Broiler Economics: The world economy begins to recover

The world economy is expanding robustly in comparison with last year despite being bedeviled by the pandemic, inflation, an energy crisis, and labor shortages. Eventually those problems will diminish in importance, but it will take months or years to fully emerge from the massive disruption caused by COVID. All industries, including the chicken industry, have been affected by this economic turmoil.

It all began, of course, in early 2020. Buyers around the world suddenly canceled orders and factories closed due to lack of orders and, in some cases, the inability to function due to the pandemic. A massive and long-lasting economic slump was expected. To give one example, rental car companies facing an 80% drop in business sold a large percentage of their cars, and more importantly, did not order any new cars.

When the slump turned out to be shorter than expected, there was a surge of orders from companies running short on supplies. When everyone attempted to get more supplies, they found long waits because the entire supply chain was unprepared for a rush of new orders and struggled to return to normal. Some of the struggles included the closing of major ports and vital factories for periods of time. Supply chain issues remain a Gordian knot that will take time to untangle. Those rental car companies won’t get the cars they need for a while.

For the poultry industry, an important issue that will take time to resolve is the bottleneck at ports and the lack of refrigerated containers. Shipping containers of all types are in short supply worldwide primarily because they are waiting for trucks to be moved and therefore are piling up uselessly.

Containers are waiting for trucks because of the shortage of truck drivers to move them around. Labor is short everywhere including in poultry processing plants. There are many reasons for the lack of labor including the retirement of the boomer generation, temporarily generous unemployment benefits, fear of returning to work and the lack of day care among others.

Often neglected in the explanations is the fact that the US will have experienced one million excess deaths (above what would have been predicted) in calendar years 2020 and 2021. Around the entire globe there are 10 million excess deaths. Millions of people who would otherwise be working are gone.

Commodities of all kinds increased in price in part due to supply chain issues as well as increased labor and energy costs. Very few people expected a worldwide commodities boom and a bull market in stocks to emerge so soon after the beginning of the pandemic. Demand for everything soared and producers are only able to increase production slowly.

Energy is a good example. When the pandemic hit, the price of oil famously fell to negative numbers in Oklahoma. Investment in new wells was extinguished. As demand ramped up later in the year, producers were cautious. Supplies of natural gas in Europe were depleted last winter as production fell behind use.

This winter there will be a shortage of gas in both Europe and Asia as well as a shortage of oil and coal. An energy crisis is at hand the severity of which will depend on the severity of the winter.

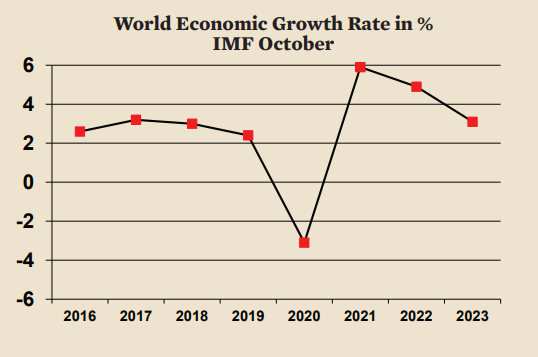

Despite all these problems, the world economy continues to rebound from the pandemic low. In fact, that rebound contributes to the spike in commodity prices, the supply chain issues, the labor shortage and the energy crisis. As the world economy continues to grow in 2022, these problems will slowly sort themselves out.

The chicken industry was, of course, not immune to the economic turmoil that occurred in the last two years. Higher grain, labor and energy costs resulted in higher production costs. The high cost of both grain and lumber earlier this year, combined with economic uncertainty, resulted in an understandable reluctance on the part of the industry to expand production. Luckily, higher chicken prices have more than made up for higher production costs.

Looking forward to 2022, the cost of production should be falling substantially. It now appears that grain prices peaked this year and are now in a long-term bear market (barring a drought). Energy prices will probably peak this winter before falling next year. Labor costs will at least plateau at a new higher level. The price of lumber, the cause of at least one cancellation of a new chicken production complex, is now much lower.

