Weekly global protein digest: China imports, World Trade Outlook report, international dairy market

Analyst Jim Wyckoff shares global poultry newsChinese meat imports rise

China imported 670,000 MT of meat in June, up 12.1% from May and 11.1% more than last year. China doesn’t break down the preliminary meat trade data by category, but the increase was driven by pork imports, which have been on the rise since late 2022. During the first half of 2023, China imported 3.81 MMT of meat, up 10.2% from the same period last year.

USDA Livestock and Poultry: World Markets and Trade

World Trade Outlook Relatively Unchanged While Brazil Makes Gains

The outlook for global meat trade remains relatively unchanged from the prior (April) forecast. Beef and chicken meat exports are not significantly revised while pork is raised 2 percent from the last forecast. However, Brazil continues to make export gains and set new records for beef, pork, and chicken meat. Brazil beef exports are revised 1 percent higher to 3.1 million tons on greater production and firm China demand. Brazil cattle prices have declined significantly compared to main competitors – Uruguay and Argentina – and lower beef prices support shipments to Southeast Asia, South America, and Middle East markets. Brazil chicken meat exports are revised 2 percent higher to 4.8 million tons on firm shipments to Asia, the Middle East, and smaller developing markets. As of July 12, Brazil remains free of highly pathogenic avian influenza (HPAI) in commercial operations and does not face restrictions as key competitors do. Brazil pork exports are revised 8 percent higher to 1.5 million tons on strong exports to most Asia markets, including particularly robust shipments to China and Hong Kong. Declining feed prices in Brazil are anticipated to further incentivize production and bolster price competitiveness.

Global beef production for 2023 is revised nearly 1 percent higher from the April forecast to 59.6 million tons. Drought has induced more herd liquidation in Argentina, raising its production 6 percent from the April forecast. Similarly, larger feedlot placements and higher cow slaughter are expected to boost U.S. production by 1 percent from April. New Zealand production is raised 3 percent as male dairy calves are now marketed for beef. EU production is cut 1 percent on lower slaughter and lighter weights due to high input costs.

Global beef exports for 2023 are virtually unchanged from the April forecast at 12.1 million tons. Upward revisions in the forecasts for New Zealand, Australia, Argentina, and Brazil offset declines in forecasts for Mexico, United Kingdom (UK), and the EU. Firm China demand is expected to attract Brazil and Argentina shipments. Australia will benefit from rising Japan and South Korea demand. In addition, robust U.S. demand for processing beef will bolster Australia and New Zealand shipments. A strengthening peso weakens Mexico’s export outlook. Waning EU demand hampers UK exports while lower EU production depresses EU shipments.

Global pork production for 2023 is virtually unchanged from the April forecast at 114.8 million tons. Increases in the production forecast for China, Canada, and Brazil offset declines in EU, Japan, the Philippines, and Mexico. Despite mostly negative margins industry-wide, China production is higher on greater than previously expected slaughter as producers seek to reduce herds and maintain cash flow. EU production continues to wane due to pressure from environmental regulation, weaker consumption, and relatively elevated feed costs. Philippines pork production is lowered 3 percent due to the expansion of African swine fever in key production regions.

Global pork exports for 2023 are forecast 2 percent higher from the April forecast to 10.8 million tons as stronger shipments from the United States and Brazil more than offset declines from Canada, UK, and EU. Reduced EU pork supplies provide opportunities for the United States and Brazil to gain market share in several Asia markets including South Korea and the Philippines. Strong demand from China has benefited most major pork exporters year to date.

Global chicken meat production for 2023 is little changed from the April forecast at 103.5 million tons. Production by Brazil, EU, and China were not revised on a continued outlook for improved feed prices and as no major outbreaks of highly pathogenic avian influenza (HPAI) have been reported. • Global chicken meat exports for 2023 are raised less than 1 percent from the April forecast to 13.8 million tons. Shipments by Brazil are revised 2 percent higher to 4.8 million tons on stronger shipments to Asia, the Middle East, and smaller non-traditional markets. Brazil expansion is supported by the absence of HPAI in commercial operations, competitive prices, and extensive product offerings fulfilling the needs of various markets. Thailand is raised 5 percent higher to 1.1 million tons on increasing shipments of uncooked chicken meat to Asia including Japan, China, and South Korea.

