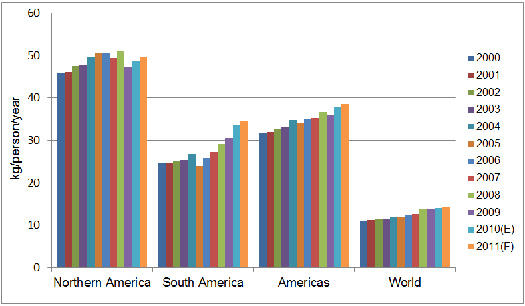

GLOBAL POULTRY TRENDS – Consumption in Americas Nearly Treble the World Average

Poultry meat consumption in the Americas is almost treble the global average, according to industry watcher, Terry Evans in his last article examining the chicken meat industry in North, Central and South America.Uptake in the region has grown from about 31.5kg in 2000 to an estimated record 38.5kg in 2011, compared to the the global average of around 14.3kg per person per year. However, a glance at figure 1 reveals that the increase, particularly in recent years, has been the result of consumption rises in South America, as uptake in Northern America has been fairly flat averaging just below 50kg per person per year since 2005.

Currently around 940 million people, or nearly 14 per cent of the global total, live in the Americas. By 2015, the number will have grown to nearly one billion. While there are more than 50 countries in this region, two-thirds live in just three countries – the US, Brazil and Mexico (table 1). Over the period 2010 to 2019, the USDA forecasts that population growth in North America will average 0.8 per cent a year compared with 1.1 per cent for both Brazil and Mexico. Global growth, which had been running at an annual rate of 1.7 per cent in the 1980s, is also expected to slow to around 1.1 per cent.

There are no direct measurements of consumption the figures being derived from estimates of available supplies, having taken account of production, trade, stocks and losses in distribution from farm to the table, divided by assessments of the human population. Clearly, there is considerable scope for error in such a calculation, and the data can vary greatly depending on the source. Hence, the trends conveyed by the figures are more important than the absolute consumption levels. It can be particularly risky to compare consumption between countries. Also, in a few instances, where a country has an unusually high number of tourists, the calculations can give misleading figures since the consumption/person data does not take this into account.

Chicken supplies for the domestic market in the US grew by nearly five per cent in 2010 but despite this, the average consumption per person at 43.4kg on a ready-to-cook basis was below that recorded in 2004. Indeed, chicken consumption declined over the three consecutive years 2007 to 2009 from 45.1kg to 42.1kg, which was an unprecedented occurrence since the USDA started keeping records in 1935. Over the three years, uptake contracted by 3.0kg per person but in 2010, it recovered to an estimated 43.4kg and the latest forecast for 2012 is 44.5kg. USDA economists believe that, 'The chicken market will have the opportunity to gain market share over the next few years due to tighter supplies of beef and pork, though high feed costs are expected to limit that opportunity' and by 2018, they predict that consumption of all poultry will overtake that for beef, pork and lamb combined.

In Brazil, the main contribution to higher domestic demand has been an increase in disposable incomes allied to exceptionally high beef prices. Total consumption is expected to continue strong in 2011 with a projected 3.5 per cent increase to 9.6 million tonnes, reflecting growth in the economy, a further reduction in unemployment and a continued increase in purchasing power particularly among the lower income groups. Between 2001 and 2010, chicken consumption jumped 47 per cent from 31kg to 45.4kg, while for 2011 a further gain to 47.3kg is anticipated.

Improvements in consumer purchasing power have also been the key driver expanding consumption in Mexico. Demand, especially among low-income consumers, will continue to rise, though a shift in the preferences of middle-income consumers from chicken to beef will likely limit the increases in uptake per person. Per-capita consumption has increased by 30 per cent in the past decade but this trend is not expected to continue unless the industry introduces new economic value-added products. Total consumption in 2011 is now considered to be marginally higher than in 2010 at 3.4 million tonnes. The average Mexican spends 34 per cent of income on food, some 24 per cent of which goes on purchasing all meats and of this, 28 per cent is spent on poultry meat. Consumers prefer fresh whole chickens as fresh products are perceived to be of higher quality. For 2011, the average uptake of chicken is postulated at 30.0kg per person, which compares with an estimate of 29.7kg for 2010 and 28.2kg back in 2007.

Consumption in Argentina has expanded rapidly from 28kg per person in 2006 to an estimated 33.7kg in 2010, with the forecast for 2011 showing an additional rise to 36.1kg. However, data from a different source maintains that uptake has risen from 20kg in 2003 to an estimated 38kg in 2011, which again underlines the point that it is more important to take note of the trend than the actual levels quoted.

Having risen from 20.4kg per person in 2006 to 24kg in 2008, consumption in Colombia has since broadly stabilised at this level with the forecast for 2011 at 24.1kg being a shade below the latest estimate of 24.2kg for 2010.

Continued consumer preference for chicken will likely increase the quantity consumed per person in Canada, although the most recent estimate for 2011 of 29.8kg is only fractionally higher than the 2010 figure of 29.7kg. Over the past 30 years, uptake has doubled, partly as the result of population growth, which rose by nearly 39 per cent from 24.5 million in 1980 to around 34 million in 2010. Also, chicken meat has become more popular due to an increase in health awareness among consumers who consider that it is leaner and therefore healthier than its competitors.

In Canada, price has not been a factor as, due to the country's supply-management system, poultry prices have been consistently higher than those for beef or pork, which are not produced under a supply-management system. The country's supply system only guarantees prices to producers and not downstream for the other participants in the supply chain. Wholesale and retail prices normally reflect market conditions in terms of supply and demand. They also reflect consumer preferences as here, like in the USA, buyers prefer breasts and wings to leg meat. In recent years, the immigrant population seems more likely to have preferences for chicken, while food-service providers have also given chicken demand a boost. Canada's Chicken Farmers Strategic Plan for 2009-2013 has the objective of raising the annual consumption of chicken to 33kg per person.

While a small rise in poultry consumption is expected in Venezuela in 2012 at 30.2kg per person, highly competitive imports – primarily from Brazil and Argentina – will likely account for a bigger proportion of the total, as domestic production is not expected to expand because of price controls and high feed costs.

September 2011