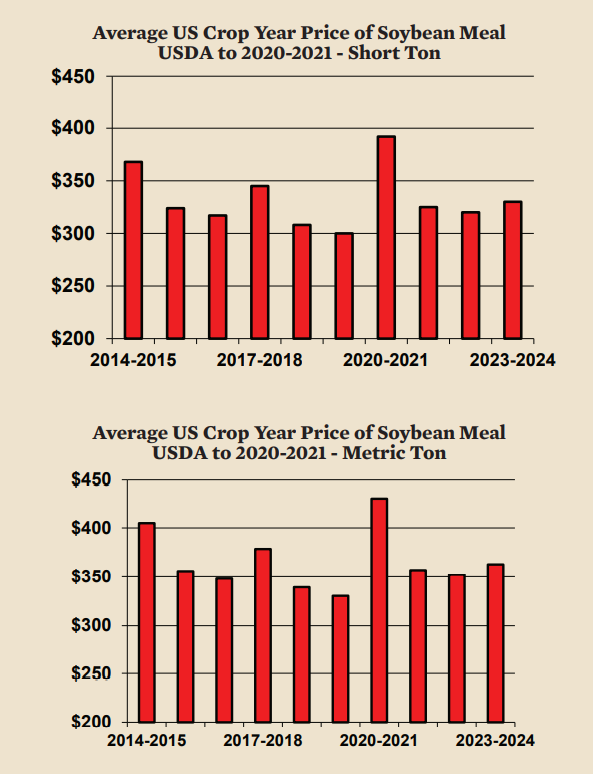

The story for corn and soybeans is promising for the users of grain and not so promising for grain farmers. From the summer of 2020 to the spring of 2021 a vigorous bull market in grain

resulted in the price of corn doubling, and the price of soybean meal rising by 50%. The highest prices are now in the rear-view mirror and grain prices are likely to continue to moderate.

Although COVID still casts a dark shadow over economic activity, economic expansion is real. World economic growth is estimated to be 6% this year compared to estimates of just 4% a few months ago. The International Monetary Fund (IMF) predicts world economic growth of 5% next year. Prospects are looking brighter for the world chicken industry as well.

The demand for animal protein is normally diminished during periods of economic recession since meat is a luxury for most of the world’s population. In the case of this recession, the negative effects on protein demand were mitigated by massive efforts by many governments to prop up consumer income. As a result, the meat recession was milder than would have been expected and demand is strengthening in many countries.

The poultry industry was well positioned to ride out this crisis. In a recession there is a shift in demand from more expensive meats toward poultry. When grain prices fall and meat consumption rises, chicken consumption will rise along with the overall increase in meat consumption.

