Analysis suggests that UK's Sustainable Farming Incentive won't offset direct payments

Results from a new AHDB analysis show that most UK farmers will not be able to completely offset the loss of direct payments with participation in Sustainable Farming Incentive (SFI).New analysis by AHDB quantifies how the proposed Sustainable Farming Incentive (SFI) stacks up against the basic payment scheme (BPS).

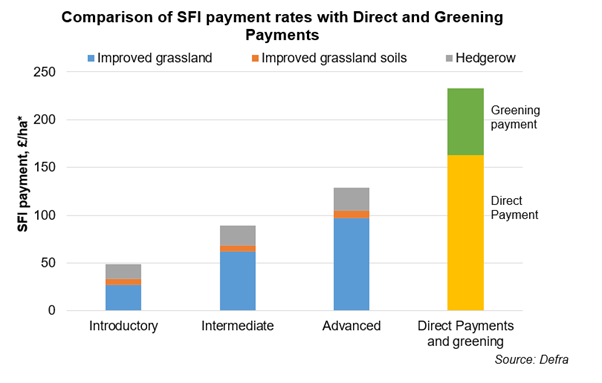

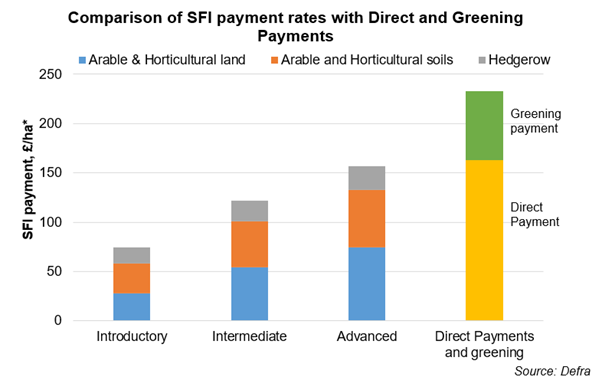

It compares per hectare payments for introductory, intermediate and advanced SFI standards against direct and greening payments.

For grassland, applying all three standards – aimed at improving land, soils and hedgerows – at the introductory level would see payments make up 21 per cent of the direct payment and greening value. This rises to 55 per cent at the advanced level.

For arable and horticultural land, introductory level payments would only equate to 32% of BPS value. At the advanced level, this rises to 67%.

The findings do not take into account the costs of implementing the scheme or any additional payments, for example by planting trees.

Amandeep Kaur Purewal, who authored the analysis, said: “We’ve shown a simplistic picture of how SFI payments could stack up against filling the gap left by the removal of direct payments. There are still a number of unknowns such as the costs involved and the SFI itself is still in the process of being developed further. Payment rates are also subject to change.

“What is apparent, is that, based on current information, most farmers will not be able to completely offset the loss of direct payments with participation in SFI. If you haven’t done so already, now is a good time to look at your business in detail, talk to family and advisers and plan for the changes ahead.”

The first SFI pilot is due to begin in England this autumn, with farmers and growers chosen to take part now getting ready to develop their plans.

The analysis can be found on the AHDB website, along with a range of business planning tools such as the Business Impact Calculator, which allows farmers and growers to see how the loss of direct payments will impact their business.