France to Support Poultry Processing Investment

FRANCE - French poultry killing and cutting plants have until 15 September to apply for government funding worth up to €250,000 to invest in processing lines, writes Peter Crosskey.The level of subsidy is dependent on factors that include the size of the business and its location. Only combined killing and cutting plants qualify: farm-based slaughtering is specifically excluded, as are processing facilities without slaughtering lines.

The programme is being overseen by FranceAgriMer, which is currently home to a national ad hoc subsidy commission. This particular scheme has been under discussion with the poultry industry for some months now. Eligible projects include automation and robotics.

However, paying off investments accounted for less than three per cent of the French poultry industry’s 2011 cost base, according to figures released by FranceAgriMer.

Even with staff costs for the industry hovering at just under 12 per cent of product costs, today’s economy is hardly a climate conducive to capital-intensive projects.

The same document notes the relentless rise in feed costs for poultry, with the feed price per kilo of finished poultry (liveweight) nudging 64 centimes/kilo for the year to the end of May.

With an averaged out all-industry figure of €1 per kilo as the going rate for live poultry during the first half of the year, producers have been losing at least 7 centimes/kilo liveweight on their production during this period.

During 2011 and 2012, FranceAgriMer notes, retail gross margins rose faster than the price of live poultry arriving at the abattoir. This has meant that while liveweight intake prices rose by €0.12/kg (up 8 per cent YOY) in the first half of 2013, these have been buffered by retail price rises of €0.11/kg (up 3 per cent YOY) over the same period.

French Pig Meat Buyers Holding Back

Last week’s Marché du Porc Breton (MPB) Thursday auction price of €1.68/kg marked a €0.06/kg weekly rise against a long term upward trend since April.

Evidently, having had “reassuring news” from other pig production areas, those at the sale (including the MPB economist) were surprised that the slaughterers were sluggish in their bidding.

As the only French pig auction to be reported directly nationally, it is possible that buyers might not want the headline price to be seen to rise unduly, even though markets across Europe have been strengthening.

This year MPB has seen fewer price swings and has generally traded above last year’s rates, with around 9,000 fewer head presented every week than 2012.

French consumers, however, are trading down too: MPB quotes TNS panel data to April this year, noting a 2.6 per cent YOY drop in fresh pigmeat sales; a 7.3 per cent lift in sausages and a 1.4 per cent rise in charcuterie, 0.4 per cent of that for ham.

FranceAgriMer calculations (source as above) for the retail price compositions focuses on loins as the retailers’ mainstay, whether as roasting joints or pork chops. While the retail price point of €6.65/kg has not moved from 2012 to the first half of 2013, the instore butchery counters managed to add five centimes a kilo to their gross margin €3.23/kg), squeezing two centimes/kg from processors and paying 3 centimes/kg less for the raw material.

As a department, the retailers argue that on the basis of 2011 figures, butchery counters are nearly two per cent shy of making money on fresh meat, although charcuterie counters earned just over five per cent net of everything.

However, fresh meat counters, charcuterie and wet fish displays play a major role in animating stores and generating retail credibility.

What is more, consumers at a serveover will shop from higher margin categories elsewhere in the store, whereas high street butchers and charcutiers will not make incremental sales on the same scale.

Until recently, instore butchery in France tended to be upscale. However, new store counters are noticeably less lavish and instore butchery is an increasingly frequent victim in refits.

French Retailers Relax Grip on Beef Margins

A shortage of French slaughter cattle during the first half of this year led to multiple retailers potentially loosening their stranglehold on retail margins for home-raised beef.

The FranceAgriMer economic model is that of an integrated breeder and finisher raising cattle primarily on grassland and relies on industry input statistics and index figures.

There is a measurable impact in the rising cost of feedstuffs, but the underlying upward pressure on production costs was generated by buildings and related livestock management.

The FranceAgriMer average boned-out carcase retail price of €6.97/kg last year rose to €7.19/kg during the first half of 2013.

In the process, estimated gross retail margins slipped from €1.67/kg to €1.65/kg. Slaughterers and cutters also took an estimated €0.02/kg hit, too, while the producer’s share of the retail ticket rose to €3.80/kg.

The FranceAgriMer economists also concluded that without subsidies, it would be impossible to cover the cost of the labour and producer capital involved. This is based on generating a national minimum wage for two people.

Since beef and pigmeat are sold through the same retail fixtures, the retailers’ estimates of making an operational loss of just under two per cent on instore butchery counters still applies and was derived from the same survey data.

