Hong Kong Poultry and Products Semi-Annual Overview - February 2006

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Semi-Annual 2006 report for Hong Kong. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

Hong Kong reported no cases of avian influenza (AI) in 2005. The U.S. in 2005 exported $52

million of chicken products plus $64 million of chicken feet to Hong Kong. A challenge for

U.S. poultry products destined for Hong Kong in 2006 will be continuing competition,

especially price competitive products from Brazil.

Also, Hong Kong’s new certification

requirement for U.S. chicken feet has contributed to a decline in U.S. export value in this

market. However, Hong Kong consumers have great confidence in U.S. products in terms of

quality and food safety. U.S. exports to Hong Kong is forecast to increase by 6 percent

reaching 35,000 MT in 2006 (excluding chicken feet and re-exports)

Situation and Outlook

In 2005, Hong Kong had an import market of $385 million worth of chicken products, plus

$72 million worth of live chickens and $137 million of chicken feet. About 26 percent and 51

percent respectively of chicken products and chicken feet were re-exported.

Hong Kong’s imports of chicken products in 2006 and beyond are predicted to inevitably

decline as a result of the trend of increasing direct shipment to China. However, when reexports

are excluded, 2006 imports are expected to rise slightly by 1 percent to 226,000 MT

because Hong Kong has been stocked with chicken products which have not been able to be

re-exported to China. (Because of AI outbreaks in China, some traders voiced concern that

demand for chicken products in China have been reduced, and re-export trade to China as

well as movement of chicken shipments between provinces have not been smooth.)

In 2005, U.S. chicken products have not yet been able to recover from its previous leading

position of market share in Hong Kong despite the governme nt’s lifting of its 3-month ban of

U.S. poultry in April 2004. The U.S. accounted for 33 percent ($121 million) of the market

share in 2003 but declined to 13 percent ($52 million) in 2005. Brazilain products have been

extremely price competitive. One salient point is that Hong Kong traders started to buy

more expensive parts from Brazil such as two-joint wings which are retained for domestic

consumption. In the past, the only most popular Brazilian parts were 3-joint wings which

were re-exported to China.

However, the U.S. is a non-AI infected area and Hong Kong consumers have good confidence

in U.S. products in terms of quality and food safety. U.S. products are advantaged in this

regard particularly when China suffers from AI outbreaks. Therefore, U.S. exports to Hong

Kong are expected to rise by 6 percent amounting to 35,000 MT in 2006. U.S. exported

33,000 MT of chicken products to Hong Kong in 2005 (excluding chicken feet and reexports).

Hong Kong’s consumption of chicken rose 5 percent in 2005 after Hong Kong banned chicken

supplies from AI infected countries namely the U.S. and China for a few months in 2004.

Another reason for the increased consumption is the fact that many products that should

have been re-exported to China are stuck in Hong Kong. In order to prevent total loss,

traders tend to dump the products in the local market.

Hong Kong’s chicken consumption is closely linked to AI development in China, which is a

major supplier for live chickens and chicken products. In Novemb er 2005, Hong Kong’s

chicken consumption plummeted significantly resulting from the news of AI human infection

cases in China. The importation of both live chickens and chilled/frozen chickens slid.

However, the Hong Kong market has already digested the fact of human infection AI cases in

China. Given the impending Chinese new year which is a typical peak season for chicken

consumption, consumers’ confidence in chicken consumption has been largely recovered.

The 2006 forecast is a modest rise of 1 percent, yet it could drop significantly if AI outbreaks

get more serious in China.

Hong Kong currently has banned imports of live birds and poultry products from 14 countries

including China because of reported AI cases. Out of the 13 provinces/autonomous regions

from China which are subject to Hong Kong’s import restriction, only Liaoning Province is a

key poultry supplying area for Hong Kong. About 14 percent of Hong Kong’s poultry imports

from China came from Liaoning Province in 2005. However, importers revealed that they are

able to source substitutes from other places such as Shandong Province with no difficulties.

Imports from China have declined since October 2005 and may well be attributed to

contracted demand rather than shortage of supply.

(Note: Two dead birds, Oriental Magpie Robin, found respectively on January 10 and 26 in

the sub-urban areas of Hong Kong were confirmed to be H5N1 positive after a series of

laboratory tests. As a safety measure, the Hong Kong government carried out inspection of

some 18 chicken farms within five kilometers of where the birds were found. Surveillance of

wild birds in the area has also been stepped up. According to a Hong Kong spokesman, the

existence of H5N1 virus in 2 dead birds might be an indication that the virus exists in the

natural environment in Hong Kong.)

