EU-25 Poultry and Products Annual Overview - July 2005

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Annual 2005 report for EU. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

Broiler production in the EU is increasing in 2005, albeit at a lower pace than domestic

consumption. Consumption is increasing more rapidly in the NMS than in the EU-15. With

stable export levels, this leaves room for increased imports, which are mainly imported from

South-America. Imports from Thailand are hampered by the Avian Influenza outbreak,

although imports of cooked poultry meat are increasing. The same trend is forecast to

continue in 2006.

The European market for turkey meat is roughly behaving in the same way, although turkey

production is faltering in 2005 as a result of restructuring in some of the NMS. However,

turkey production, imports and consumption are all forecast to increase again in 2006.

Executive Summary

One year after the accession of ten New Member States (NMS) to the EU, it appears that

market integration is going well without any major disruptions, as was feared by some. The

enlargement in 2004 initially provoked a significant import of poultry meat from the NMS into

the EU-15, as a result of the price differential and increased trade dynamics between EU-15

and NMS are expected to last. Production of broilers is increasing, albeit at a slower pace

than domestic consumption, which is leading to a decrease in the European oversupply of

broiler meat.

Domestic consumption is increasing faster in the NMS than in the EU-15,

where per capita consumption has stabilized. The end of cheap imports of salted poultry

meat at a reduced tariff in 2003, created a stable EU market in 2004 and 2005. With stable

exports, imports are forecast to increase in the future. The same trend is forecast for 2006.

However, it is yet unclear how much imports may jump up again as a result of the WTO

ruling against the EU ban on salted poultry meat imports.

A similar situation exists in the EU turkey market, although a downward fluctuation in 2005

is expected to interrupt the increases in production and consumption. This fluctuation in

production is expected to stem from some sector restructuring in the Czech Republic and in

Hungary, as a result of decreased profitability for the producer because of the ending of

government support upon accession. However, turkey production, imports and domestic

consumption are all forecast to increase again in 2006.

Broiler: 2004

Broiler production was reviewed marginally up from previous estimates. Production

increases in the Benelux, Germany, Poland and Portugal more than offset decreases in France

and Italy. Provisionally final broiler imports turned out to be higher than previously

estimated, but still 8 percent below 2003 imports. The reduction of broiler meat imports

compared to 2003 is a consequence of the closure of the loophole for low duty imports of

salted broiler meat from Brazil and reduced imports from Thailand as a result of export

restrictions in connection with an outbreak of Avian Influenza.

Thailand may only export

cooked poultry meat to the EU. EU broiler meat imports originate from Brazil (65%) and

Thailand (23.5%) mainly. U.S. broiler exports to the EU-25 boiled down to 2.3 percent in

2004, as it lost about 10,000 MT of exports to the NMS upon accession. EU broiler exports

were lower than previously estimated, especially from the Benelux and France. The main

export destinations were Saudi Arabia, Russia, Ukraine and Yemen. Most of the exports to

Russia consist of cheap mechanically deboned meat for processing. Domestic consumption

of broiler meat had previously been underestimated by about 15 percent, mainly in the

Benelux, Poland and Portugal.

2005

EU broiler production is expected to remain stable in 2005, as increases in the Benelux, Poland and the United Kingdom are likely to offset production decreases in France and Italy. Imports are expected to remain stable. Exports are expected to decrease marginally, as higher exports from the Benelux are not expected to fully compensate for lower exports from France. Domestic broiler consumption is expected to increase marginally, with only the U.K. expecting a more significant increase.

2006

Broiler production in 2006 is forecast to slightly increase. Production increases in Poland and the U.K. will expectedly be partly offset by a decrease in France. Imports are forecast to increase again as Thailand is expected to export more cooked poultry meat to the EU as a way to overcome the import ban for AI. Exports are forecast to remain stable, with further decreases in exports from France and the U.K., which are expected to be be offset by higher exports from the Benelux. Domestic consumption is forecast to further increase, mainly in Poland and the U.K., with smaller increases in the Benelux and Germany.

Turkey: 2004

Turkey production was revised downwards as more accurate data on several NMS was collected. The only turkey slaughter plant in Denmark closed operations in April 2004. Turkey final import and export numbers were higher than previously estimated. Turkey imports from Brazil accounted for 85 percent of EU imports. Turkey exports are mainly destined to Russia, Benin and Ukraine. Domestic consumption was lower than previously estimated.

2005

Turkey production increases in Germany, Italy, the Benelux, Portugal and Poland are expected to more than offset decreases in France, the U.K. and Hungary. Turkey imports, mainly from Brazil, are expected to increase into France and Germany. Exports are expected to increase, as increased exports from Germany should more than offset decreasing exports from France. Domestic consumption is expected to remain stable, although at a lower level than previously estimated.

2006

Turkey production is forecast to further increase in 2006, although at a slower pace than the increase in domestic consumption. Production decreases in France and the United Kingdom are not forecast to offset production increases in Germany, Hungary and Poland. Turkey imports are forecast to further increase, while turkey exports should remain stable, with increasing exports from Germany to Russia offsetting decreasing exports from France.