$85 billion U.S. beef industry is currently challenged by a strong preference for chicken

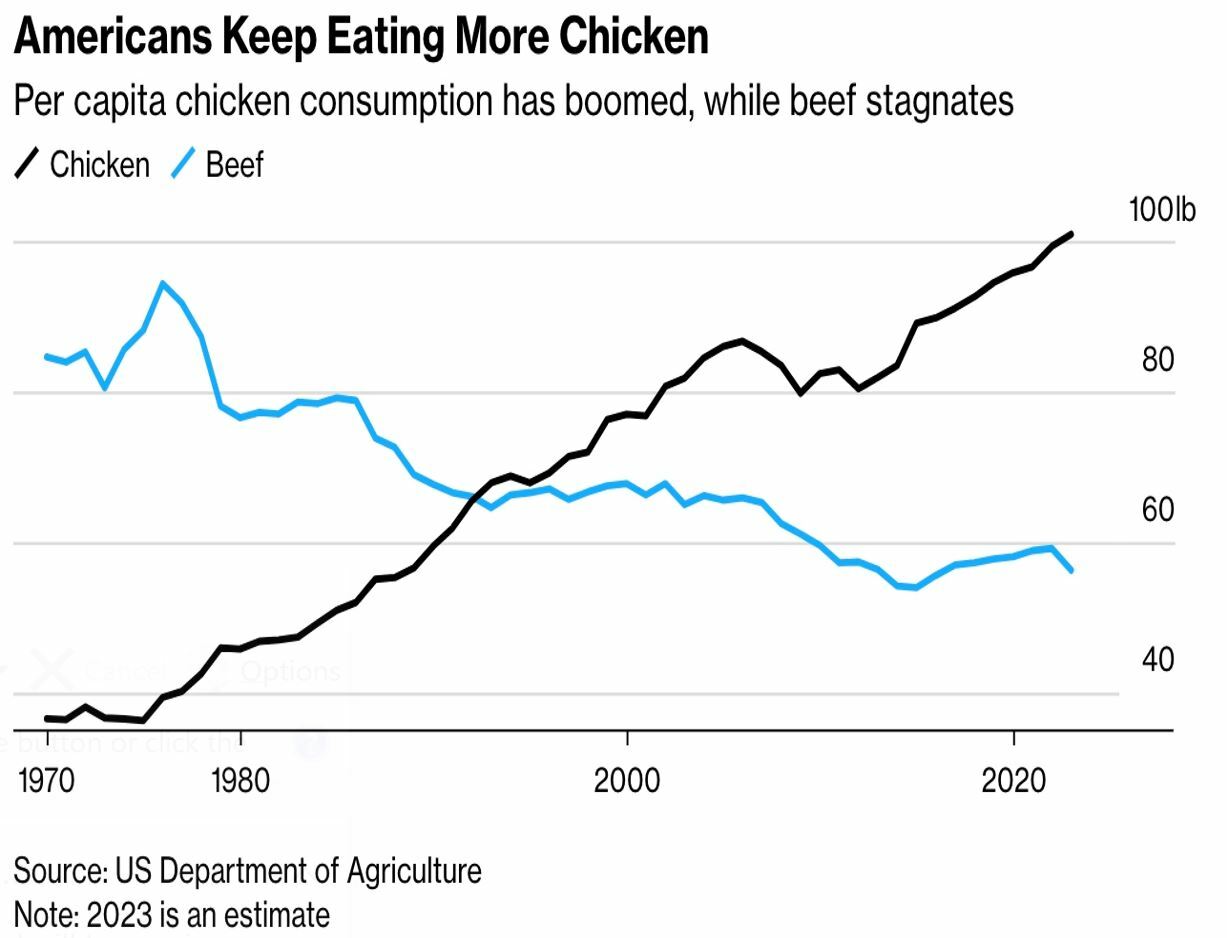

A recent Bloomberg article says the fear of competition from plant-based meat alternatives proved to be misplaced as they hold a small market share. The real competition comes from chicken, which overtook beef in per-person consumption in 1993, and the gap continues to widen.