Corn

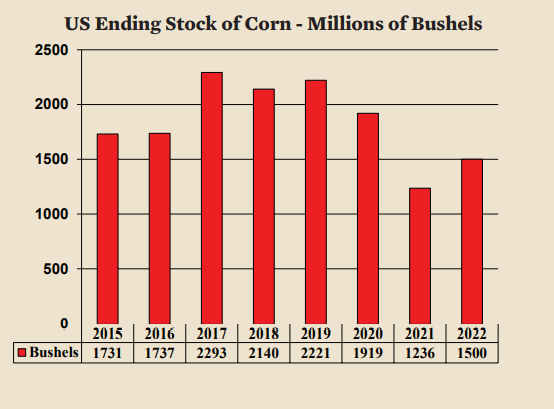

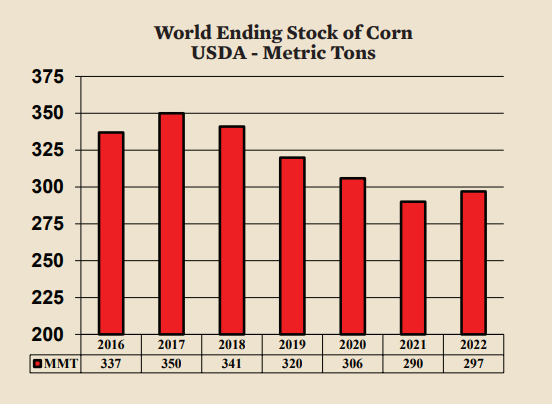

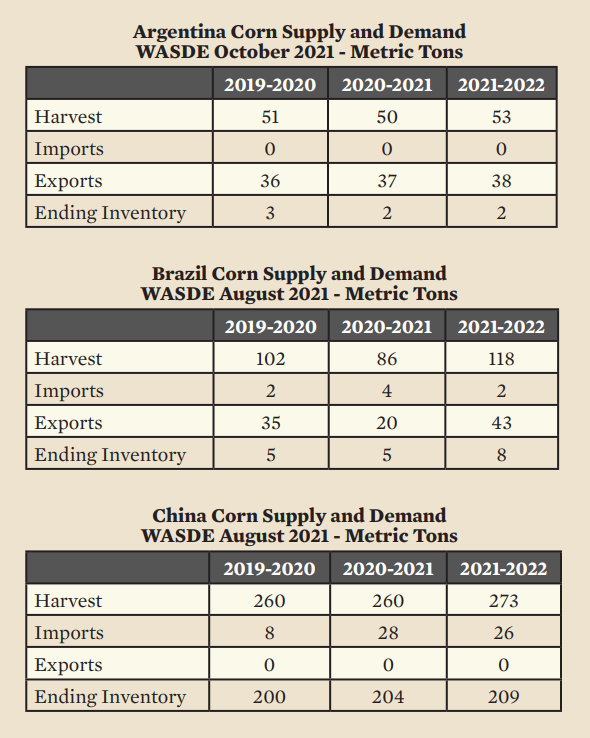

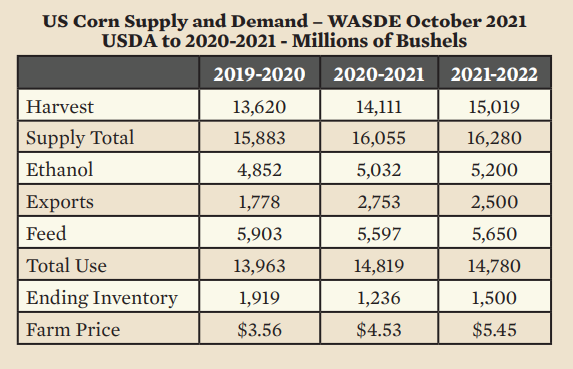

After a peak in May, the price of corn moved down significantly. The harvest in the US is looking good and projections by the USDA are for higher ending stock next year than was expected by the trade. This crop year, 2020-2021, ending inventory was 1.2 billion bushels. For next year, the projected ending inventory is 1.5 billion bushels. Ending inventory is projected to rise because of a better harvest this year and reduced exports to China. World-ending stock numbers are ample and are expected to also rise next crop year. In addition, there are no grave issues in the rest of the world that would indicate a resurgent bull market.

