GLOBAL POULTRY TRENDS 2011 - Record Egg Output but Growth Slows in Asia

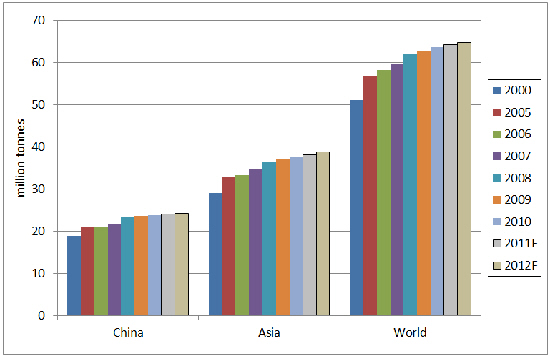

Economic pressures on producers' margins and in some instances, disease outbreaks, have markedly cut the rate of expansion in global egg production since 2009, according to seasoned industry watcher, Terry Evans.Between 2000 and 2008, the annual growth rate in egg output worldwide was well above two per cent but from 2008 to 2010, the rate of expansion fell to 1.5 per cent and is currently likely to be around one per cent. Nevertheless, output in 2012 could reach a record high of just under 65 million tonnes. Although this figure includes hatching eggs, these are unlikely to account for more than five per cent of the total.

Between 2000 and 2010, the rates of growth have varied between the regions, ranging from around one per cent in Europe to almost 2.6 per cent in Asia. Consequently, the latter region expanded her share of the global total from around 57 per cent to nearly 59 per cent. Africa has managed to increase its stake a little to almost four per cent. The share held by the Americas has slipped a shade to just under 20 per cent, while Oceania has just about maintained a share of some 0.4 per cent. Hardest hit region was Europe, where production, although rising from 9.5 million tonnes to an estimated 10.5 million tonnes in 2010 (table 1) lost two percentage points of market share. Here, output could currently amount to only 10.2 million tonnes, or less than 16 per cent, compared with 18.6 per cent back in 2000.

In 2010, the most recent year for which final data was available for all countries at the time of writing, there were 6,501 million layers (including breeders) worldwide, of which 4,146 million (64 per cent) were in Asia, 1,044 million (16 per cent) in the Americas, 788 million (12 per cent) were in Europe, 505 million (8 per cent) in Africa and 18 million (0.3 per cent) in Oceania.

This, the first in a series of four regional reports, examines developments in Asia.

Large Potential for Egg Products in Asia

Although there are nearly 50 countries in the region, more than 90 per cent of egg output comes from just 11 of these (see Tables 2 and 4), a situation which is unlikely to change in the near future.

Annual production of all eggs in Asia in 2010 amounted to around 42.6 million tonnes, of which some 37.5 million were hen eggs. Although the plant capacity is considerably higher, a maximum of one million tonnes of eggs (about three per cent) are processed into egg products by some 150 factories, of which 24 specialise in powdered products. The egg products industry has grown dramatically in the past 10 years with some 30 new factories being built in China, Korea and Taiwan. Developments in South-east Asia (Philippines, Indonesia, Singapore, Malaysia, Viet Nam, Thailand and Myanmar) have been slower due to relatively high egg prices and competition from imported egg products.

China

China is not only the leader in the region – accounting for some 63 per cent of total production – but is also the world's largest egg producer with the total for all poultry estimated to exceed 28.3 million tonnes in 2012, according to the China National Statistics Bureau. However, some four million tonnes of other (mainly duck) eggs are produced, which points to a 2012 forecast of some 24.3 million tonnes for hen eggs.

However, Morten Ernst (Managing Director of Sanovo International Asia-Pacific) considers that hen egg output in China in 2010 amounted to 24 million tonnes, which indicates that the Bureau's estimate for 2012 may be on the low side. However, according to the USDA's Agricultural Marketing Service, higher costs are making Chinese producers more cautious about expanding and there are also concerns over possible labour shortages. In that case, production in 2012 may fall short of 24.5 million tonnes. Since 2000, China's share of the regional total has actually declined a little.

Because output in China is so much greater than in any other country in the region, the trend in production is shown in Figure 1 rather than in Figure 2, which applies to the other leading producers in Asia. In China, most commercial egg producers are found in the top five egg producing provinces of Hebei (15.7 per cent), Shandong (14.2 per cent), Henan (13.3 per cent), Liaoning (8.1 per cent) and Jiangsu (6.6 per cent). There are about 10,000 farms with less than 2,000 layers, 100,000 with between 2,000 and 10,000 birds, some 20,000 with more than 10,000 but fewer than 100,000 birds and 2,000 with more than 100,000 hens.

It is estimated that some 75 per cent of China's eggs are brown-shelled and that around 90 per cent of the commercial flock is housed in cages.

The egg products industry in China comprises about 18 plants – not counting in-house processing by the food industry. About half of these 18, with a combined processing capacity of about 200,000 tonnes a year, are considered to be up to international standards. Eight produce egg powder, while those located near urban centres concentrate on fresh liquid products. The fresh liquid market is around the big city regions especially in the Shanghai and Beijing/Tianjin areas. Whole egg accounts for about 45 per cent, the remaining 55 per cent being separated yolks and whites. Four of the plants are foreign-owned and only three belong to egg producers, the remainder sourcing their egg requirements through egg traders and contract farmers.

China is not a processor of cheap egg products, prices of shell eggs having doubled since 2006, a trend that is expected to continue as feed, labour and energy costs are on the increase. So, China does not pose a threat in international markets with cheap egg products. The market for egg products is within the country and will continue to be as the urban metropolis moves in the direction of international quality food products for the growing middle class.

