Snapshot of Australian Agriculture 2021 report shows production growth

The Snapshot of Australian Agriculture report shows a ag production is growing, exports are strongClick here to read the full report covering all eight key aspects of Australian agriculture.

Agriculture's place in Australia

Australian agriculture accounts for:

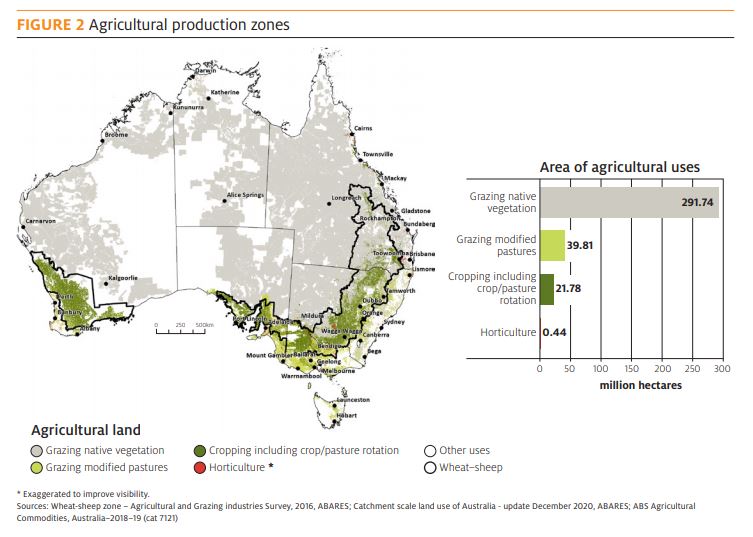

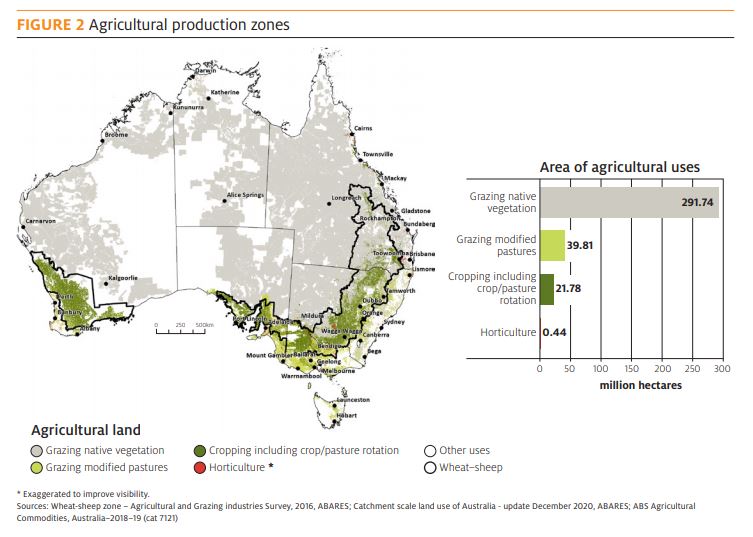

- 55% of Australian land use (427 million hectares, excluding timber production in December 2020) and 25% of water extractions (3,113 gigalitres used by agriculture in 2018–19)

- 11% of goods and services exports in 2019–20

- 1.9% of value added (GDP) and 2.6% of employment in 2019–20

The mix of Australian agricultural activity is determined by climate, water availability, soil type and proximity to markets. Livestock grazing is widespread, occurring in most areas of Australia, while cropping and horticulture are generally concentrated in areas relatively close to the coast (Figure 2).

Agricultural production is growing

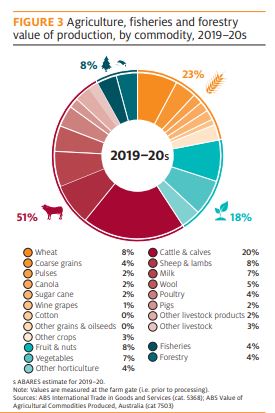

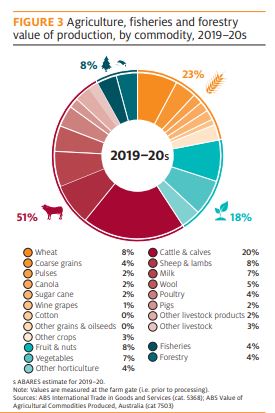

Australia has a diverse agricultural, fisheries and forestry sector, producing a range of crop and livestock products (Figure 3). The gross value of agricultural, fisheries and forestry production has increased by 7% in the past 20 years in real terms (adjusted for consumer price inflation), from approximately $62 billion in 2000–01 to $67 billion in 2019–20.