Narrative on Supply and Demand, Policy & Marketing: Production

Though there are outbreaks of Avian Influenza cases in various parts of the world in the past

few months, there have been no AI cases reported in Hong Kong. The Hong Kong

government early last year worked out a contingency plan in response to outbreaks of avian

influenza in poultry in local farms and retail markets. The Hong Kong government restated

that the plan remained unchanged. In the event of two confirmed H5N1 cases in local

poultry farms, the government will terminate all local live poultry trade on a compulsory

basis. Also, when there are two confirmed H5N1 cases in retail markets, all live poultry in

Hong Kong’s retail markets will be culled.

Hong Kong government officials have always said they have done as much as they could to

prevent AI. As such, there have not been any significant changes in production policy since

this last report. In view of the mounting pressure of the risks of AI outbreaks, the Hong

Kong government nonetheless has made the following two changes in November 2005.

First, a free avian influenza vaccination program for backyard poultry is offered. Second, the

three duck farms remaining in Hong Kong are required to have bird-proof facilities.

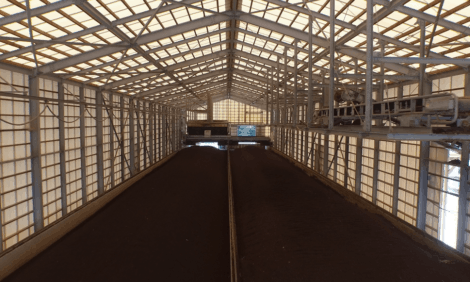

Currently, there is compulsory vaccination for all imported and local chickens and all chicken

farms are required to provide shed-proof facilities in order to prevent wild bird droppings

from contacting the stock.

When the government launched the farm-license buy-back scheme in August last year, there

were 147 farms with a 3.7 million chicken capacity allowed. In the past five months, over 20

licenses were returned to the government. About 120 farms are still in operation with a

capacity of 3.2 million chickens. This is still far above the government’s target of reducing

the number of chickens to 2 million by the end of 2005. It is not known at this moment

whether the government will take any measure to cut the number to 2 million. However, the

government has set August 2006 as the deadline for the voluntary license buy-back scheme,

it is very possible that many farmers would wait for the last minute before they are willing to

return the license and obtain the cash compensation.

The current production of chickens in Hong Kong has been very consistent, amounting to

approximately 60,000 head per day, with imports and local farms each supplying 30,000

head. The government setting this import limit is based on the rationale that the retail

markets can accommodate this amount and that overcrowded situations will give rise to the

risks of an AI outbreak.

Since Hong Kong banned importation of live chickens from China between January and April,

2004, the production of live chickens (table 1) in 2005 increased by 30 percent over 2004.

With the supply limit imposed by the Hong Kong government, it is very unlikely that

production in 2006 will rise. On the other hand, production will drop significantly in case AI

outbreaks in China become uncontrollable or spread to Guangdong province, which supplies

all Hong Kong’s live chicken imports.

Consumption

Hong Kong’s consumption of chicken, particularly live chicken, plummeted in mid November

when news of human AI cases in China was widely reported in Hong Kong. China supplies

almost half of Hong Kong’s total live chicken consumption while the rest are supplied locally.

The sporadic outbreaks of AI cases in birds in various provinces of China did not significantly

impact Hong Kong consumers’ confidence in chicken consumption. The news of human

infection, however, rocked the retail market. The wholesale price of live chickens dropped

tremendously from the normal price of HK$12/catty (US$2.6/kg) to HK$4/catty

(US$0.87/kg). The market remained sluggish over 20 days. The market gradually

recovered towards the end of December. The current wholesale price (January 2006) is

around HK$10/catty (US$2.2/kg). The table below shows that live chicken supplies began

to decline in October but dropped significantly in November. The decline in supplies was due

to consumer confidence.

The retained chicken meat products also declined in November but not as dramatically as the

frozen chicken supplies. Brazil, China and the U.S. are the three largest suppliers of frozen

chicken products and Brazil and U.S. are non-AI infected areas. Consumer confidence in

frozen chickens was not as negatively affected as in live chickens.

There were different factors at play regarding the consumption of frozen chicken products.