Policy

Market adjustments resulting from Enlargement

While poultry production has mostly recovered from the 2003 Avian Influenza outbreak in

the Benelux or the 2003 nitrofuran scare in Portugal, producers and processors in both the

EU-15 and the NMS are still adapting to the new market situation that arose as a result of

the 2004 Enlargement process.

Indeed, within the EU-15, different trends developed in response to local market situations.

Increasing competition in world markets and decreases in EU export refund levels are driving

poultry and turkey production down in France and Spain in 2005 and probably also in 2006.

In the Benelux, Germany and the United Kingdom production is increasing in response to

increases in domestic consumption and after the European Commission put the brakes on

poultry imports from Brazil and Thailand that were entering at low import tariffs under the

salted poultry meat heading. However, this increase in production may prove to be moderate

and for a limited time only. Increases in poultry consumption are expected to continue. This

is due to increasing numbers of immigrants from Africa and Asia, who traditionally have

dietary preferences for poultry.

In the NMS, mainly Poland, the growth of the poultry sector is expected to be structural and

longer lasting. However, in the short term producers in the Czech Republic and Hungary

suffer from being weaned from pre-accession government subsidies to the sector. First of all,

per capita consumption of poultry is rising at over 2 percent per year, compared to a

stagnating per capita consumption in the EU-15. The availability of large supplies of cheap

grain provides NMS producers with a competitive advantage from lower feeding costs. The

proximity of important export markets in Ukraine and Russia offers good export perspectives

as processors in Poland and other NMS are getting export approvals back from Russia after

they were removed upon accession to the EU. Another competitive advantage lies in the fact

that new investments in the NMS poultry sectors already comply with new EU legislation in

the domains of hygiene and animal welfare.

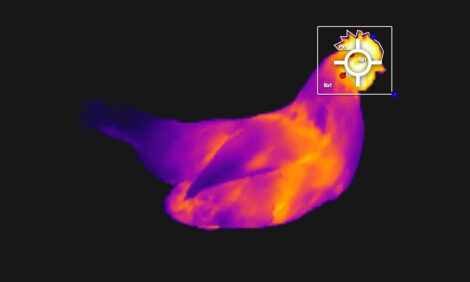

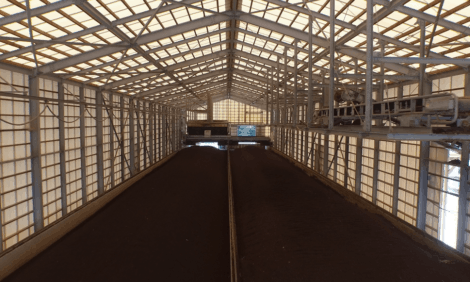

Consequences of new animal welfare standards for broilers

The EU is currently involved in the adoption process of a Directive1 that would set maximum

stocking densities for broilers and establish a number of minimum conditions for animal

welfare. This proposal suggests reducing the weight of live birds per square meter to 30

kg/m? instead of the current EU-25 average of 40 kg/m?. It would also set strict conditions

for temperature and air moisture in broiler establishments. This proposed Directive is based

on a report of the Scientific Committee on Animal Health and Animal Welfare (SCAHAW),

which was adopted on March 21, 2000, “The Welfare of Chickens Kept for Meat Production

(Broilers).”2

This Directive would reportedly most impact the competence of broiler sectors

in Denmark and The Netherlands, whic h now have the highest stocking densities. However,

the competence of the whole EU broiler sector could be negatively affected (see GAIN

E35108 - The EC proposes the legislation for its new Broiler Welfare Directive3). After full

implementation in member states, this Directive calls for mandatory labeling for welfare

conditions, including imports. The full implications of this proposed Directive are not yet

clear.

Impact of the WTO panel on poultry

On May 30, 2005, a WTO panel ruled against the EU in the complaints by Brazil and Thailand

on the Customs Classification of Frozen Boneless Chicken Cuts” (DS269 and DS286) (see

GAIN E35113 - WTO rules against EU in salted poultry case4). In 2002, the EC, in Regulation

1223/2002, stipulated that boneless chic ken cuts, which were slightly salted, were still to be

considered as fresh, chilled or frozen poultry meat under the customs code 0207 and not

under customs code 0210. The EC issued this Regulation to close the loophole, under which

Brazil and Thailand were exporting poultry cuts at the much lower customs tariff for heading

0210.

Expectations are that Brazil will start to export poultry under this heading to the EU

again, after the EU appeal against this ruling has been dismissed. Thailand temporarily can’t

because of the ongoing AI situation. Unless the EC is successful in dealing with this problem,

this could put a lot of pressure on EU poultry markets as of 2006 again, with eventual

repercussions on world markets if the EC were to decide to use export refunds again to

balance EU supplies.

Further Information

To read the full report please click here

Source: USDA Foreign Agricultural Service - July 2005