CoBank - Strong US dollar, low Mississippi River limit grain movement & oilseed exports

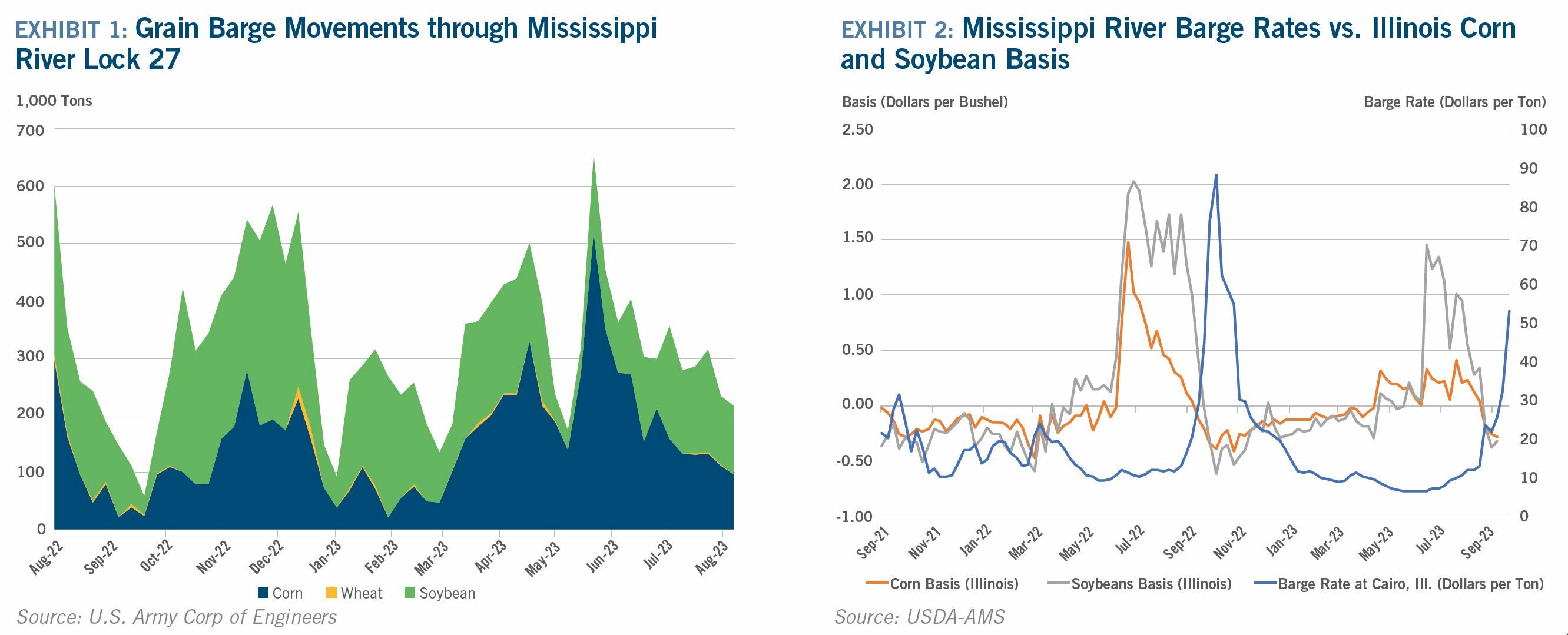

Robust export competition from Brazil and Russia also creating headwinds for US corn, soybean and wheat in the months aheadHistorically low water levels on the Mississippi River, which moves nearly half the US grain and oilseed exports, are limiting grain movement heading into peak fall harvest season (Exhibit 1). Correspondingly high barge freight rates on the Mississippi River are also pressuring interior basis values for corn and soybeans (Exhibit 2). For example, downbound barge rates from Southern Illinois had risen from $12 per ton in July to $46 per ton in late September. Combined with the strength in the dollar and robust export competition from Brazil and Russia, the US grain and oilseed export program faces major headwinds in the weeks and months ahead.

The market’s attention next quarter turns to the planting of South America’s corn and soybean crops. Farmers in Brazil are struggling with dry soil conditions and a stressed margin outlook on corn, which is expected to pull planted corn acreage lower. Soybean acreage, though, is expected to continue expanding.

Corn

Outstanding corn export sales start the new crop year leading last year’s sales pace by 6.7% with a much bigger crop and as exports flow through routes outside of the Mississippi River. USDA currently estimates the 2023/24 US corn crop at 15.134 billion bushels, up 10.2% YoY. Conspicuously absent from the export sales ledger for US corn is China, with outstanding sales down 64.8% YoY. The combination of higher shipping rates on the Mississippi River, strength in the US dollar, competitive offerings for corn in South America, and political saber rattling between the US and China has severely limited China’s buying interest in US corn.

USDA reported US corn inventories on Sept. 1 at 1.361 billion bushels, which was notably lower than market expectations. The smaller ending stocks number for the 2022/23 crop year indicated higher feed usage, but ethanol bears the burden of holding up corn demand. Corn consumption for fuel alcohol in July was up 2% YoY as ethanol processors benefit from historically strong margins.

Soybeans

Soybean export sales are also sluggish in the absence of Chinese demand, with total outstanding sales at the start of the new crop year down 36% YoY. Chinese sales are down 48% YoY. The smaller export pace is balanced by the expectation of a smaller harvest this fall with the US soybean crop pegged at 4.146 million bushels, down 3% YoY following a season of prolonged heat and drought in the Midwest. Soybean stocks at the end of the 2022-23 marketing year on Sept. 1 totaled 268 million bushels, down 2.2% YoY.

Although the soybean export pace remains lethargic, domestic usage is strengthening. Soybeans crushed for crude oil in July totaled 185 million bushels, up 2.2% YoY, as the market fills growing demand for renewable diesel.

Wheat

Winter wheat planting is underway in the US and acreage is expected to be down slightly as prices languish below expected breakeven costs of production. Winter wheat demand faces strong headwinds from record Russian exports and an ample supply of corn competing for feed usage (Exhibit 3). A short Canadian spring crop has lifted sales of US hard red spring (HRS), Chinese demand has appeared for soft red winter (SRW), while uncertainty over dry conditions in Australia and Argentina is raising concerns of short global wheat supplies heading into 2024. US all wheat stocks on Sept. 1 totaled 1.780 billion bushels, up 0.1% YoY.