Chicken's affordability, three times cheaper than beef, and versatility give it an edge over beef. Its popularity has increased greatly due to its use in home cooking, processed foods, and restaurants. Despite health and environmental concerns linked to beef, the beef industry has struggled to rebrand and innovate.

David Maloni, a supply-chain consultant, suggested that reversing this declining trend would be challenging given its long-standing nature. The sector faces multiple issues including increasing feed costs, drought, and competition, reducing profits and threatening more hardships with a cooling economy.

The preference for chicken is particularly apparent in fast food and takeout, which strongly influences teens' and young adults' eating habits. In 2022, chicken featured in four of the top 10 items ordered on Grubhub, while beef only appeared in cheeseburgers.

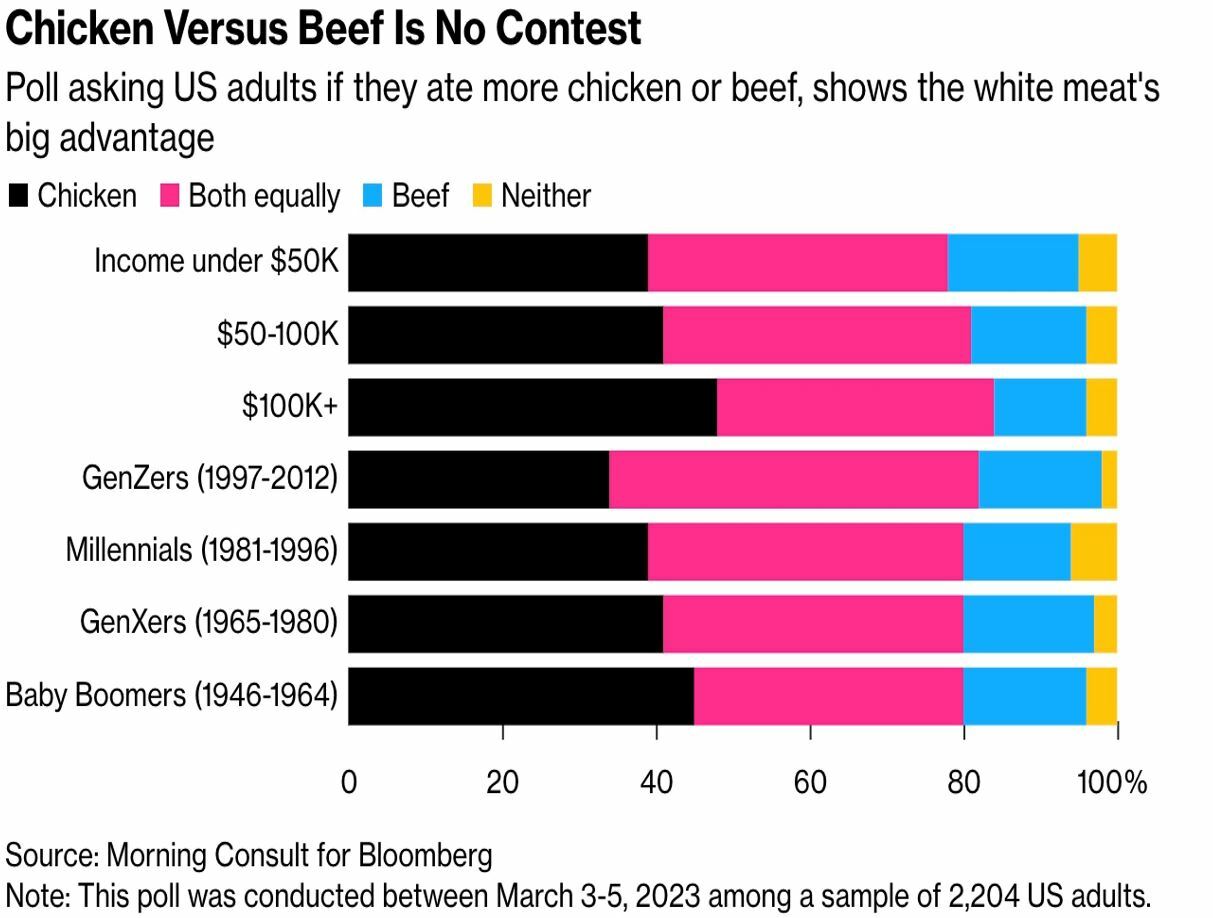

The chicken rage is significant within the nearly $1 trillion U.S. restaurant market. Chains like Chick‑fil‑A and Popeyes have thrived, even causing non-chicken chains to bolster their chicken strategies. In a Morning Consult poll, 41% of U.S. adults claimed to eat more chicken compared to 16% for beef, with chicken favored across all demographics.

Of note: Although chicken is consumed more, when asked which meat they prefer, Americans drew beef even with chicken. A dominant 75% cited taste as their primary reason for choosing beef, presenting an opportunity for the industry. However, strategies must be swift as people return to their pre-Covid routines.

Stats:

- According to Technomic, Chick-fil-A locations average $6.8 million in annual revenue, almost double burger-centric McDonald’s $3.6 million.

- The Beef Board spent $1.8 million last year running “It’s What’s for Dinner” ads. Mega chicken producer Perdue Farms dedicated almost 20 times as much to marketing its birds.

— Supermarket items seeing increased prices are not perishable goods like chicken breasts or pork chops, but rather those found in the "center store.” The term refers to products found in the middle of a supermarket, typically non-perishable goods such as potato chips, ketchup, crackers, cereals, cookies, paper towels, and even dish soap. These essential items that have a longer shelf life, and are not easily skipped by consumers, prove to be getting more expensive.

Global food prices have fallen to the lowest point in over two years

That’s according to the U.N. Food and Agriculture Organization (FAO). The organization's Food Price Index (FPI) recorded 122.3 points in June 2023, showing a decrease of 1.4% from May, and a significant 23.4% drop from its record high in March 2022.