First, some restaurants have changed their menu from chicken to other meats when HRI

sectors considered consumers’ AI concern. Once menus are changed, it takes time to switch

menus back again to chicken. Second, the market was also affected by weak re-export sales

to China in the past few months. When products could not find buyers in China, they

became stuck and sold in Hong Kong at very competitive prices. Third, high-end retail

outlets selling premium chicken meat products did not experience any significant decline in

retail sales of American chicken products. Fourth, in ordinary retail outlets where the origin

of frozen products is not well labeled, the overall sales of chicken products declined.

Hong Kong’s consumption of chicken products in 2006 is expected to show modest rise,

reaching 273 MT, provided that Hong Kong does not have any AI cases. Hong Kong being a

mature market should not experience any drastic demand change for meats. (Chicken

consumption in 2004 was about 5 percent lower than 2005. This was the result of Hong

Kong’s ban on live chicken and chicken products from China and the U.S. in early 2004

because of AI cases, resulting in consumption at that time being severely affected. )

However, the consumption, particularly live chicken, will depend very much on the

development of AI outbreaks in China. If the neighboring province, Guangdong, has AI

outbreaks, both supplies and confidence will be adversely affected. Guangdong is the major

supplying area for live chickens and chilled whole chickens. Any AI outbreak there,

according to the existing policy, will lead to Hong Kong government’s ban on chicken product

exports to the territory.

Trade

Hong Kong had a chicken product market of over $385 million (303,035 MT) in 2005, plus $137 million (188,415 MT ) worth of chicken feet.

Change in Market Share

A significant point worth mentioning is Brazil’s overtaking the U.S. as the largest supplier for

the second year since 2004. The U.S. exported $52 million of chicken products to Hong Kong

in 2005, being the 3rd largest supplier taking up 13 percent of the market share. It used to

take up 33 percent ($121 million) in 2003 and was the leading chicken meat supplier for the

Hong Kong market. The Hong Kong government banned U.S. chicken products between

February 11 and April 30, 2004 because of AI cases in the U.S. Since then, the Brazilian

products greatly expanded the market. Hong Kong importers have established new business

relationships with Brazilian exporters. Since the products are receptive by their customers,

many importers do not have a big incentive to stick to U.S. products even after the lifting of

the ban. Instead, importers will compare the prices between U.S. and Brazilian products and

offer both choices to their customers. Because of the price discrepancy, importers and end

users very often will end up buying the price competitive Brazilian products.

Brazil is particularly strong in mid-joint wings. Several years ago, they largely supplied 3-

joint wings which were primarily re-exported to China. Traders like the soldier layer packing

method and size guarantee for Brazilian products. For example, Brazilian exporters are able

to guarantee 2-joint wings in a reasonable region of 35 gms. For the first 11 months of

2005, Hong Kong’s imports of Brazilian chicken wings rose by 18 percent reaching $105

million. In contrast, U.S. exports of chicken wings to Hong Kong dropped by 21 percent at a

value of $28 million.

Table 6 indicated that the average price of Brazilian products in 2005 rose by 45 percent

compared to 2003. The increased average price reflected the fact that Hong Kong traders

bought more expensive parts from Brazil than in the past and these more expensive parts

very often are retained for domestic consumption.

The Impact of the New Certification Requirement for Chicken Feet

Effective April 30, 2005, U.S. chicken feet exports to Hong Kong are required to meet the

same health certification as poultry meat. To meet the new requirements, processing plants

need to modify their plant facilities in order to process chicken feet which are derived from

birds which have been given ante-mortem and post-mortem inspection. Since the Hong

Kong government has taken the “production date” as the cut-off date, products exported to

Hong Kong in May with production date prior to April 30 were still eligible to be imported to

Hong Kong without complying with the new requirement.

The import figures between Jan – May and June – Nov are compared in order to gauge the

impact of the requirement change. The import figures of U.S. chicken feet declined from

59,000 MT in January – May 2005 to 21,000 MT in June – November 2005, representing a

decline of 64 percent. For other U.S. chicken products, the decline was recorded less at 37

percent (Jan- May 30,000 MT; June – November 19,000 MT). There could be only two

reasons that explained the bigger decline in chicken feet. One is the change of certificate

requirements. Another reason could be the fact that China’s demand for chicken feet

products slackened in the second half of the year. Since 51 percent of Hong Kong’s chicken

feet products are re-exported while 26 percent of other chicken products are re-exported,

the change in demand in China would have a bigger impact on Hong Kong’s import of U.S.

chicken feet than of other U.S. chicken products.

