USDA Ag Outlook Forum: A pathway to resilience through innovation

USDA Chief Economist Seth Meyer discussed the ag economy in terms of the pandemic and what industry can expect in the months ahead.When the pandemic hit, economies collapsed, work sites and retail outlets were shut down, and supply chains were disrupted. While the 2020 planting season progressed rapidly compared to previous years, the late season yielded dry conditions in the eastern half of the US and a rare derecho in the Midwest.

Even with these challenges, hope is on the horizon in 2021. Despite continued challenges, markets are functioning well, the food supply is safe, abundant and affordable, and the US is positioned to maintain its position as one of the lowest-cost, abundant and sustainable food supplies in the world.

Optimism was the theme of USDA’s 97th Agricultural Economic Outlook Forum, led by Chief Economist Seth Meyer. He walked through how the industry got to its current state, and what we can expect in the months ahead.

2020: grain prices rise amid rising exports

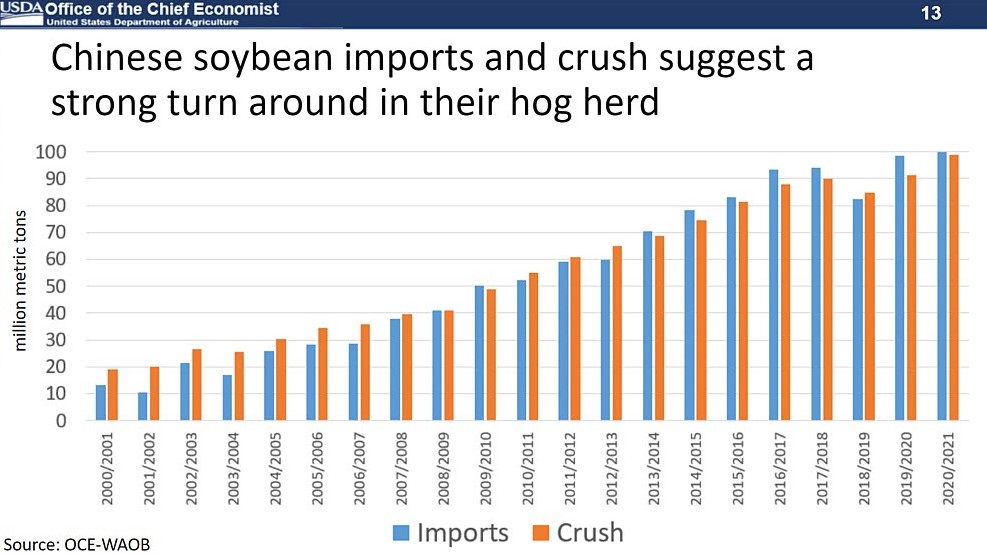

