India Poultry and Products Annual 2006

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Annual 2006 report for India. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights:

Post forecasts India’s 2007 poultry meat production to grow by 10 percent to 2.2 million tons. This higher production forecast is supported by an expected surge in domestic demand and an increasing trend towards integrated poultry operations.

Production

India’s broiler meat production, which was growing at over 15 percent per annum in recent years, was badly hit by the HPAI outbreak in February/March 2006. Assuming the country remains free of HPAI, broiler meat production in calendar year (CY) 2007 is forecast to grow by 10 percent to 2.2 million tons. Production growth is supported by likely strong growth in domestic poultry meat demand in response to affordable prices and increasing incomes, an increasing trend towards integrated poultry operations, and improving bird weights and dressing yields due to better genetics.

Post’s broiler meat production estimate for CY 2006 is revised downward to 2.0 million tons due to losses caused by the avian influenza outbreak in February/March in some of the producing regions. Poultry meat prices dipped below the cost of production for several months1, resulting in colossal financial losses to the industry and forcing several units to scale down or close operations. Although market prices have recovered since May, high corn prices continue to affect profit margins. Maize prices will soften with the harvest of new crop in October. Consequently, market sources expect a strong recovery in broiler production in the last quarter of CY 2006.

The market share of integrators in India’s total poultry meat production is gradually expanding in all parts of the country2, which should result in better production efficiency (better bird weight, higher FCR, lower mortality) in the sector. The poultry sector in India employs three million people and contributes rs. 260 billion ($5.7 billion) to the national income.

AI Crisis

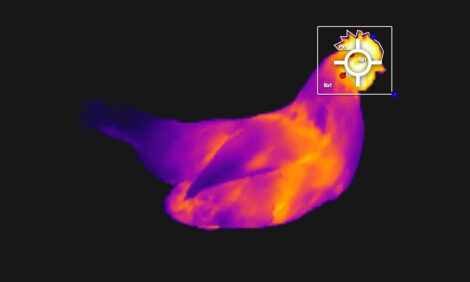

On February 18, 2006, India notified the OIE of an outbreak of HPAI virus subtype H5N1 in poultry birds in western India. Between January 27 and April 18, 2006, several outbreaks were reported in two districts (Navapur and Jalgaon) of Maharashtra and adjoining areas in Gujarat and Madhya Pradesh. Control measures initiated included culling the entire poultry population, destruction of eggs, feeds, consumables, litter, and other potentially infected material in a 10 kilometer radius of the outbreak location, restrictions on the movement of poultry, poultry products and personnel to and from the affected areas, and cleaning and sanitization of the infected area. More than one million birds and over 1.5 million eggs were destroyed, which is a fraction of a percent of the country’s total bird and egg production, and farmers were compensated for their losses3.

The government carried out surveillance (clinical, virological, and serological) in a 15 kilometers radius of the outbreak area. Surveillance was also carried out throughout the country through random sampling and sampling of observed abnormal mortality of poultry and wild migratory birds. On August 11, 2006, the government declared that India had regained its notifiable AI-free country status per the OIE regulations4. The surveillance of poultry and wild migratory birds is continuing. For more on government’s bird flu action plan, please refer the website - http://dahd.nic.in/birdflue.htm

The wide media coverage of the HPAI outbreak panicked consumers, with most of them avoiding poultry meat. Broiler meat prices crashed, forcing several poultry units to close or scale down operations to minimize losses. The poultry industry initiated a media campaign on the safety of poultry meat to regain consumer confidence. In early April, the government announced a relief package5 for the poultry industry.

With the scaling down of production and increasing consumer demand, poultry meat prices have recovered since May. More and more units are getting back to production. Financial losses due to AI have prompted several small poultry operators to switch to contract agreements with large poultry integrators, to minimize price risk6.