The price fall has primarily been driven by a decline in the cost of all major cereals and most vegetable oils. Major contributing factors include a 2.1% drop in cereal prices due to Argentine and Brazilian harvests, better yield prospects in certain regions of the U.S, and a 3.4% decline in coarse grain prices. Wheat prices also decreased by 1.3% because of the commencement of harvests in the Northern Hemisphere and favorable conditions in the U.S., among other reasons.

Vegetable oil prices fell by 2.4%, even though lower palm prices were somewhat offset by an increase in soyoil and rapeseed oil prices. Meanwhile, the cost of dairy and sugar went down in June, whereas the meat price index remained almost consistent.

The June 2023 FPI is 3.4 points lower than that of the entire year 2021. Global food price inflation continues to slow down, although it remains persistent in some regions. Nonetheless, this trend presents a positive outlook, especially for countries that rely heavily on imports to feed their populations.

Despite long-standing trends showing an increase in meat consumption as countries' incomes rise, a shift seems to be occurring. According to a world agricultural outlook report, in high-income nations like Western Europe and North America, per capita meat consumption is predicted to decrease in the coming decade. These nations, constituting roughly one-sixth of the global population, account for about one-third of the total meat consumed worldwide.

More on the report: The Organization for Economic Cooperation and Development (OECD) and the U.N. Food and Agriculture Organization (FAO) indicate in their Agricultural Outlook 2023-32 report that the trend of stagnation in meat consumption is noticeable in most wealthy countries. They predict poultry will supply 41% of meat protein in 2032, primarily due to consumers' increasing sensitivity towards animal welfare, environmental impacts, and health concerns wherein poultry has the smallest carbon footprint.

Specifically, in the European Union, an ongoing shift from beef and pig meat to poultry is anticipated. Similarly, in North America and Oceania — which have historically preferred beef — a significant dip in per capita consumption is expected.

Even though affluent consumers might consume lower amounts of meat, global meat demand remains strong, particularly in lower-income nations. The report expects a 2% per capita increase in global meat consumption over the upcoming ten years, brought on by rising incomes and population growth. Meat consumption, as per type and tonnage, is poised to increase 15% for poultry and sheep, 11% for pork, and 10% for beef.