Drivers of output growth over the past 20 years vary by sector:

- In cropping, long-term falls in real prices have been offset by volume growth, as producers have improved productivity by adopting new technologies and management practices.

- In livestock, higher prices have been the main driver of growth, reflecting growing demand for protein in emerging countries and also some temporary factors, such as drought in the United States and disease outbreaks such as African Swine Fever in meat importing countries.

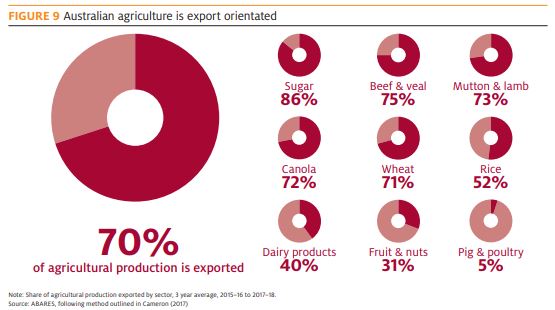

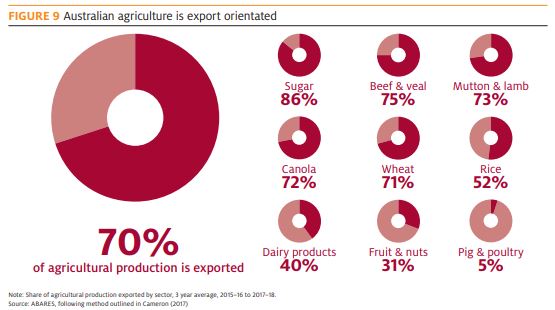

Around 70% of agricultural output is exported

Australia exports around 70% of the total value of agricultural, fisheries and forestry production. Export orientation of each industry can vary by commodity type. Wheat and beef, which are large sectors, are more export-focused than dairy, horticulture and pork (Figure 9).

In real terms the value of agricultural exports has fluctuated between $40 billion and $60 billion since 2000–01. Meat and live animals has been the fastest-growing export segment, growing 86% over the period, followed by horticulture up 64% and forest products up 16%.

Global agricultural demand is growing very strongly, reflecting rising per capita incomes as well as population growth, but export competition is also increasing. Asia is the fastest growing export region for the Australian agriculture, fisheries and forestry sectors.

- Exports to Australia’s eight largest markets in Asia increased by 62% to $33 billion over the 20 years to 2019–20 and accounted for 62% of the total value of agricultural, fisheries and forestry exports in 2019–20.

- China is Australia’s largest export market for agricultural, fisheries and forestry products, at $16 billion in 2019–20. Exports to China are about 5 times larger than they were in 2000–2001.

- Asian demand is projected to double between 2007 and 2050, providing opportunities for exporters of high-value, high-quality agricultural and food products.

Agriculture was resilient despite COVID‑19 uncertainty

COVID-19 was a major event for Australia’s agricultural, forestry and fisheries sector in 2019–20, but the sector demonstrated an ability to adapt and transition to new opportunities (Greenville, McGilvray & Black 2020).

Because food is an essential good, demand does not fall significantly in times of crisis, although the types of goods being demanded through the pandemic shifted away from high-value products consumed typically in the hospitality sector (e.g. wine and seafood) to foods consumed at home. Disruptions to domestic and international food supply chains early in 2020 were largely resolved, allowing agricultural trade to remain resilient through the pandemic. International food processors continued to operate and demand Australian products as inputs; and the resurgence of international textile and wood products manufacturing strengthened export demand for these products throughout 2020–21.

One of the lasting challenges of COVID-19-related travel restrictions has been the reduced availability of farm workers from overseas and higher airfreight costs for exporters of high-value commodities. Horticulture, some intensive production, and meat processing industries have been most affected by the reduced number of overseas workers. The result been increased costs of production for these industries and potentially lower horticultural production, as producers find it difficult to harvest. Exports of high-value and highly perishable products, such as live seafood and fresh produce, have also faced cost increases given the reduced supply of cargo space on flights to key export markets.