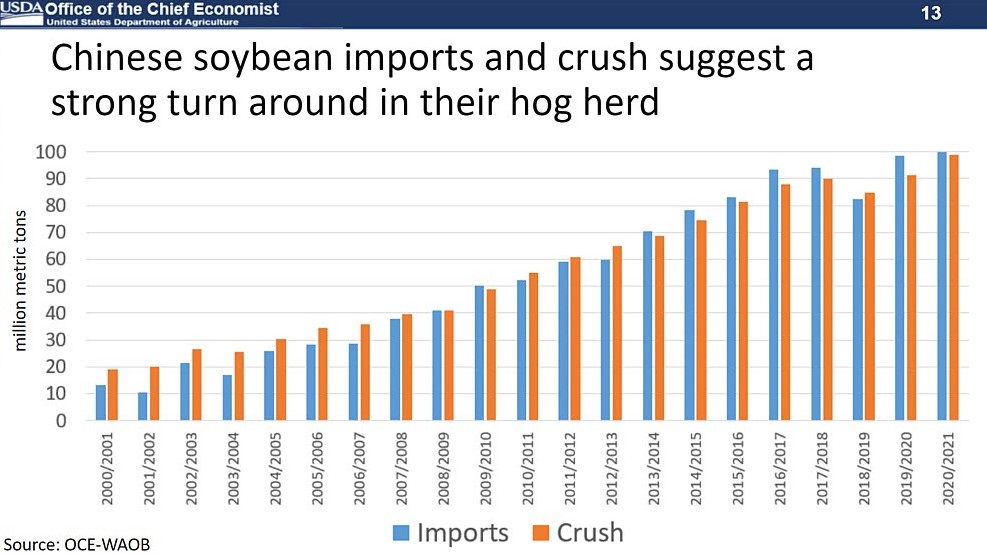

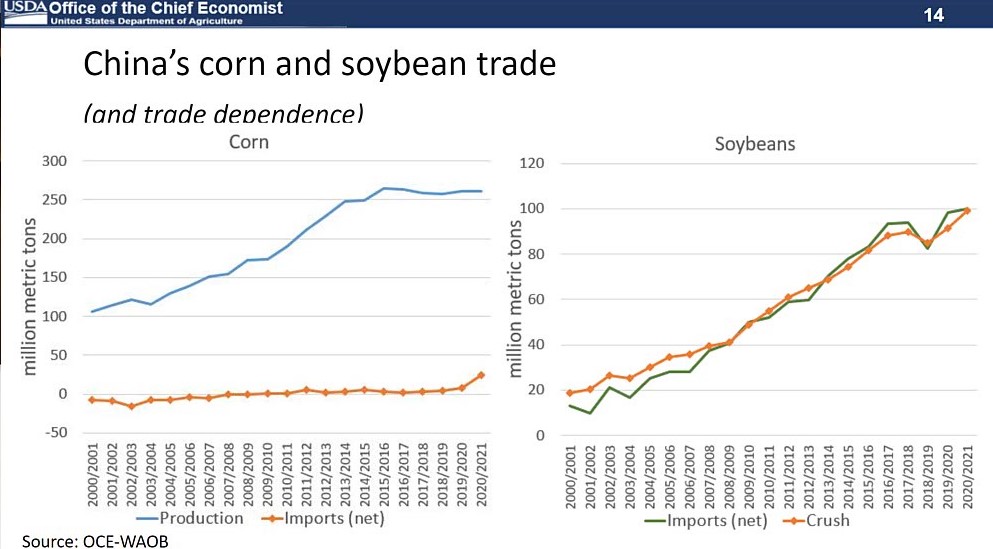

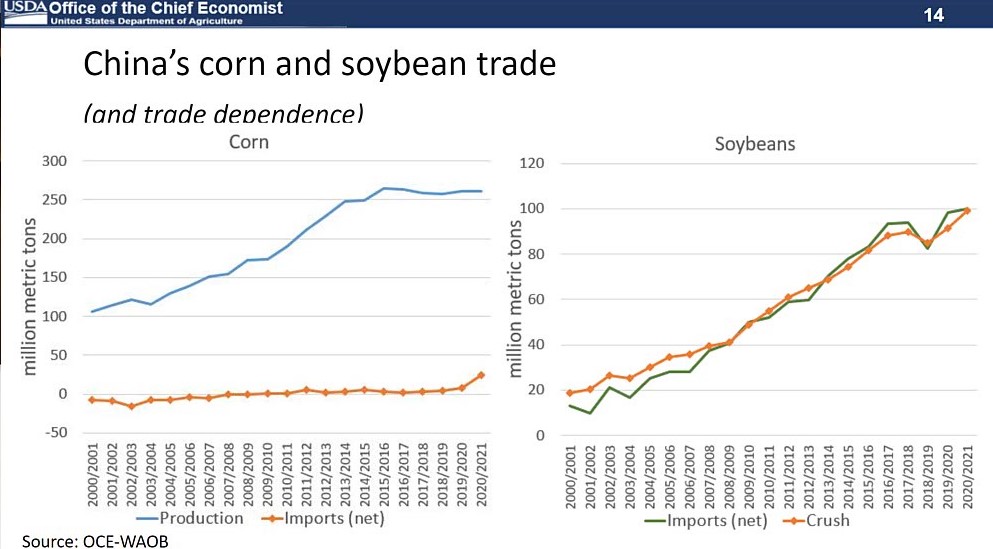

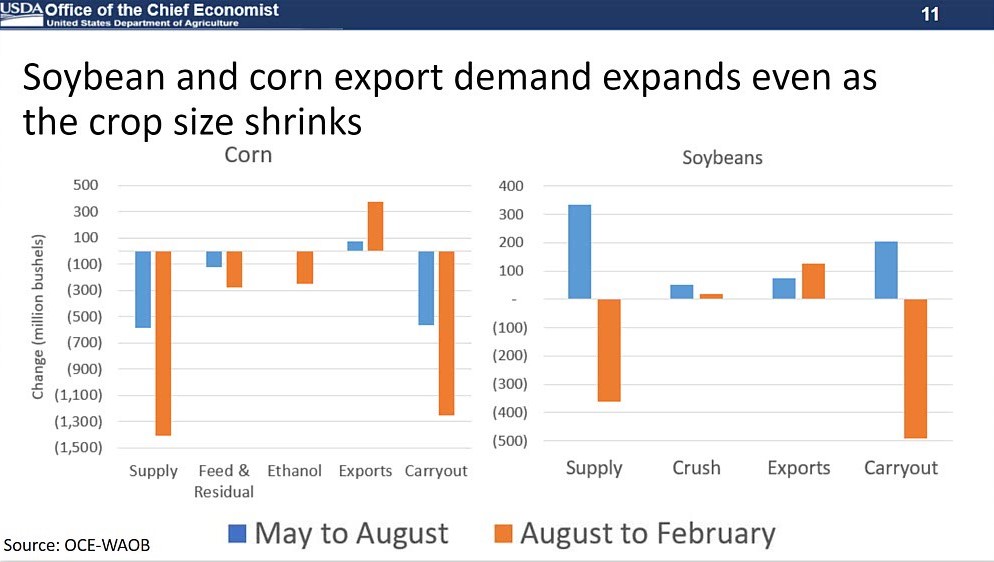

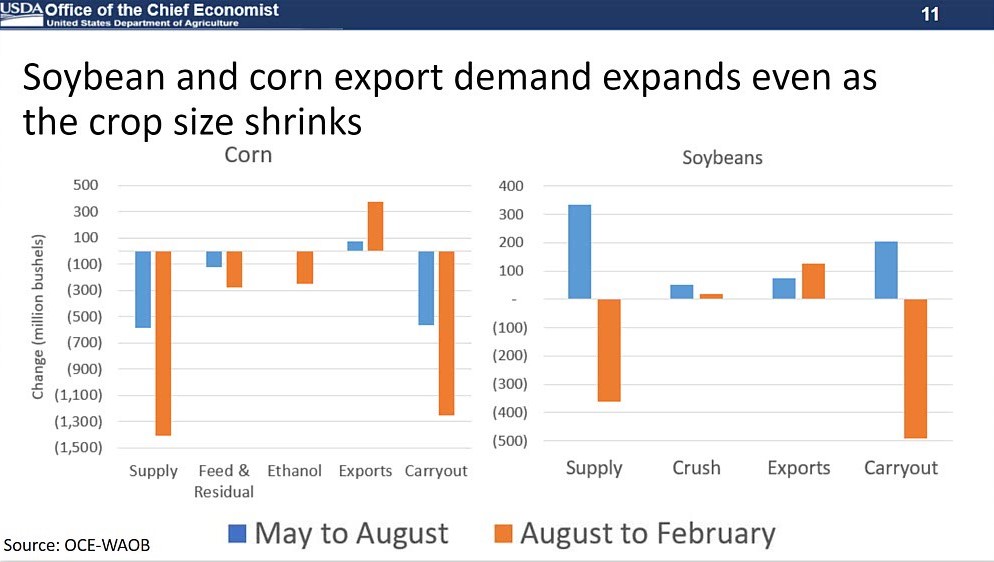

US season average prices for corn, soybeans and other commodities are projected to hit 7-year highs. According to Meyer, this spike is due to the combination of the Phase One Economic and Trade Agreement between the US and China, as well as the rebuilding of the Chinese livestock sector after the effects of the African Swine Fever.

