CoBank macro outlook: “Higher for longer” boosts US dollar, hits export prospects

US Fed officials now expect interest rates to stay higher for longer“Higher for longer” is now the trending catchphrase among market watchers following the demise of “transitory inflation” and the quickly fading “economic soft landing.” Fed Chairman Powell commented at the Sept. 20 meeting that despite his 5.25% in combined hikes to date, consumer spending, employment, and inflation were all still running hotter than he liked.

When Powell followed up by saying “the process of getting inflation sustainably down to 2% has a long way to go,” home builders, auto manufacturers and borrowers were hit with another spell of queasiness as the 10-year Treasury yield jumped to 4.5%, the highest level since 2007. The average new 30-year fixed-rate mortgage is currently sitting at 7.4%, the highest since President Bill Clinton was in office.

A close reading of the September Federal Open Market Committee transcripts points to the general conclusion that while Fed committee members now view rates as being at or very near their cyclical peak, they also believe the overnight rate will remain plateaued above 4% well into 2025.

Boston Fed President Collins said, “I expect rates may have to stay higher, and for longer, than previous projections had suggested, and further tightening is certainly not off the table.”

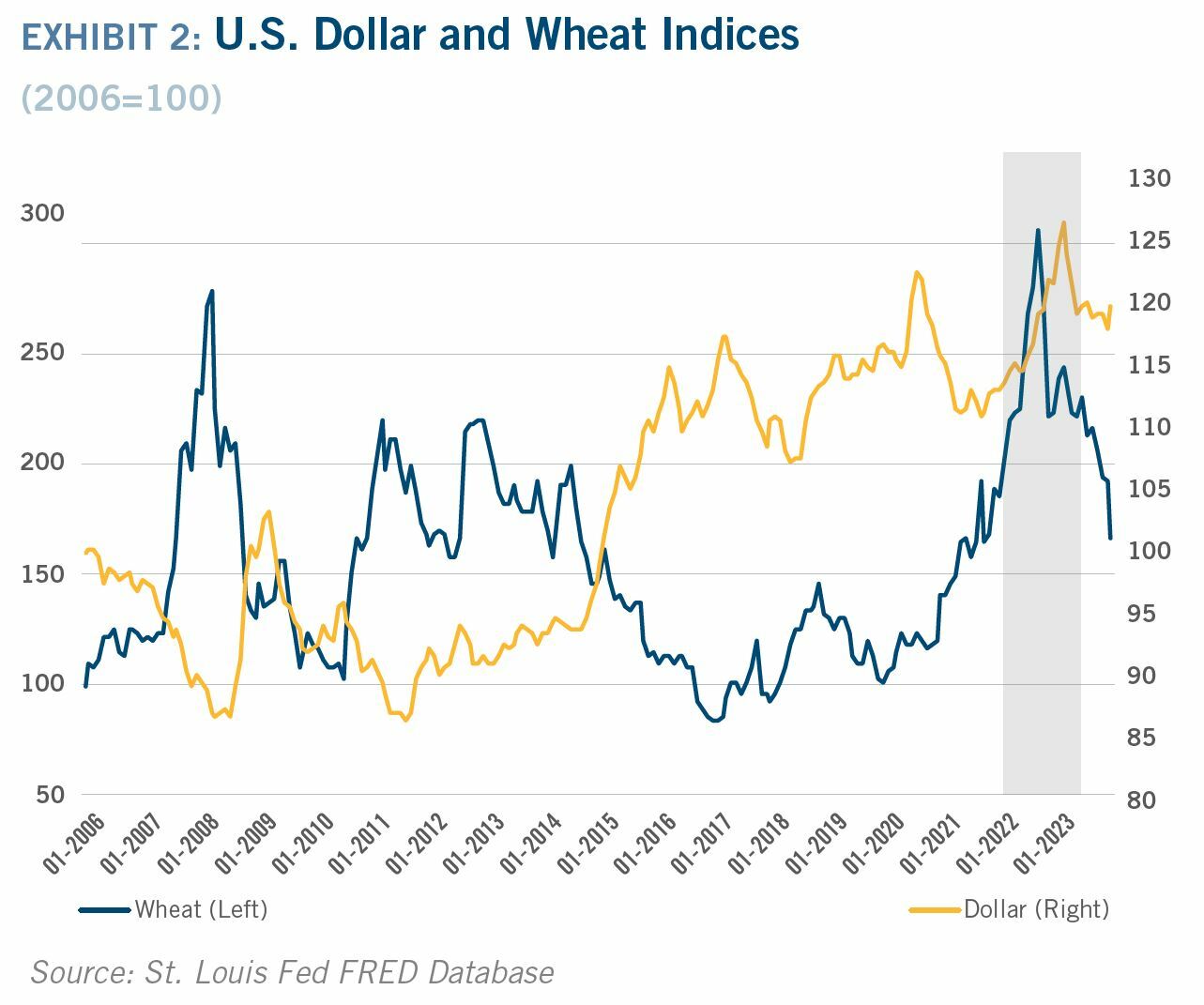

While the US economy is outperforming expectations, the rest of the world – Europe and China in particular – has fallen far short of them. As a consequence of the US now being the world’s economic “strongman” and our interest rates trending “higher for longer,” the dollar has gotten stronger than anyone had previously expected (Exhibit 1).