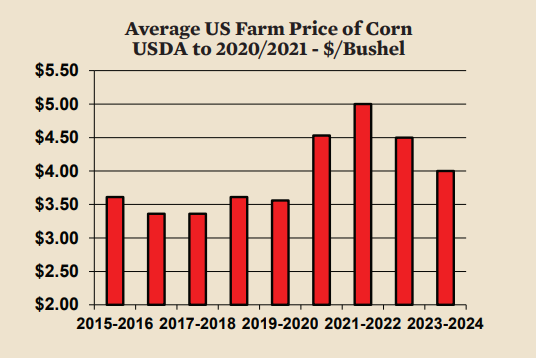

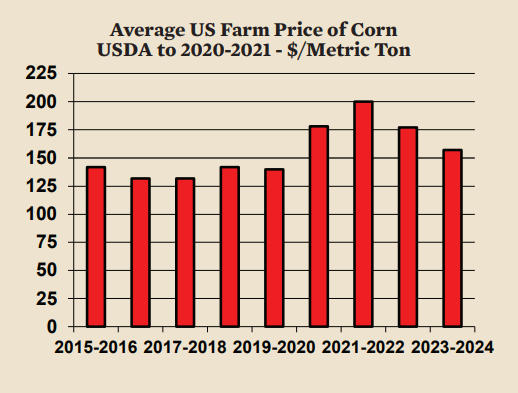

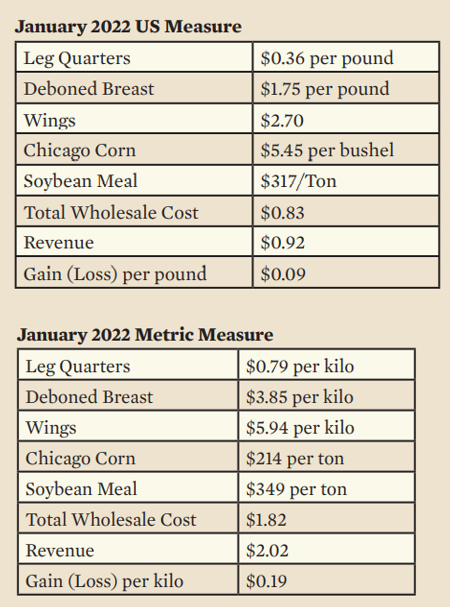

The average farm price of corn will be higher in the current crop year. That is, in part, because prices were so low at the beginning of last crop year. In addition, the high price of fertilizer may push some corn production to soybeans in the spring. If that proves to be true, corn inventories will be held tightly thus increasing the price. The USDA projects the corn price on the farm this crop year at $5.45. That appears to be too high given the likely increase in ending inventory. Therefore, corn may well vary between $4.50 and $5.50 per bushel ($177-$217 per ton) this crop year.