“Sales of agricultural commodities to China accelerated in the summer and fall,” says Meyer, “and by the end of the year the pace of corn and soybean sales to China was at or approaching new records.”

Additionally, agricultural trade remained resilient with our other trading partners, including Mexico, Japan, Korea and others, which provided further support to rising prices.

Overall, Meyer says, US agricultural trade proved resilient and remained stronger than non-agricultural sectors. This strength is reflected in USDA’s revised forecast for 2021.

According to USDA FAS’ weekly report for February 4, outstanding sales of U.S. corn for the current marketing year is over 11 million metric tons (mmt). Sales of US cotton, beef, pork, poultry and other products were strong as well.

2021 agriculture economic forecast

Exports in agricultural trade in FY 2021 are forecast at a record $157 billion, a more than $21 billion increase from FY 2020. Exports to China alone are forecast to be $31 billion, which reflects the strong October-December shipments of US soybeans, corn, wheat, cotton and chicken paws.

“This strength in agricultural exports over the past 12 months has helped to drive the price of many commodities from recent lows at the start of the pandemic to highs last seen more than five years ago,” said Meyer.

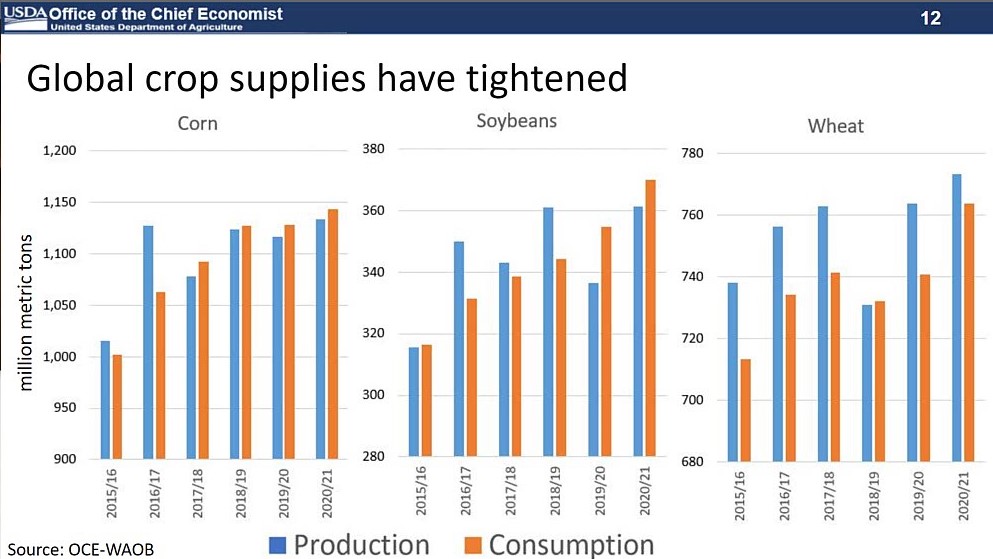

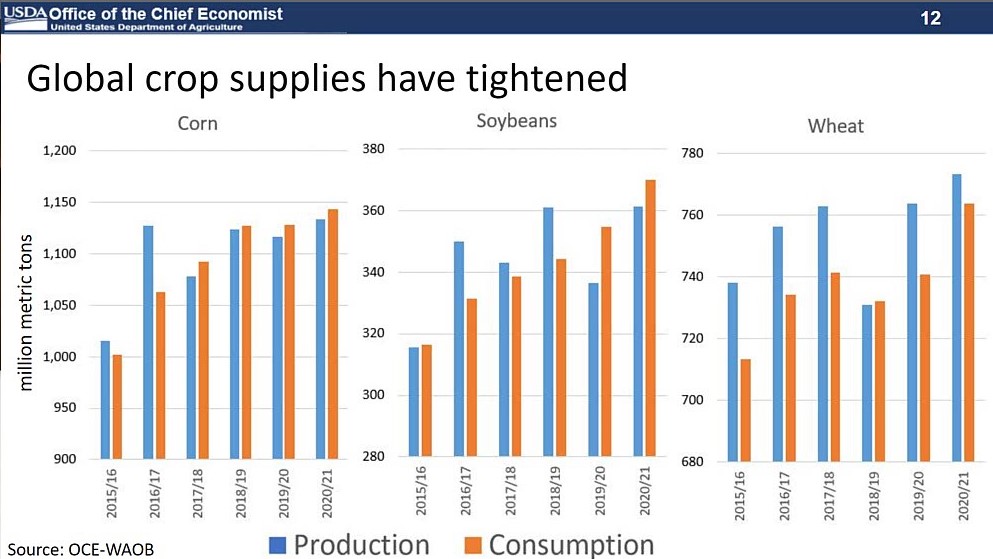

Grains and oilseeds particularly have seen sharper increases since the tightening of global supplies and a strong international demand. The 2021-22 market year will see the tightest beginning stocks for corn, soybeans and wheat in years. Increased demand from China, a rebound in gasoline consumption boosting ethanol demand, and other factors will increase global demand.

However, any number of factors could dip prices lower:

- Above trend yields in the US or competing suppliers

- A prolonged decline in economic growth

- A reduction in demand by China or other major importers

“With a tightening stocks-to-use ratio, increased price volatility is likely as fundamentals are revealed,” said Meyer.

2021 US planted acreage predictions

To understand what the US planted acres will look like in the context of current high prices, the USDA reexamined the most recent period where prices and stocks-to-use ratios were at similar levels for major crops.

During the 2012-14 peak, planted acres of the major row crops (corn, soybeans, wheat, upland cotton, sorghum, rice, barley and oats) averaged nearly 257 million acres. Since 2014, they have averaged around 8 million fewer acres. This includes recent years where prevented plantings were higher than normal.