The highly unusual geopolitical/economic events during the 2020-2022 timeframe (pandemic shutdowns, supply chain chaos, rampant inflation, the Ukraine invasion, and simultaneous central bank tightening) resulted in the anomalous historic situation where commodity prices and the dollar were both moving upward in tandem. But those events are now fading as market drivers, and in our view, the historic fundamental inverse relationship between the broad array of commodities and the dollar has returned in large part.

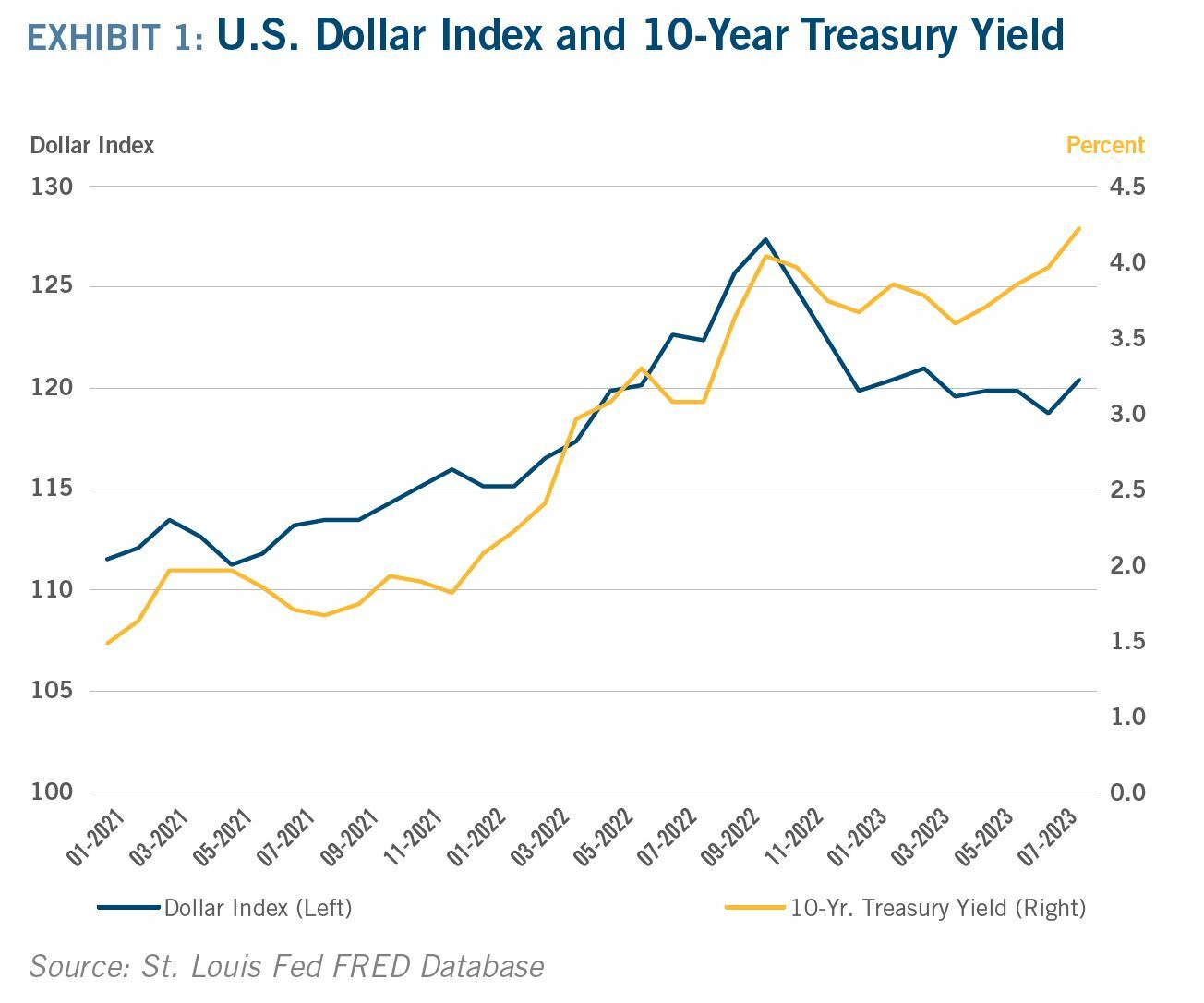

The global wheat market illustrates this situation clearly (Exhibit 2). Starting on July 24, Chicago wheat futures fell for nine straight weeks while ICE dollar index futures rose for nine straight weeks. That is not a coincidence but a return to normality: For the 20-year period prior to COVID, the simple correlation between the monthly dollar index and monthly wheat prices is -0.77, where -1.0 represents a perfect 1:1 inverse relationship. The petroleum market currently remains an outlier however, with prices still rising amid OPEC+ and Saudi production cutbacks, sanctions on Russian oil, and declining investments by the major oil companies.

The majority of international transactions are still conducted in dollars, and a strong dollar makes US exports more expensive and imports cheaper – both of which disproportionally hurt the backbone of the rural economy: agriculture, durable goods manufacturing, mining, and forest products. Combined with slower global economic growth, it’s a double whammy – our export customers can’t afford to buy US products.