The analysts expect global meat consumption will continue to grow until 2075. However, factors like demographic trends, human health, animal welfare, and environmental concerns could negatively influence meat consumption in the long term, with world meat demand potentially starting to fall during the remainder of the century.

The report forecasts global agricultural and food production to grow annually by an average of 1.1% through 2032, which is half of the growth rate observed in the decade before 2015. Furthermore, an increase in fertilizer prices by 10% could result in a 2% rise in food prices, disproportionately affecting the poor.

Of note: The OECD and FAO call for investments in innovation, productivity gains, and reductions in production's carbon intensity to ensure food security, affordability, and sustainability long-term.

China’s sow herd contracts further in June

China’s sow herd declined 1.68% in June compared with the prior month, state-backed Shanghai Securities News reported. The pace of the decline is bigger than in prior months, suggesting that farmers are accelerating culling of sows to cut their losses.

Weekly US beef, pork export sales

Beef: US net sales of 9,900 MT for 2023 were down 42 percent from the previous week and 28 percent from the prior 4-week average. Increases primarily for Japan (3,200 MT, including decreases of 300 MT), Taiwan (1,600 MT, including decreases of 100 MT), China (1,400 MT, including decreases of 100 MT), South Korea (1,200 MT, including decreases of 600 MT), and Mexico (1,100 MT, including decreases of 100 MT), were offset by reductions for the United Kingdom (100 MT). Exports of 14,000 MT were down 21 percent from the previous week and 16 percent from the prior 4-week average. The destinations were primarily to Japan (3,800 MT), South Korea (3,300 MT), China (2,400 MT), Mexico (1,300 MT), and Canada (1,100 MT).

Pork: Net US sales of 24,500 MT for 2023 were down 6 percent from the previous week and 9 percent from the prior 4-week average. Increases primarily for China (13,700 MT, including decreases of 100 MT), Japan (3,800 MT, including decreases of 200 MT), Mexico (3,600 MT, including decreases of 100 MT), South Korea (1,300 MT, including decreases of 600 MT), and Canada (600 MT, including decreases of 500 MT), were offset by reductions for Australia (400 MT). Exports of 19,300 MT were down 46 percent from the previous week and 41 percent from the prior 4-week average. The destinations were primarily to Mexico (6,800 MT), Japan (2,600 MT), China (2,600 MT), Canada (1,600 MT), and South Korea (1,600 MT).

Weekly USDA dairy report

CME GROUP CASH MARKETS (7/7) BUTTER: Grade AA closed at $2.4800. The weekly average for Grade AA is $2.4725 (+0.0565). CHEESE: Barrels closed at $1.3800 and 40# blocks at $1.3925. The weekly average for barrels is $1.3506 (-0.0329) and blocks, $1.3750 (+0.0415). NONFAT DRY MILK: Grade A closed at $1.0875. The weekly average for Grade A is $1.1056 (-0.0139). DRY WHEY: Extra grade dry whey closed at $0.2275. The weekly average for dry whey is $0.2344 (-0.0121).

BUTTER HIGHLIGHTS: Cream is available throughout the country, though some contacts in the East report ice cream makers are ramping up production and are drawing on available supplies. Contacts note high temperatures in the southern parts of the Central and West regions are contributing to tighter cream availability. Butter makers in the East and West are operating busy production schedules. In the East and West, demand for butter is steady from both retail and food service customers, though bulk butter demand is steady to lighter in the West. Contacts in the Central region report moderate demand for butter, but say sales are meeting seasonal expectations. Inventories of butter are available in the Central and West regions and are noted to be strong in the East. Bulk butter overages range from 0 to 10.75 cents over market value.

CHEESE HIGHLIGHTS: Milk is available for Class III production in all regions. Some cheesemakers in the Midwest report high temperatures, and declining milk output could cause processors in the south and southwestern states to bring milk in from other states in the coming weeks. Central region cheesemakers say production has been less steady, due to the holiday this week, but anticipate more stable production through the end of the week into next week. Northeast cheese contacts report seasonally steady production, while cheesemakers in the West note strong to steady production. Food service demand for cheese is steady in the Northeast and West regions. Retail demand is reported to be strong in the East, but contacts in the West say retail sales are steady to lighter. Western cheese exporters relay steady to lighter demand. Cheese inventories are balanced in the Midwest, and available to meet current barrel and block demands in the West. In the Northeast, plant managers note strong cheese inventories.