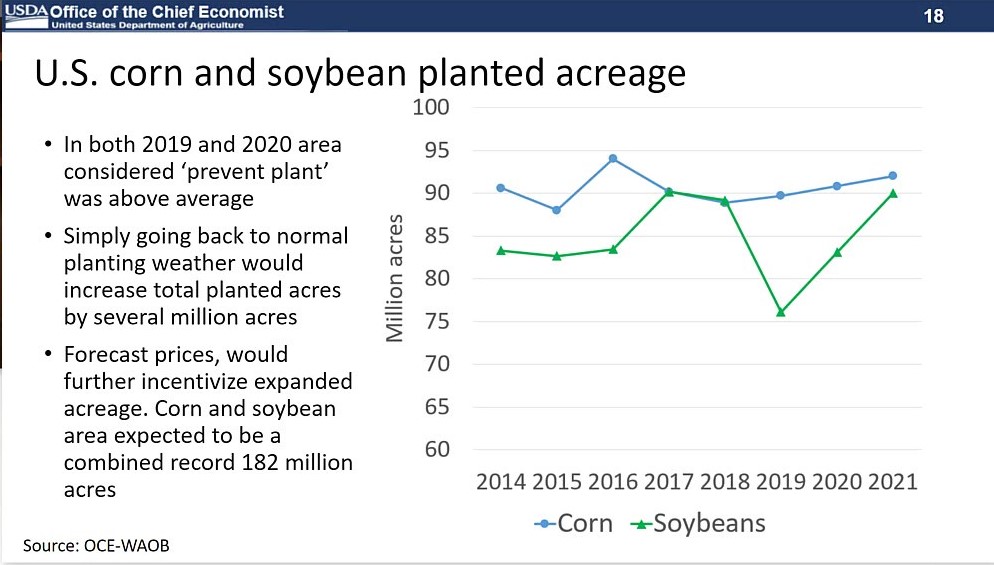

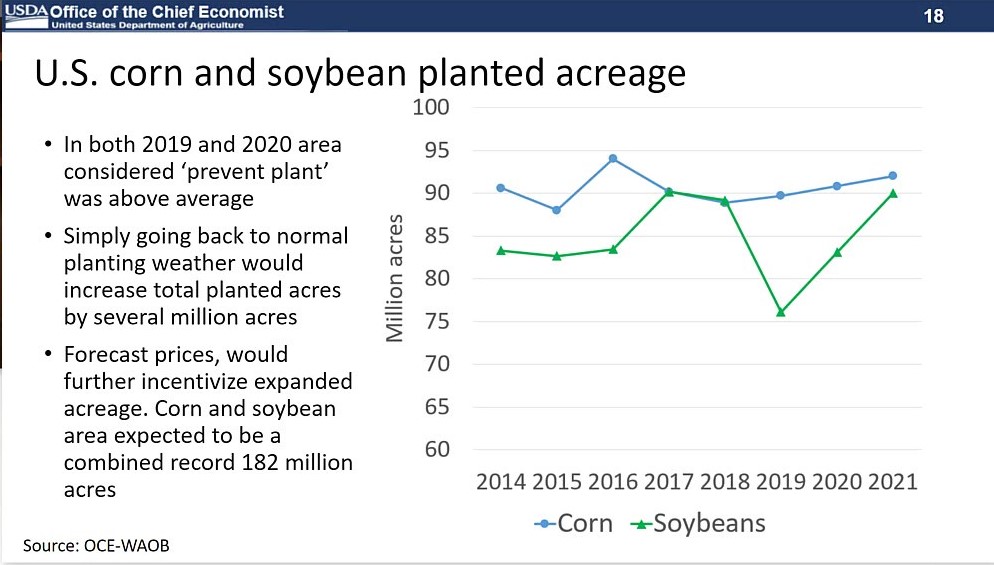

While 2020 was not nearly as devastating as 2019, there were challenges with uncooperative weather in some parts of the country. With a return to more normal planting weather, the USDA expects a good portion of unplanted acres last year to be planted to corn and soybeans in 2021.

The current tight stocks-to-use ratios for corn and soybeans also suggests better returns for corn and soybeans, giving a strong incentive to plant. Current new crop futures prices and contract bids for delivery seem to indicate strong acreage increases, particularly for soybeans, which are expected to expand to 90 million acres. Corn is also expected to grow to 92 million acres.

The combined corn-soy acreage is projected to 182 million acres, compared to the previous record in 2017 of 180.3 million. To offset this increase, the USDA expects lower spring wheat and cotton acreage.

Winter wheat is predicted at 32 million acres, a 5% increase and the first increase seen since 2013-14. However, higher expected returns for corn and soybeans in the Northern Plains is expected to reduce spring and durum wheat plantings for 2021-22.

2021 US commodity price outlook

Given strong demand and tight stocks, the USDA projects soybean prices to remain elevated, supported by strong domestic demand and growth in US renewable diesel capacity. However, corn prices, with larger corn acres and an expected return to trend yields could lead to higher ending stocks, assuming normal weather conditions.

Total wheat area is projected at 45 million acres, up 651,000 acres from 2020-21 but still below the 5-year average. With predicted tighter ending stocks, the USDA projects higher wheat prices in 2021-22.

Generally, the rising global demand for more varied diets and increased animal and plant protein consumption stimulates demand for feed grains and soybeans. Additionally, increased competition from Brazil could potentially impact the price of US corn.

The late planting and harvesting for Brazil’s soybean crop has delayed their second crop corn planting, risking lower yields. However, current prices offset some of that risk by supporting planted area expansion.