Soybeans

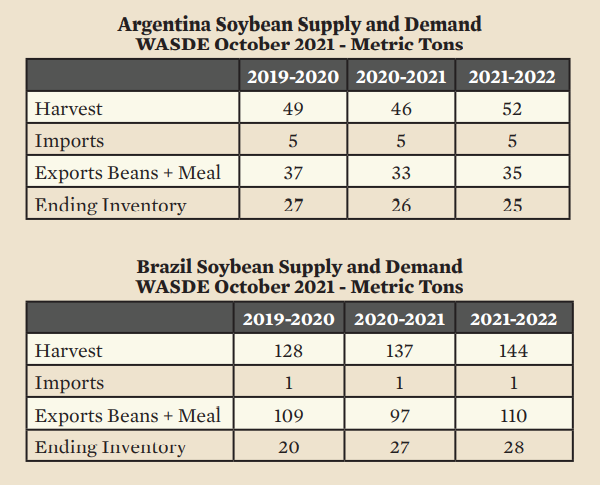

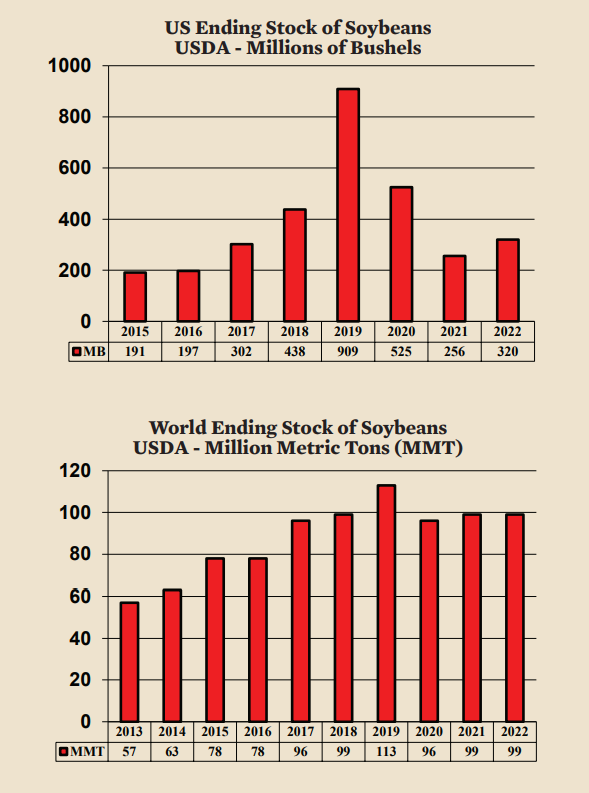

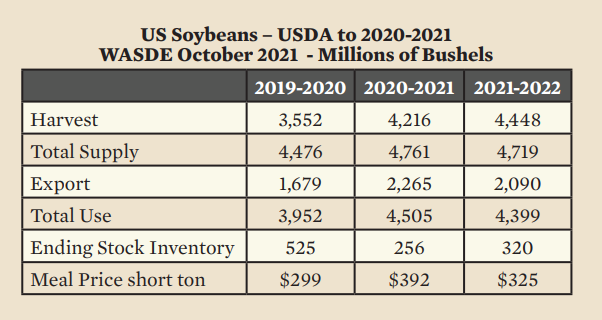

The outlook for the users of soybeans is even better than that of users of corn. From a high of $425 per short ton in May prices have come down $100 to $325. The one-time sharp increase in exports last crop year to China is now over. A good harvest in the southern hemisphere, followed by the current apparently good harvest in the US, helped reduce soybean prices. In addition, when soybean oil prices are high, as they are now, meal tends to drop as more soybeans are crushed for the oil. Brazil and Argentina produce far more soybeans than the US so a good crop in the southern hemisphere ensures that there is a limit to how high soybean prices can rise. Last crop year, South America produced a combined 194 million metric tons (MMT) compared to 115 MMT produced by the US. For this crop year South America is expected to produce 209 MMT. More importantly, exports from Brazil and Argentina are expected to rise 15 MMT this crop year.

Although the US does not dominate world soybean production like it does corn, low-ending stock numbers in the US raised concern earlier this year. Ending stock did fall to a low level at the end of last crop year but the number was higher than expected and is projected to increase next year. Unlike corn, the average price of soybean meal this crop year is expected to be lower than last crop year.

US Chicken Industry

The US chicken industry, like a lot of industries, was reluctant to expand production in the teeth of the COVID recession and the accompanying problems with labor and raw materials. In addition, production was constrained by the effects of the disease itself on the workforce at processing plants. When the economy and meat demand started recovering faster than imagined, the supply of chicken turned out to be surprisingly short. All chicken prices rose, especially wing prices. Deboned breast climbed as sandwich wars broke out between fast food companies that offered new chicken sandwich products this year. Chicken prices can be expected to moderate over the next year as labor shortages are sorted out and production increases return.

Last year, China opened their market to US chicken and became the second largest market for US chicken after Mexico. The market is not just for paws, which can be worth as much as $2 per pound, but also large amounts of leg quarters as well. Although exports of leg quarters to China slowed as prices rose, exports for the entire year can be expected to at least equal that of last year.

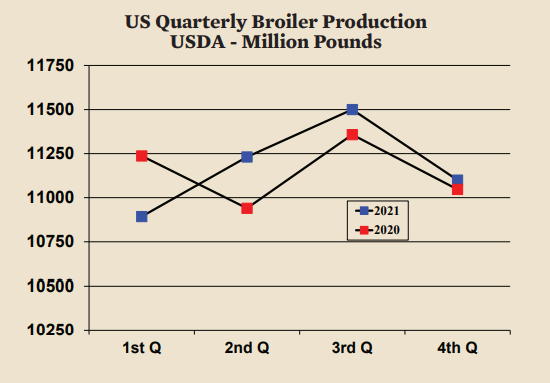

The USDA (October WASDE) expects chicken production to be only 0.3% higher this year. As can be seen on the graph below, chicken production was lower in the first quarter, higher in the second quarter and then only slightly higher in every other quarter this year. Next year production is expected to accelerate slightly to a 1.2% gain and surely will increase more rapidly in 2023.