Once again, it should be noted that an instore butchery counter is not an isolated business unit, but operates within a retail environment surrounded by plenty of high margin categories.

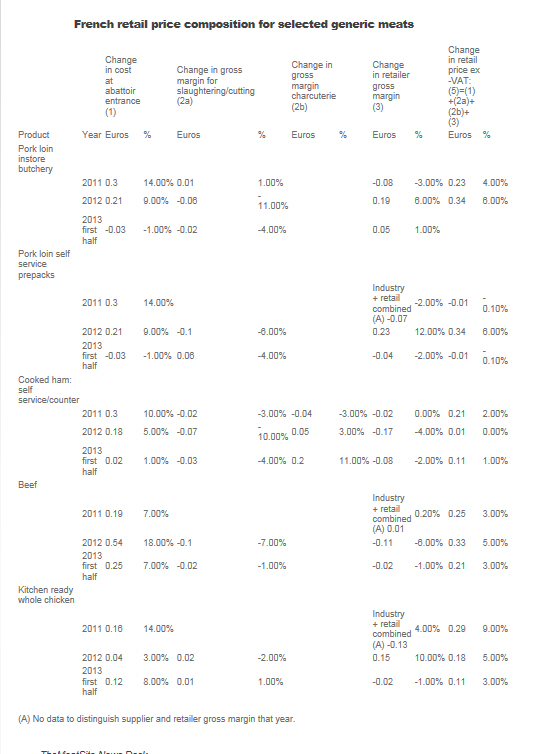

French retail price composition for selected generic meats | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Change in cost at abattoir entrance (1) | Change in gross margin for slaughtering/cutting (2a) | Change in gross margin charcuterie (2b) | Change in retailer gross margin (3) | Change in retail price ex-VAT: (5)=(1)+(2a)+(2b)+(3) | |||||||

| Product | Year | Euros | % | Euros | % | Euros | % | Euros | % | Euros | % |

| Pork loin instore butchery | |||||||||||

| 2011 | 0.3 | 14.00% | 0.01 | 1.00% | -0.08 | -3.00% | 0.23 | 4.00% | |||

| 2012 | 0.21 | 9.00% | -0.06 | -11.00% | 0.19 | 6.00% | 0.34 | 6.00% | |||

| 2013 first half | -0.03 | -1.00% | -0.02 | -4.00% | 0.05 | 1.00% | |||||

| Pork loin self service prepacks | |||||||||||

| 2011 | 0.3 | 14.00% | Industry + retail combined (A) -0.07 | -2.00% | -0.01 | -0.10% | |||||

| 2012 | 0.21 | 9.00% | -0.1 | -6.00% | 0.23 | 12.00% | 0.34 | 6.00% | |||

| 2013 first half | -0.03 | -1.00% | 0.06 | -4.00% | -0.04 | -2.00% | -0.01 | -0.10% | |||

| Cooked ham: self service/counter | |||||||||||

| 2011 | 0.3 | 10.00% | -0.02 | -3.00% | -0.04 | -3.00% | -0.02 | 0.00% | 0.21 | 2.00% | |

| 2012 | 0.18 | 5.00% | -0.07 | -10.00% | 0.05 | 3.00% | -0.17 | -4.00% | 0.01 | 0.00% | |

| 2013 first half | 0.02 | 1.00% | -0.03 | -4.00% | 0.2 | 11.00% | -0.08 | -2.00% | 0.11 | 1.00% | |

| Beef | |||||||||||

| 2011 | 0.19 | 7.00% | Industry + retail combined (A) 0.01 | 0.20% | 0.25 | 3.00% | |||||

| 2012 | 0.54 | 18.00% | -0.1 | -7.00% | -0.11 | -6.00% | 0.33 | 5.00% | |||

| 2013 first half | 0.25 | 7.00% | -0.02 | -1.00% | -0.02 | -1.00% | 0.21 | 3.00% | |||

| Kitchen ready whole chicken | |||||||||||

| 2011 | 0.16 | 14.00% | Industry + retail combined (A) -0.13 | 4.00% | 0.29 | 9.00% | |||||

| 2012 | 0.04 | 3.00% | 0.02 | -2.00% | 0.15 | 10.00% | 0.18 | 5.00% | |||

| 2013 first half | 0.12 | 8.00% | 0.01 | 1.00% | -0.02 | -1.00% | 0.11 | 3.00% | |||

| (A) No data to distinguish supplier and retailer gross margin that year. | |||||||||||