Short Term Outlook for EU Poultry Market 2014-2015

Poultry meat production keeps on increasing in spite of the higher availability of other meats, according to the 'Short Term Outlook for EU arable crops, dairy and meat markets in 2014 and 2015' from the European Commission.

Poultry meat has been expanding steadily for several years and, for the time being, there are no signs that 2014 and 2015 will be an exception. Lower feed prices, reduced pig meat availability and sustained demand are expected to drive the 2014 production up by 1.9 per cent compared to 2013.

More poultry meat production is expected in Germany, Spain, the Netherlands and Poland, while decreases in production are expected in Italy and France. Some problems in the United Kingdom on hygiene conditions could have a negative impact on the domestic consumption.

The recovery expected in beef and pig meat production in 2015 could limit the expansion of poultry meat to 0.7 per cent.

*

"The recovery expected in beef and pig meat production in 2015 could limit the expansion of EU poultry meat to 0.7 per cent."

Imports into the EU retreated slightly in the first seven months of 2014 compared to last year, with fewer shipments from Thailand due to political tensions and to their reorientation to closer markets (as Laos or Japan).

In addition, Brazil is increasingly supplying the Russian, Saudi Arabian and Chinese markets. Therefore, 2014 imports are expected to decline (-3 per cent) for the second year in a row and to remain at this level into 2015.

Exports of poultry are expected to decline as well for the second year in a row. The slight increase registered in the first part of the year was mainly driven by Russia, which was compensating for lower pig meat supply.

The introduction of an import ban on poultry too stopped this possibility. Increased demand from South Africa, Philippines and Hong Kong will not be able to outstrip the declines in volumes to Saudi Arabia, Ukraine, Yemen and Ghana (and the closed Russian market).

(Source: DG Agriculture and Rural Development)

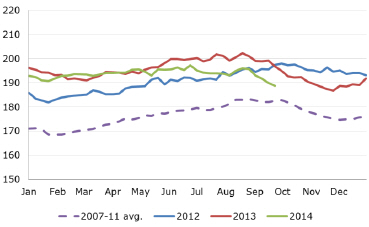

After reaching record levels above €200 per 100kg in the summer of 2013, the EU average price for poultry meat developed within a range of €187 to €197 per 100kg; from €196 per 100kg in July 2014, it moved in the second half of August to €193 per 100 kg, the same level as the 2009-13 average. However, this small decrease is not directly linked to the Russian ban: feed costs have been declining and prices have adjusted downwards to the increased production.

Increased production over the outlook period and consequently lower prices should stimulate further domestic consumption to reach the level of 21.8kg per capita (retail weight) by 2015.

Focus on Russia

Russia is one of the most important EU meat export destinations but exports to Russia represent a limited share in EU poultry production at less than one per cent. In addition, growing levels of Russian domestic production to increase self-sufficiency had been limiting already EU exports of poultry towards Russia.

Russia is the fifth destination for EU poultry meat exports with eight per cent or an average of 100,000 tonnes of poultry meat, mainly fresh and frozen shipped by France, Germany, the Netherlands and Belgium, which together account for 70 per cent of the quantity.

EU exports to Russia are a mix between fresh and frozen valuable bone-in cuts and frozen mechanically separated meat of lower value.

Further Reading

You can read the full 'Short Term Outlook' report by clicking here.

Read the highlights of the report by clicking here.

October 2014