Poultry Feed Developments

Industry sources estimate CY 2006 poultry feed consumption at 14.0 million tons compared to 13.2 million tons in CY 2005, with the major ingredients being corn (7.0 million tons) and soybean meal (1.8 million tons). Poultry feed prices have soared in CY 2006, with the current prices 14 percent higher than a year ago, largely due to high corn prices, which are currently at a record $158 per ton. Although the government has supplied small quantities of corn from its stocks to the poultry industry at a lower than market rates, it was not enough to contain the price rise. The poultry industry is now seeking duty free imports of corn to ease the supply situation, which the government is unlikely to permit in view of the impending corn harvest.

Production Policy

The government’s poultry development programs are mainly focused on disease surveillance and control, as well as development and supply of improved breeding stocks, feed and production practices. The Indian Council of Agricultural Research conducts research and development activities in these areas at the national level. The state agricultural universities, regional research institutions, and various state agricultural extension agencies further support these efforts. The total central government funding in Indian fiscal year (IFY) 2005/06 (Apr-Mar) was Rs. 415 million ($ 9.0 million) for poultry development activities, and rs. 678 million ($ 14.7 million) for animal disease control7 activities. Furthermore, the Agricultural and Processed Food Export Development Authority (APEDA) of the government assists with infrastructure developments for exports.

Consumption

Due to wider consumer acceptance8 and affordable pric es, poultry meat is the major meat consumed in India, with per capita consumption in CY 2006 estimated at 1.9 kg. High muttons prices, religious restrictions on beef and pork, and availability of fish mainly in coastal regions has made poultry meat the mo st preferred and consumed meat in India. Expanding domestic production and increasing integration has pushed poultry meat prices downward and stimulated consumption. The integrators have established price leadership in their markets by reducing the number of middlemen and forcing the wholesalers and retailers to reduce their margins.

Indians typically prefer fresh chicken meat, mostly slaughtered in small corner shops. The processed poultry meat market (chilled/frozen dressed/cut chicken) is limited, largely confined to institutional sales. Its market share is currently estimated at 10 percent, but is growing at 15 to 20 percent per annum. Some of the leading integrators market branded packed chilled chicken products at the retail level. The market for processed poultry meat products is constrained by inadequate cold chain facilities and consumer preference.

Trade

India’s poultry product exports are mainly confined to table eggs and egg powder9, which are growing due to cost competitiveness, improving hygienic standards, and logistical advantages. Poultry meat exports are negligible due to high costs, inadequate meat processing facilities, and infrastructure bottlenecks. In recent years, some South Indian based integrators have been exploring the possibility of exporting poultry meat to the Middle East and South East Asian markets. The recent AI outbreak jeopardized their efforts, with most of them shelving their export development plans.

There are no restrictions on exports of poultry and poultry products. The government provides some transportation subsidies (Rs. 3.0–15.0 per kg) for its exports (see http://www.apeda.com/apeda/Ta06-07.pdf)

Please refer to Table 2 for India’s policy treatment and tariffs on poultry and poultry products. Although India does not impose any quantitative restrictions on imports of poultry meat, high tariffs, restrictive and non-science based sanitary import regulations, and lack of cold chain facilities constrain imports. India’s import health protocol10 for poultry meat has unjustified and highly restrictive conditions which the US export certification agencies cannot meet.

Market Opportunities

Most integrators do not have their own grandparent operations, and regularly import breeding stocks. Most of the broiler breeds in the country are from American strains such as Cobb, Hubbard, Arbor Acres and Hyline. Although currently India is more or less self sufficient in corn, trade sources believe that demand will outstrip supplies in the near future leading to corn imports. Currently, domestic corn prices are about 70 percent ($68/ton) greater than interior U.S. corn prices. However, this price spread would likely need to increase further in the future to cover all sea and internal transportation costs. U.S. corn supplies also face a restrictive 15 percent duty for in-quota (500,000 tons) imports and a 50 percent duty for out-of-quota imports. Furthermore, prohibitive biotech requirements, which were recently implemented, would likely restrict U.S. corn imports into India.

To read the full report, including tables, click here (PDF)

List of Articles in this series

To view our complete list of 2006 Poultry and Products Annual reports, please click hereSeptember 2006