As a result of the internationalisation of Chinese egg products, it is increasingly important that the government establishes egg product processing guidelines that will eventually become law. Currently, each processor determines their own quality standards, though increasingly a growing number of food processors, who use egg products, are effectively becoming the regulating body for quality and traceability.

India

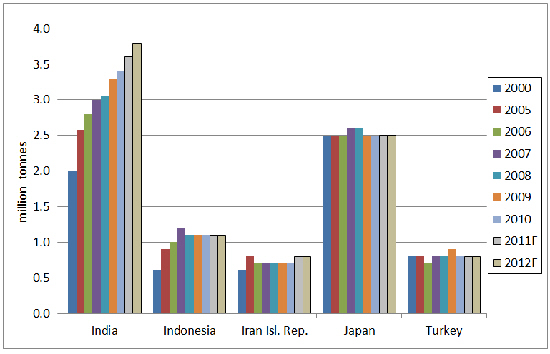

Second largest egg producer, India, has one of the fastest growing industries in the world, production having expanded by more than five per cent a year over the past decade with the result that by 2010, output had risen to 3.4 million tonnes, according to FAO data, while our estimate for 2012 of some 3.8 million tonnes is almost two million tonnes higher than in 2000 (Table 2). However, at least one assessment puts egg production in 2010 at 3.7 million tonnes, pointing to a more than 11 per cent increase over the estimate for 2009 of 3.3 million tonnes. All the birds in the commercial sector are kept in cages, more than 90 per cent of which are white-egg layers.

India's gross domestic product grew by 6.4 per cent a year between 2000 and 2008, making this country the second fastest growing major economy in the world after China. Its human population is forecast to overtake that of China by 2023, when it will likely exceed 1,431 million. Middle-class households are the fastest growing segment of the population, of which possibly 20 per cent are vegetarian but rising incomes and urbanisation will give a significant boost to non-vegetarian diets.

The country's egg products industry is young and concentrated in few hands, primarily because almost all egg products are exported. The first egg products company was established in the mid-1990s and four more came on stream shortly after although today, only three are still operating. They all have dryers and have a combined annual output of about 10,000 tonnes of egg powder. As all were established under the 'Export Oriented Unit' (EOU) scheme, they were designed to meet stringent international regulations.

Japan is the third largest egg producer in the region but although there has been some variation in production from year to year, in broad terms, the annual total has remained steady at around 2.5 million tonnes since 2000. Nearly 99 per cent of birds are kept in cages, and about two-thirds of eggs are white.

Although this country has more than 65 egg product plants, Japan is by far the largest importer of egg products in Asia, as only a couple of the plants manufacture egg powder.

During the period 2000 to 2010, the egg industry in Indonesia came close to matching India's rate of growth with an annual average of 5.7 per cent. While the period 2000 to 2007 witnessed an annual expansion of nine per cent, in the succeeding years, output contracted slightly, presumably as a result of the impact of outbreaks of highly pathogenic avian influenza (HPAI). However, a recent Rabobank report highlighted the point that Indonesia has emerged as one of the leading Asian countries for economic growth since the global financial crisis, and looks set to continue to do so for the next decade. Rising per-capita incomes and increasing health awareness, along with the development of modern retailing practices are considered to boost domestic demand for affordable food products for the middle- and lower-income groups from which the poultry industry, including the egg sector, will likely benefit.

Until 2010, Turkey's egg industry expanded steadily with output of around 750,000 tonnes in the middle of the last decade, rising to exceed 860,000 tonnes in 2009. However, while FAO statistics point to a cut-back in 2010 to 740,000 tonnes, another series of figures points to continued growth in that year. Nevertheless, it looks as though annual output could reach one million tonnes in the foreseeable future. Virtually all production comes from cages and it is considered that the brown to white egg ratio is 30:70. Turkey has four egg processing operations.

If the expansion that has taken place in Iran since 2006 can be maintained, annual production could soon top 750,000 tonnes year. However, one report late in 2011, said that an outbreak of avian influenza had resulted in a drastic reduction in production. Should this prove to be correct, it will take some time for Iran's industry to recover.

Iran is reported to have between six to eight processing plants, while there is just one in Pakistan.

Behind the 'Top Six' egg-producing countries in Asia, there are a further five, each producing around half a million tonnes of shell eggs a year.

South Korea has seen a sharp increase in the number of egg product factories over the past few years. There are now 14 producing liquid pasteurised products for the food and food-service sectors. A trade agreement with the EU, finalised in 2011, will gradually lower the import duties on egg products to zero over time.

Taiwan has also dramatically expanded its egg products sector with several new factories, bringing the total to 11 processing fresh liquid products. As there is no domestic powder production, this demand is covered by imports.

Compared to many other regions of the world, eggs are not cheap in South-east Asia. Several multinational food processors operate in this region and they frequently rely on imported egg products both frozen and dried. Local food processors also require eggs of the high hygiene and microbiological standard found in imported products, but otherwise eggs are mostly broken manually 'in-house' in bakeries. The food processing industry in this region is huge and eggs are a popular ingredient in many of the diets. Finished food products are often processed for export to Japan, Europe and North America and these manufacturers require egg products of international standard. Eleven plants in the region process around 70,000 tonnes of eggs into liquid egg, and one plant in Thailand also produces dried products. Three Thai plants supply the domestic food and food-service industries with pasteurised products, one of which manufactures dried products.

Due to its proximity to Singapore, Malaysian egg processors (of which there are three) supply this market, which has three small plants, with most of its local requirements for liquid pasteurised egg products.

Both the Philippines and Indonesia have one small plant but the demand for the bulk of egg products is met by imports from the US, Europe and India.

As the egg products sector in South-east Asia is relatively small, large volumes of products are imported.

February 2012