Mozambique Targets National Chicken Consumption

MOZAMBIQUE - A new report from the FAO reviews the current state of the poultry meat and egg sectors in Mozambique and analyses their strengths and weaknesses. The local poultry association aims to increase consumption by 26 per cent annually. Jackie Linden summarises the report.In order to develop appropriate strategies and options for poultry sector development, including disease prevention control measures, a better understanding is required of the different poultry production systems, their associated market chains and the position of poultry within human societies is required, according to Filomena Dos Anjos, senior lecturer at the Faculty of Veterinary Medicine of the Eduardo Mondlane University in Maputo, Mozambique.

In a report entitled Poultry Sector Mozambique, No. 5 in the series, 'Animal Production and Health Livestock Country Reviews' published by the UN Food and Agriculture Organization (FAO), Ms Dos Anjos gives an overview of her country and its poultry industry.

Mozambique is in south-eastern Africa, bordering the Mozambique Channel, between South Africa and Tanzania. It has an area of some 786,000 square kilometres and a population of almost 24 million in 2011, growing at a rate of 2.23 per cent.

In 2012, the World Bank estimated that in 2008, 60 per cent of the population lived below the poverty line, then set at US$1.25 per day although gross national income doubled between 2003 and 2011. The urban population is growing somewhat faster than that in the rural areas.

Overview of the Poultry Industry

In 2011, FAOSTAT estimated the total number of poultry at about 41.2 million, including chickens (58 per cent), guinea fowls and geese (36 per cent), ducks (five per cent) and turkeys (0.3 per cent), according to the FAO report.

Almost half of the poultry are found in the central regions of the country but all types are represented in each province. )

The country's National Statistics Institute estimated that, in 2011, there were 2.325 million holdings with chickens, of which 20,409 were classified as medium sized and 444 were large. Similar patterns were seen for farms with ducks (total: 317,044 farms; 311,632 small farms), geese (total: 3,193 farms; 2,698 small farms), turkeys (total: 23,406 farms; 22,033 small farms) and guinea fowls (total: 126,879 farms; 123,777 small farms).

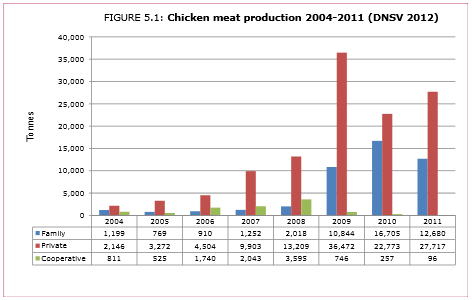

In 2011, domestic production of chicken meat was 40,503 tonnes, 12,680 tonnes of which were derived from the smallholder family sector, 27,717 tonnes from the private sector and 96 tonnes from the cooperative sector.

The majority of the officially marketed poultry meat comes from broiler chickens produced by the co-operative and private sectors. The largest producers include General Union of Agricultural and Livestock Cooperatives (UGC), Mozambique Farms, the Mozambique National Poultry Association (AMA) in the South of the country, Frangos de Manica, Abilio Antunes in Manica province in the central part of the country, and Novo Horizonte and Pintainhos Stewart in Nampula province, in the North of Mozambique.

In 2011, the country was 73 per cent self-sufficient in chicken meat.

According to the FAO report, there was a considerable increase in poultry meat production starting from 2006 and 2007, which was attributed to increased hatchery capacity in the north, the establishment of new hatchery companies in the Maputo region and an increase in the production of day?old chicks by one producer in the central region. Furthermore, the Government supported the development of domestic chicken production by controlling imports and offering financing. Nevertheless, in 2011, 31 per cent of the chicken came from small farmers.

An increase in egg production was achieved between 2004 to 2011, so in the latter year, output was put at 90.6 million. Egg production is centred in Maputo province of central Mozambique. The family sector only accounts for about four per cent of the total.

Because of the high costs of egg production in Mozambique, an estimated 90 per cent of the eggs consumed there are imported from neighbouring countries.

Egg production in 2012 was estimated at 121.6 million, of which 14 per cent came from the family sector.

On marketing and distribution of poultry products, chickens from commercial production systems are sold live at local markets or slaughtered at frozen through supermarkets or butchers. Eggs tend to be sold door-to-door or through supermarkets and butcher shops.

The local type of birds tend to be sold live door-to-door or in urban markets for higher prices than commercial birds. Eggs from local breeds tend not to be sold to customers.

Feed Ingredients

The FAO report includes a table giving the volume of feed ingredients imported into Mozambique. In 2009, the most recent year for which figures are given, these included: concentrates (protein/ micronutrient mixtures), 9,400 tonnes; feed, 15,147 tonnes; soybean cake, 7,543 tonnes and calcium phosphate, 845 tonnes. In the preceding years, sunflower cake, fish meal and meat meal had also been imported.

Analysis of the Poultry Industry in Mozambique

In her report for the FAO, Ms Dos Anjos reports that the poultry sector has been identified as the second pillar of the country's Livestock Strategy Plan.

Top priorities for the expansion of chicken meat production, in her view, are feasibility studies into local production of feed ingredients such as soybean and fishmeal as well as better quality controls for feed, day-old chicks and frozen chickens.

Furthermore, production agreements should be made to include the small-scale farms in the family sector, poultry farmers' associations should be set up and training improved.

The report's author does not consider it feasible to set up large-scale egg production in Mozambique for the time being but the output could be increased from smaller units using more productive specialised or dual-purpose breeds. Partnerships between private producers and the family sector should be promoted and research should focus on alternative feed and genetic lines for more sustainable production.

Ms Dos Anjos identifies the chief weakness of the poultry sector being high feed costs and the need to import premixes and proteins.

Control of Newcastle disease is being addressed but remains a risk, she reported, as there is a shortage of breeding and hatchery capacities.

Finally, local supply does not meet seasonal demands so the government permits imports. However, some importers manipulate the period of imports as well as quantities imported, she reports, and there is evidence of dumping.

Five-year Prospects for the Poultry Sector

Currently, the government works with the national poultry association, AMA, to improve the environment for the poultry industry, according to the FAO report. For instance, a credit line of approximately US$620,000 with low interest rates was created through a partnership with a major bank to benefit poultry producers in the South of the country. The pilot has been successful and it will be rolled out to other producers across the country.

Furthermore, added Ms Dos Anjos, the AMA has introduced a strategic plan for 2011-2015, which aims to boost chicken consumption by almost 26 per cent annually where they stressed that the prevision of consumption chicken meat will increase 25.8 percent per year, which is more than double the rate achieved between 2007 and 2009.