In the past few years, Hong Kong’s imports of chicken products have been decreasing. The

major reason was the decreased re-export trade to China. (See figures below). In recent

years, China’s import duty for chicken products has been lowered. On the other hand, Hong

Kong has expensive terminal handling charges in addition to the pre-inspection process now

required by the China Inspection Co. in Hong Kong. As long as there are no conspicuous

savings through Hong Kong, traders tend to ship products directly to China.

The importation of whole chicken is the only category exception that it has increased over

the years. Less than 1 percent of whole chicken imports are re-exported. Almost all imports

are retained for domestic consumption. As such, the changed climate in re-export trade has

not had any impact on the importation of whole chickens. In fact, it has been increasing

steadily because the government has restricted the importation of live chickens and

chilled/frozen whole chicken imports have been the substitutes for live chickens. China

accounted for 91 percent of the market share in this product category. The chilled/frozen

whole chickens imported from China have heads and feet on, which are different from other

supplying countries.

The second figure below indicted that retained imports in 2004 surged suddenly. In fact, this

was due to the decline of re-exports to China caused by China’s ban on chicken products.

Many products were retained in Hong Kong as a result. In order to prevent total loss when

products fail to access China, traders tend to dump the products in Hong Kong. While Hong

Kong’s consumption of chilled/frozen chickens are increasing steadily, it should not

experience such conspicuous jump in one year.

Forecast for 2006

As the Hong Kong market is still stocked with chicken products, imports in early 2006 will go

slowly with a modest annual growth of about 1 percent in 2006, amounting to 226,000 MT.

The U.S. will continue to face strong competition from Brazilian products. However, Hong

Kong consumers have strong confidence in U.S. food products in terms of quality and food

safety. U.S. chicken products will be advantaged in this regard under the increasing threat of

AI problems in the region. As such, U.S. product import is forecast to rise by 6 percent

reaching 35,000 MT in 2006.

Given the trend in the past few years, Hong Kong’s overall imports of chicken products,

including chicken feet and re-exports, are expected to continue to decline. For products and

certain destinations in China that are still favorable for being re-exported through transport

companies, they will still come to Hong Kong first. However, these products going to China

may take various routings. For example, Vietnam and Taiwan were favorable routing centers

in 2004 and 2005 respectively.

Policy

Hong Kong has imposed restrictions on imports of live poultry and poultry meat from

countries where AI cases have been reported. As of January 16, 2006 Hong Kong has

restricted live poultry and poultry meat from the following countries.

Though Liaoning Province is one of the significant provinces exporting chicken meat products

to Hong Kong, Hong Kong traders have shifted their sourcing to other provinces such as

Shandong Province and supplies have been sufficient. Nonetheless, imports from China have

declined but the reason was due to slackened demand in Hong Kong rather than reduced

supply in China.

Hong Kong allows the importation of cooked-processed poultry products from AI infected

countries. However, import consignments have to be accompanied by health certificates

stating that the products do not come from AI infected zones.

Reorganization Plan for the Food Safety Regulatory Framework

The Hong Kong government has decided to reorganize the food regulatory framework in

Hong Kong by setting up two new departments called Department of Food Safety, Inspection

and Quarantine (DFSIQ) and Department of Agriculture and Environmental Hygiene (DAEH).

These two departments will be under the policy bureau --- Health Welfare and Food Bureau.

FEHD’s (Food and Environmental Hygiene Department) existing regulatory functions over

food, live food animal meats and slaughterhouse management and AFCD’s (Agriculture,

Fisheries and Conservation Department) existing functions over the inspection and

quarantine of imported non-food live animals, birds and plants, licensing of livestock and

mariculture farms, and regulation of pesticides to be transferred to the new DFSIQ. The

new DAEH will take up the operational responsibilities to promote and facilitate the

development of agriculture and fisheries activities in Hong Kong and maintain environmental

hygiene. Also, the government is planning to set up a Food Standard Committee consisting

of experts and academics to enhance the formulation and review of food safety standards.

The purpose of the re-organization is to set up a new department to regulate all matters

related to food safety.

The government aims to have the new DFSIQ set up by April 2006. Sources revealed that

the reorganization has encountered some resistance from staff and the project may not be

completed before the target date. As an interim measure, the Hong Kong government

intends to set up a Center for Food Safety under the existing FEHD. The Controller of the

Center will be responsible for formulating and implementing all food safety measures, leading

high level negotiations, and liaison with mainland China and overseas food authorities on

food safety matters.

Further Information

To continue reading the report, including tables, click here (PDF)

List of Articles in this series

To view our complete list of 2006 Poultry and Products Semi-Annual reports, please click hereSource: USDA Foreign Agricultural Service - February 2006