Commodity prices spur regulatory action

We’ve written previously about the many changes to our everyday lives since the COVID pandemic first brought the world to a halt, and wondered aloud how many would become permanent fixtures in our lives. Will companies continue to allow employees to WFH (“work from home”)? Will video calls and online conferences continue to replace our in-person gatherings?

Already, we’re seeing these changes dissipate, but changes backed by regulatory action remain. The economic consequences of COVID have pushed governments to lubricate the gears that keep our societies turning, whether through unemployment compensation or small business support amidst closures. In some cases, COVID has even caused governments to consider previously deferred decisions with enormous potential impact on our industry. We’ll explore this further with our product selection this week.

Here are some of the most significant market trends identified by Glowlit in the last week:

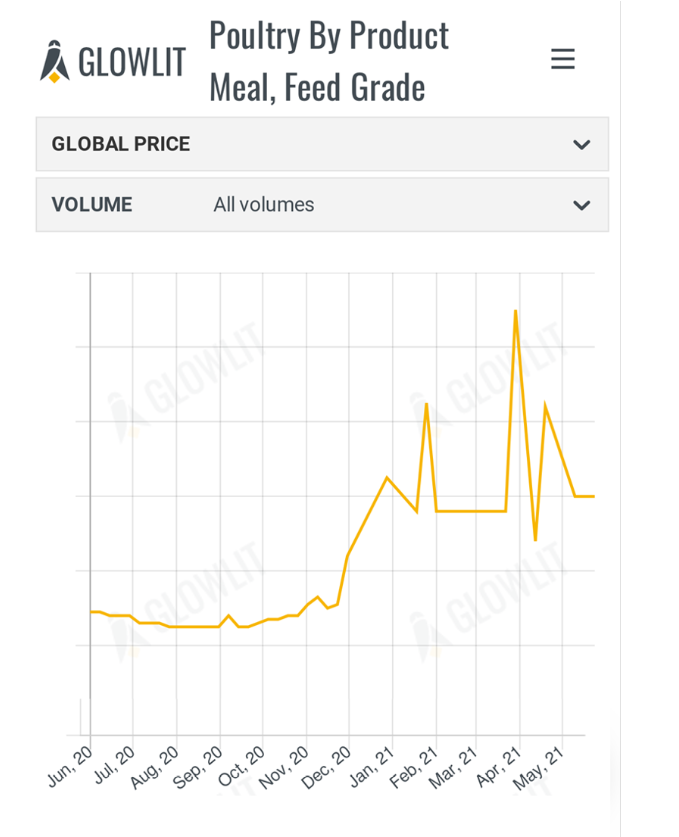

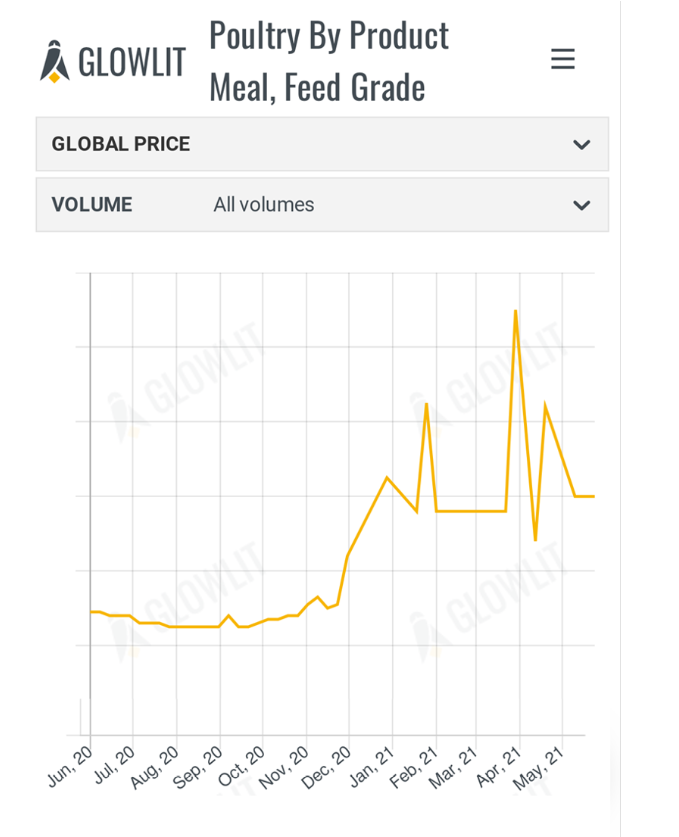

EU Considers Lifting Ban on Processed Animal Proteins

Rising commodity prices and shipping costs have strained feed ingredient supply chains around the world. With a 70% protein deficit, The European Union must import expensive protein sources from around the world. But now it appears that economic pressure is pushing the EU to reconsider the existing bans on Processed Animal Proteins (PAP) - like feed grade poultry by-product meal - a change that will supply some of the demand for protein from local sources. This change seems to come far sooner than even lobby groups involved in the matter had anticipated. While we wait to see whether conferences return in full force, we can be sure that the approval of PAPs by the EU would fundamentally change the balance of feed ingredients supply and demand around the world.

