CME: Egg Sets & Chicken Placements Down from 2011

US - This may be called the Daily Livestock Report but as cattle and pork producers have known for the past 20 years, what happens with chicken directly affects the price they get for the hogs and cattle they bring to market, write Steve Meyer and Len Steiner.

Much of the talk

about demand in recent months has focused on a) the impact

that exports markets have had on beef and pork prices via reductions in US per capita disappearance b) what price are US

consumers willing to pay given ongoing economic troubles and

the fact that as much as 18% of the US population is either unemployed or underemployed. The question that is heard often

is: how high is high enough and at what point do consumers give

up and decide to stop going to the back of the store and head for

the pasta isle.

In our January 24 and 25 reports we went over

the demand issues for the various species and will not belabor

the point here or go back to reviewing Econ 101. Rather it is

important as we consider the path for beef and pork prices going into the all important March and April period to keep an eye

on broiler production and overall meat protein availability during the spring and summer months.

So far, broiler producers have been able to not only cut

back sharply but also sustain those reductions for a relatively

prolonged period of time.

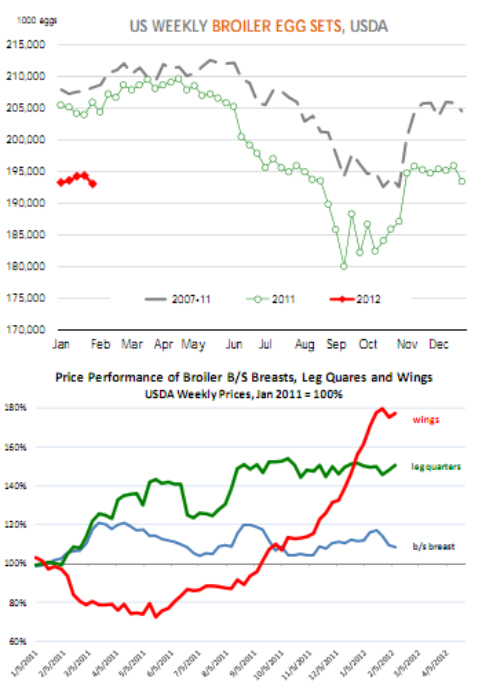

The latest data shows egg sets for the

week ending February 4 were down 6.2% from the previous year

and they were 7.3% lower than the five year average. Since the

beginning of the year egg sets have been on average about 5.5%

lower than the previous year.

Chick placements since the start

of the year are down about 4% compared to a year ago. This

implies that overall chicken production will remain well below

year ago levels at least through the end of Q1 and very likely

into Q2. Indeed, given sharp reductions in the hatching flock,

most analysts now expect broiler production in 2012 to be lower

than the previous year.

The impact of the cutbacks in broiler

production has not been uniform on chicken prices. Whole bird

prices are somewhat higher compared to a year ago but any

price inflation for whole birds remains somewhat limited at this

point. Prices for boneless skinless chicken breasts also have not

increased as much as one would expect and current prices are

about 8% higher compared to January 2011.

One factor that

continues to negatively impact the chicken breast market, in our

view, is the slow recovery in the foodservice business. While

reports are that foodservice demand may have turned a corner

we still think the recovery there will take time given high rates

of unemployment. As a result, chicken companies still have too

many loads of chicken breast that they need to move in the spot

market, keeping prices in check. On the other hand, prices for

leg quarters are up some 51% and wings have jumped some 80%

compared to a year ago, trading at record high levels.

Profits in

the industry are slowly returning but they are tenuous at best

and highly dependent on keeping supplies in check.