South, Southeast Asia to play pivotal role in global poultry market growth

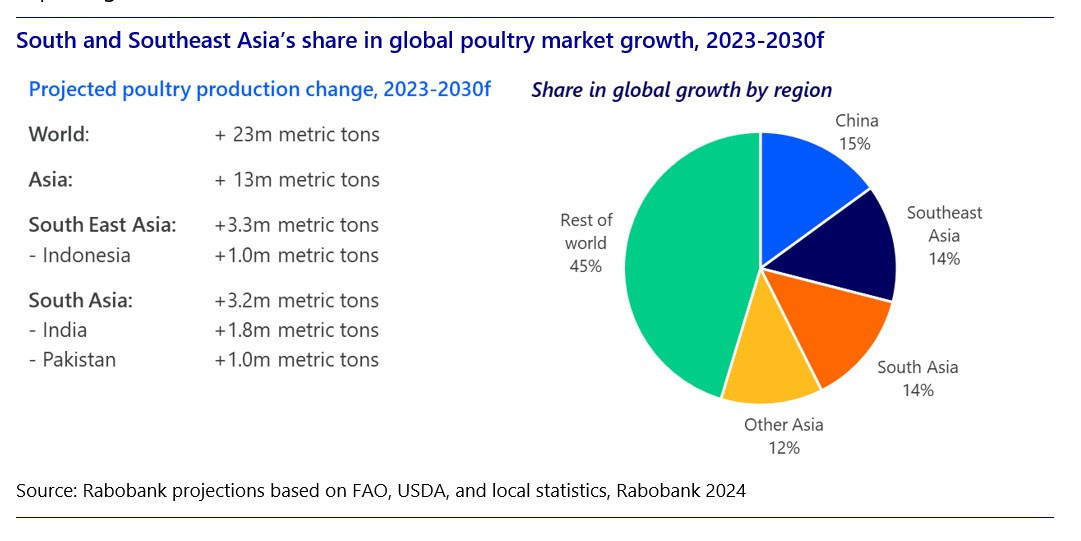

The regions' markets expected to grow 30% by 2030A recent Rabobank report spotlights South and Southeast Asia as the epicenters of growth for the global poultry market over the next decade. The regions’ poultry markets are expected to grow by 30% from 2023 to 2030, underscoring vast potential for industry stakeholders. In addition to volume growth, many value opportunities will emerge, increasingly creating room for value addition and branding strategies.

Stronger economy, growing population, and improved demand to drive growth

After navigating a period of slower growth from 2020 to 2023, the poultry industry in South and Southeast Asia is poised for a robust recovery. “We forecast a combined total growth of 30% by 2030, driven by a resilient economic outlook, burgeoning populations, and a shift in consumer preferences toward poultry as a preferred source of protein,” says Nan-Dirk Mulder, Senior Global Specialist – Animal Protein at Rabobank. India, Indonesia, and Pakistan are expected to drive 60% of the total growth.

Investment opportunities arise in the world’s fastest-growing poultry markets

A wealth of investment opportunities come with the expected market growth, according to Rabobank. The outlook for volume and value growth will make investments in this region attractive for local, regional, and global investors. Such growth will require the significant expansion and upgrade of local poultry supply chains.

With the rise of modern distribution networks and platforms, investors are presented with the chance to delve into value-added markets and branding strategies, tapping into the evolving demands of the Asian consumer base. “Low- and middle-income consumers, who should have increased spending power according to the projections, are gradually expected to buy less from traditional markets and more from supermarkets, convenience stores, home delivery platforms, and restaurants,” explains Mulder.

Most growth will come from local production

While local production will continue to dominate, imports will play a strategic role in the regional supply chain. Food security remains a priority, and with less than 5% of the market supplied by imports, there is potential for countries like Thailand, India, and Vietnam to emerge as significant exporters.