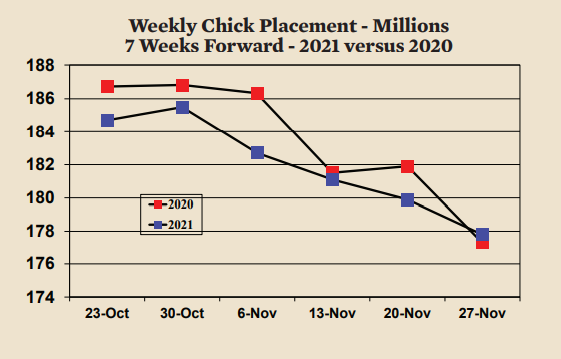

The graph below of chick placements, moved 7 weeks forward to show the processing date, indicates that production at this moment is temporarily lower than last year. This is the time of year when production drops seasonally. Going forward, production can be expected to increase next year both seasonally and in comparison to 2021.

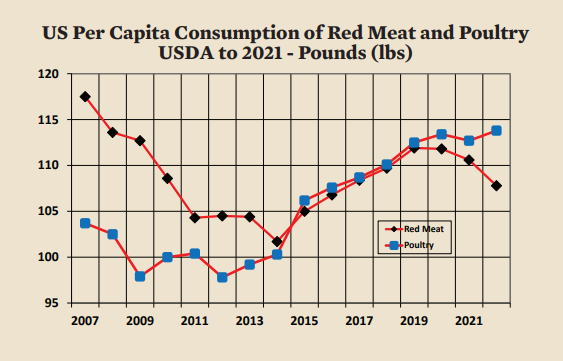

After a decline from 2007 to 2013 (the great recession) US consumption of both red meat and poultry per capita rose steadily year after year until 2019. Last year, beef and pork started to fall while chicken consumption leveled out, a trend that continues this year and next. As a result, total meat consumption per capita is falling. Total meat supply of both red meat and poultry was 225 pounds in 2020, 223 pounds in 2021 and is projected to be 221 pounds in 2022. With supply falling and demand rising, it is no wonder that prices are high for all meats.

Deboned Breast

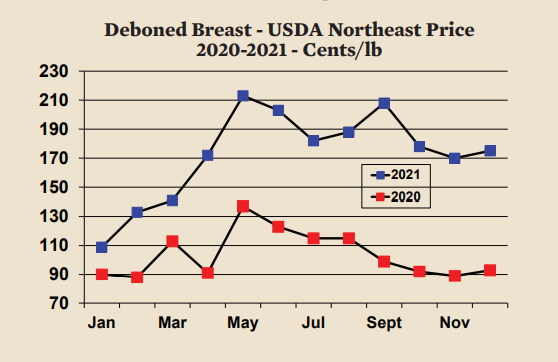

The price of deboned breast sank to less than a dollar late last year just when grain prices were in the process of doubling. It was no wonder that there was little desire to increase production at that point. In fact, large bird deboning declined late last year. This year, breast meat rose during the first five months of the year as supply turned out to be surprisingly short for a suddenly increased demand, a familiar story for many industries. The price is now seasonally dropping but at a level of double that of last year. Since prices in 2020 were unusually low and 2021 was unusually high, it would not be surprising to see prices next year somewhere in between as production begins to expand and the increase in demand calms down in year-to-year comparisons. That would put the USDA Northeast price in December of 2022 at $1.35 ($3.00 per kilo).

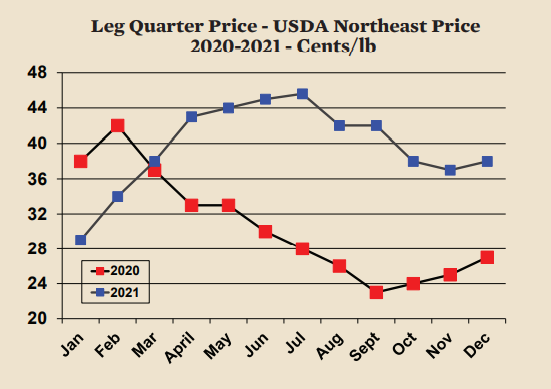

Leg Quarters

Total US exports of leg quarters will be about 7% higher in 2021 than last year while the value is about 25% higher due to higher prices. The prices of all meat, domestic and foreign, rose this year helping to lift the value of leg quarters. In addition to strong exports, there is increasing domestic demand for leg quarters. Last December the Northeast price of leg quarters was 27 cents per pound (60 cents per kilo). This year in December the price is likely to be 38 cents per pound (84 cents per kilo). Given the strength of the export and domestic market, the price next December is likely to be close to the same as this year, 38 cents per pound (84 cents per kilo).

