Prospects for Poultry in the Global Animal Protein Market

Speaking at Merial’s Global Avian Forum in Spain earlier this year, Nan-Dirk Mulder from Rabobank International described the next 20 years as the decades of Asia and Africa for poultry industry development, offering many opportunities.Mr Mulder said the short-term prospects for the industry are good, given that all three major feed ingredients, wheat, soy and maize, are currently going through a period of oversupply.

Whilst feed prices have been volatile since around 2007, the past three years have seen relatively low prices. This has offered producers good margins, although some regions have been over-optimistic in their response and are now facing oversupply, he said.

Feed price volatility will remain a challenge going into the future, but the industry will face other problems coming from avian influenza and consumer concern, Mr Mulder said.

This has already been evident in China. There have been a number of scandals relating to product mislabelling or contamination that have put consumers off, and human cases of avian influenza also turn people away from choosing chicken.

China is the only exception to the general rule of growth in the poultry industry across the world in the last few years, Mr Mulder said. Beef and pork consumption have gone up in China at the expense of chicken, whilst in other areas chicken benefits from lower prices than other meats.

China and Asia as a whole offer lots of potential for the future in the longer term, Mr Mulder said.

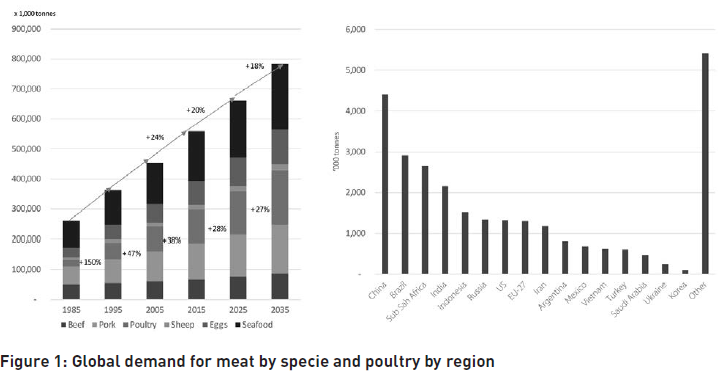

Speaking of projections for the next 20 years, Mr Mulder said: “In general we expect 45 per cent more demand for animal protein.

“For chicken, for poultry in general, we expect 65 per cent more demand in the next 20 years.” Egg demand will also go up by 50 per cent.

Looking deeper into the figures, a majority of this extra demand is going to come from emerging markets, and Asia in particular. This creates substantial challenges for the industry, as Asia lacks resources such as water and land availability, making poultry production in these regions more expensive.

This means the importance of global trade looks set to increase, Mr Mulder said.

“That’s already happening, actually – if you look through the major proteins, you see that the growth of meat trade is fast, with chicken growing at 5-5.5 per cent per year. A lot of that trade is going to the Asian region and the Middle East.”

From an investment perspective, Mr Mulder says the current troubles for the Chinese poultry industry means that investments have moved out of the country and into the wider Asian region. However, he emphasised that there is still a lot of scope to increase poultry consumption in China, if the industry can regain consumer trust.

In Europe, the east is growing very fast, with Poland the cheapest producer of chicken on the continent. In the west, production is slowing or even declining in some countries as producers move to higher welfare systems following consumer sentiment.

In Africa, Mr Mulder said investment is beginning to take off in earnest. Some African countries are seeing growth of up to 10 per cent per year, due to the growth of the middle classes for which meat is becoming more affordable.

The global business of poultry has changed rapidly over the last decade, with the rise of companies from emerging economies such as Brazil.

Whereas in the past European and American companies would invest in poultry production around the world, Mr Mulder said in the future we can expect to see more investment coming out of Asian or Middle Eastern countries and into areas of cheaper production around the world, as internationalisation continues.

“At the moment we are at the stage of some of the Asian markets, but it’s going to move further, and ten years ahead definitely the growth is going to move further into Africa, into India, Indonesia and that part of the world.

“So it’s changing all the time, but we believe that it’s absolutely a big opportunity for the industry,” Mr Mulder concluded.

.PNG)