FAO Food Outlook 2021- what does it say about meat?

Following two years of African Swine Fever-driven decline, global meat production is anticipated to expand in 2021, rising by 2.2% to 346 million tonnes.This is driven primarily by China, although production in Brazil, Vietnam, the US and the EU is also expected to increase. In contrast, declining production is foreseen for Australia, the Philippines and Argentina, according to the FAO Food Outlook report.

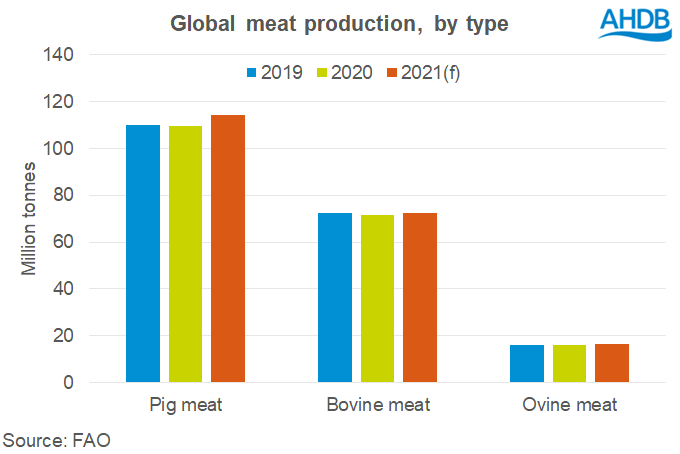

Within this, pig meat output is forecast to expand by 4.2% to 114 million tonnes. However, this is still 5% below the level before ASF began affecting Chinese production. Most of the anticipated increase stems from a recovery in Chinese production, expected to reach 46 million tonnes, a 10% increase on 2020 and 85% of the pre-ASF level. Global production of bovine meat is also forecast to recover slightly, up by 1.2% to 72 million tonnes. Growth is expected in particular from the US, Brazil and China. Global ovine meat output is forecast to expand by about 1% to 16 million tonnes. Again, China is expected to be the source of much of this growth.

Global meat trade is forecast to stagnate in 2021, totalling 42 million tonnes (carcase weight equivalent). Recovering meat production in China means the main driver of trade growth in recent years has waned.

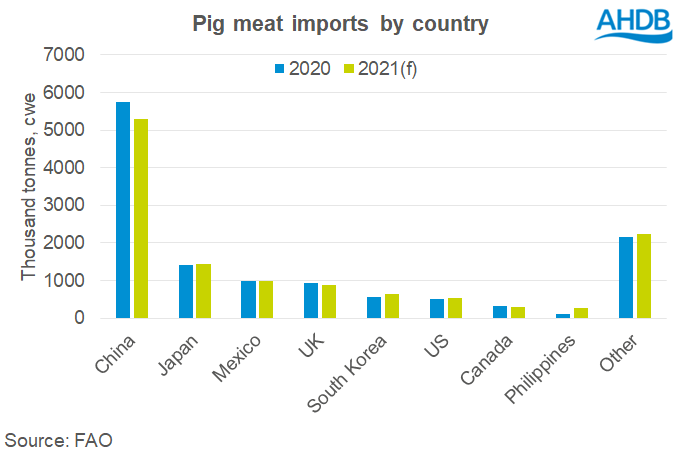

Pig meat trade could falter this year, falling by 0.6% to 12.8 million tonnes. An 8% decline in purchases is expected from China, and moderate import drops are also expected from Vietnam, Canada, and here in the UK. In response to the falling demand, exports are expected to fall from the EU, Chile and Canada, as well as the UK.

Global poultry meat output in 2021 is forecast to expand by 1.3 percent to 135 million tonnes, mainly driven by gains in China, Brazil and the European Union, with moderate expansions anticipated worldwide. China’s higher production stems primarily from increased consumer demand, including those looking for affordable meat to replace expensive red meat products.

Significant investments that went to the sector, especially to build large-scale farms and processing operations, are also supporting production growth in China. In Brazil, solid foreign demand, especially from East Asia and the Middle East, drives production growth, but less buoyant internal demand is likely to constrain the pace of expansion.

Production increases are anticipated worldwide due to high demand for relatively affordable meat, especially where household incomes continue to be lower than the pre-COVID-19 levels, impacted by economic downturns, loss of employment, reduced remittances and shrunken tourism-related incomes.

World poultry meat exports are forecast to expand moderately, growing by 0.9 percent to 15.6 million tonnes in 2021, which would mark the sixth year of uninterrupted expansion. Increased imports by Saudi Arabia, United Arab Emirates, Ukraine, Japan, Mexico and the European Union are foreseen to drive this expansion, which is likely to be partially offset by declines in purchases by China, South Africa, the Russian Federation and the United Kingdom.

Global sheep meat trade is also forecast to contract this year, declining by 0.8% to just over 1 million tonnes. Supply constraints in New Zealand and here in the UK will lead to falling imports by the Middle East, as well as the US and EU. Chinese imports are still expected to rise.

In contrast, world bovine meat trade is expected to recover a little this year, rising by 1.1% to 12 million tonnes. This is mainly due to robust import demand from China. Brazil, the US, Uruguay and Canada are projected to meet much of the additional demand.

To read the full report, click here.