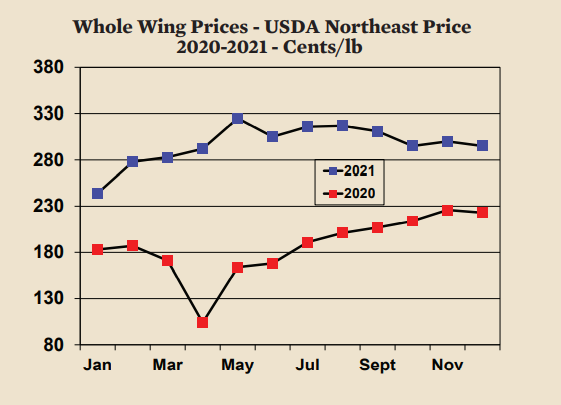

Wings

Nowhere was the collapse of food service demand last year more evident than in the wing market. Suddenly higher unemployment, falling wages, sports being cancelled, and restaurants and bars being closed were a major but temporary blow to wing prices. Wing prices bounced right back and continued higher the rest of last year and through the first half of this year. Part of the reason for rising prices was lower supply as large bird deboning production dropped. With food service reopening, wings soared to above $3 per pound ($6.60 per kilo) wholesale (Northeast Price). Although wing prices may well have peaked, they are likely to remain relatively high throughout next year, ending the year around $2.50 per pound ($5.50 per kilo).

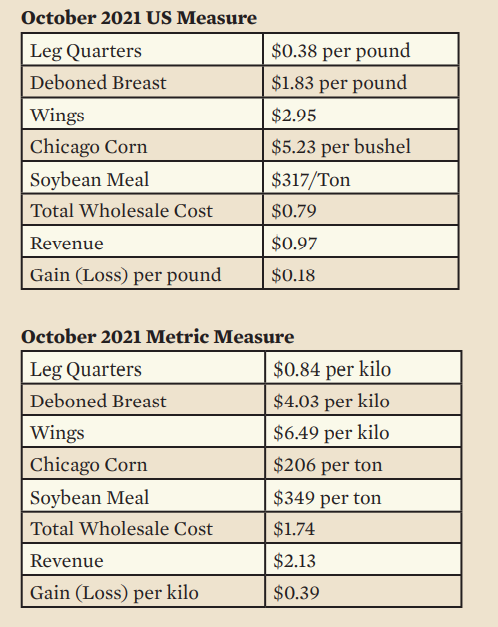

Chicken production in the US is profitable thanks to high wing, leg quarter and breast meat prices. Prices will drop seasonally this fall and winter but to a lessor extent than in previous years. With both grain and chicken prices dropping, the industry should remain profitable.

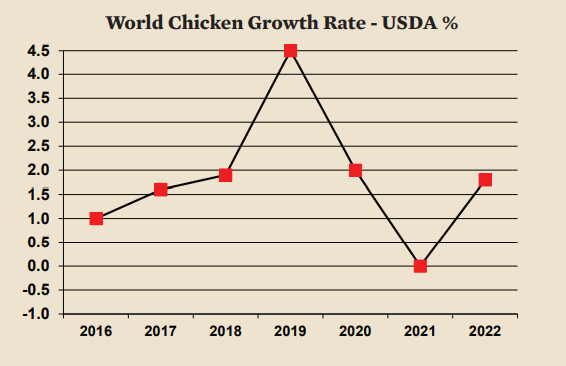

World Chicken Growth Rate

World chicken production grew at an unusual rate of 4.5% in 2019 in large part due to surging production in China to make up for lack of pork in the wake of African Swine Flu. Since then, production increases have moderated in China while the problems associated with COVID reduced production increases everywhere. As a result, there was no increase at all in production this year. Growth is expected to accelerate to 1.8% in 2022, a level that is probably close to the long-term rate of growth that can be expected. With world population increasing at 1% per year, a growth rate of 2% for chicken would mark a continued steady increase in world per capita consumption.