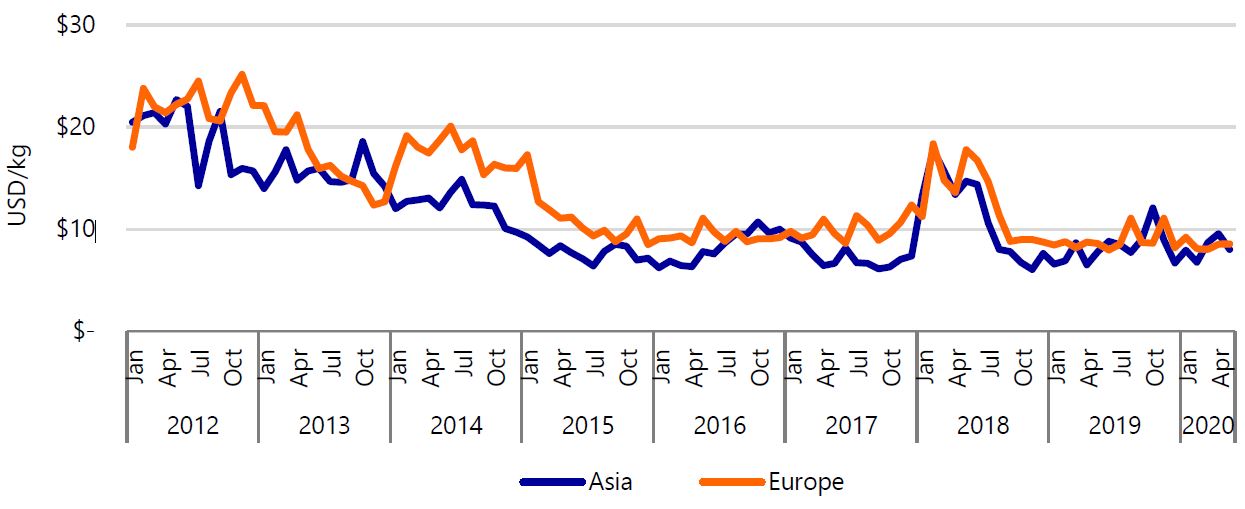

China, the world’s largest producer of vitamins and amino acid, represents ~86% of US vitamin imports, with a three-year average value of USD 1bn. Production is highly concentrated in China, as government incentives and economies of scale help make Chinese products more competitive than those from other regions. Any further disruption to Chinese production would have an impact on global prices and product availability. By diversifying purchases in the short term, the industry can mitigate some of the risks when it comes to product availability. In the short term, the industry should consider buying product from different regions in Asia, such as South Korea and India, while in Europe, the UK and Germany also offer several products. However, diversification is likely to come at a price, as bringing in micro ingredients from other regions will be more costly (see Figure 1).

© U.S. Census Bureau, Rabobank 2020

© U.S. Census Bureau, Rabobank 2020

Long-term structural changes could mean that the US relies less on imports and increases domestic production of micro ingredients. In the coming years, the US livestock and poultry population is likely to continue growing as the country remains one of the most competitive producers around the globe. Investment in the domestic production of feed ingredients would limit the potential disruption from geopolitical disputes and could add another layer of biosecurity.

Another long-term strategy is the continued Investment in novel feed ingredients, which could also help to decrease the reliance on imported micro ingredients and even reduce the need for other by-products. Novel feed ingredients have several benefits. Products like antioxidants help to ensure feed quality and avoid vitamin degradation. At the same time, enzymes help to absorb nutrients from feedstuffs by utilizing vitamins from feed ingredients more efficiently. Not only do absorption of nutrients and quality play key roles; using novel feed ingredients helps to reduce the amount of feed intake needed to maintain vitamins and other requirements per species, while reducing the environmental impact. A combination of novel feed ingredients will help to reduce the feed cost of feeding operations and improve the feed conversion ratio.

Different technologies have been developed to produce vitamins, but most are produced as part of a larger chemical process, making them by-products. Investment in added capacity can be costly, especially for a by-product. Therefore, economies of scale are needed to produce at competitive prices. Moreover, regulation tends to be stricter in the US, compared to other regions. However, innovation in biotechnology continues to thrive, and this might offer solutions to produce vitamins at a lower cost.

Moving Forward…

The animal feed industry is adapting to recent disruptions in the supply chain – and these are likely to continue in 2021. International dependence on imports of micro ingredients has been disruptive due to a lack of diversification by suppliers. Moreover, locally sourced by-products are susceptible to other industry shocks – in this case, the energy and consumer industry – reducing product availability and increasing the cost. Therefore, in the coming months, our research on animal feed will focus on supplier diversification and investment in feed alternatives by looking at the following publications:

Animal Feed Outlook 2021. Animal feed demand is quickly changing among the species as a result of Covid-19 disruptions. As feeding operations make adjustments, this will have an impact on the demand of animal feed ingredients. Demand for more stable and high-energy ingredients relative to DDGS and other by-products is likely to change as concerns of future disruptions increase incentives for traditional macro ingredients.

US Vitamin and Amino Acid Imports. Among feed ingredients, vitamin and amino acid

production is highly concentrated in Asia, especially in China. The US has been impacted by trade tariffs and recent Covid-19 disruptions. The industry needs to rethink sourcing and production of these micro ingredients.

Amino Acid Demand in Animal Diets. Essential amino acids are key for animal development. As economies of scale for synthetic amino acids increases, their cost declines, making them lower cost sources of supplementing limiting amino acids in animal diets. Depending on the cost of traditional ingredients, the substitution for synthetic amino acids might either increase or decrease.