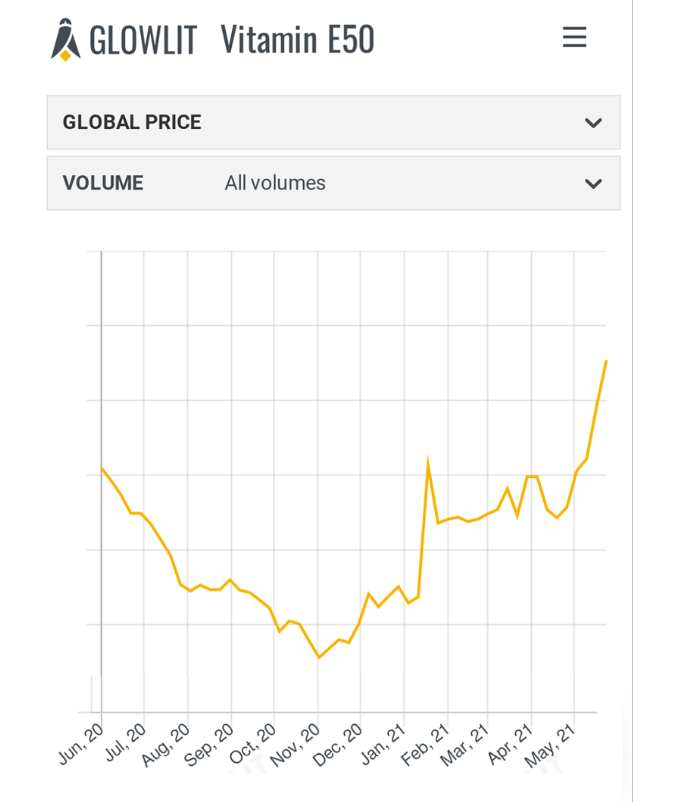

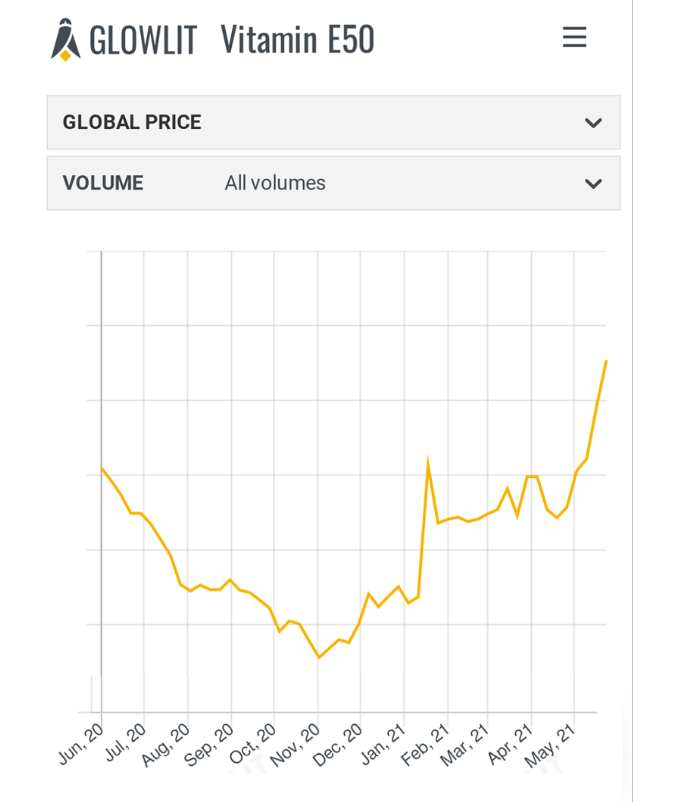

Will Vitamin E50 Prices Continue Their Climb?

Last week, DSM reported that the production of key Vitamin E50 intermediates at its Yimante facility have now resumed following an incident at the end of April. This was preceded by a price increase from NHU for Vitamin E that got customers around the world to source material and increase interest on Glowlit for the product. Glowlit data shows that the global price of Vitamin E50 has increased 23.5% since April 19th. As production increases, we’re waiting to see whether this price trend is sustained or when it will reverse.