FLUID MILK: Milk production and availability vary throughout the country. Contacts in some areas experiencing higher temperatures note a decline in output, though others in some cooler parts of the country note steady production. In the Northeast, some contacts report volumes of milk are being discarded. In the West, milk supplies are available to meet manufacturing needs, though stakeholders in the Pacific Northwest and the mountain states of Idaho, Utah, and Colorado note supplies are slightly heavy. Contacts in the Midwest say milk and cream volumes have been ample in recent weeks, but volumes are now moving to the southern parts of the region. In the Pacific Northwest, demand for Class II milk from ice cream makers is trending higher. In the East, contacts note steady to strong Class II demand. In the Midwest, Class III spot milk prices edged higher this week but continue to move at below Class prices. Cream multiples were unchanged in the Midwest and West this week. Cream multiples moved upwards at the top of the range for cream in the East region. Cream multiples are 1.28 – 1.38 in the East, 1.20 – 1.32 in the Midwest, and 1.05 – 1.29 in the West.

DRY PRODUCTS: Prices for low/medium heat nonfat dry milk (NDM) moved lower in all facets throughout the country. Domestic demand for low/medium heat NDM is steady in the Central and West, while export demand is softening. Meanwhile in the East, demand for low/medium heat NDM is quiet. High heat NDM prices moved lower across the range in the Central and East regions, and at the bottom in the West. Prices for dry buttermilk held steady across the range in all regions. Dry buttermilk demand is steady to moderate in the West, but quiet in the East and Central regions. Prices for dry whole milk moved lower this week. Market tones remain bearish as inventories remain available for spot purchasing, and spot activity was slow, during the holiday week. Dry whey prices moved lower at the top of all regional ranges, while the bottom of each varied by region. The whey protein concentrate 34% price range is unchanged this week. The top of the lactose price range moved lower this week, as the start of July signaled the shift from Q2 to Q3 lactose contracts. Acid and rennet casein markets were quiet during the holiday week, and prices held steady.

INTERNATIONAL DAIRY MARKET NEWS

WESTERN EUROPE: The seasonal decline of milk output has continued across much of Europe. Various industry sources suggest weekly milk collections are decreasing. The lower weekly milk volumes are stabilizing milk prices for the moment. Weekly spot milk prices have also stabilized or have risen in a few cases. Uncertainty of milk supplies, for the second half of the year, have market participants trying to determine market direction. Dairy markets, in general, are quiet as many Europeans begin their summer holidays. But there is a bearish sentiment to markets due to the uncertainties of future demand, economic pressures, and the ongoing conflict in Ukraine.

EASTERN EUROPE: In Eastern Europe, there are seasonal declines in weekly milk volumes, but year-to-date milk output is still ahead of last year in Bulgaria, Romania, and Poland. According to online information sources, milk production in Poland has continued to grow in each month of 2023 when compared to 2022. Regionally, Poland supplies Ukraine with 69 percent of their fresh dairy imports. As the 2023/24 grain export season begins, trade officials note lower volumes of grain getting exported from Ukraine. While the season is only in the first few days of the new season, officials say grain shipments are about half of what was exported last year during the same period.

OCEANIA: NEW ZEALAND: Following the recent approval from the European Council, the free trade agreement between New Zealand and the European Union has moved closer to completing the contract as early as next month. There is contention from some European farmers who say the deal could cause a flood of New Zealand dairy products into European dairy markets. Meanwhile, New Zealand dairy export volumes and values for May 2023 show an increase for all major dairy commodities.

AUSTRALIA: Welcome news for the Australian dairy industry was the May milk production report, which underlined a 1.6 percent, year-over-year, increase in output. The increase was the first monthly growth observed this short season, as harsh weather and dairy industry constraints limited milk production output. Meanwhile, Australian April dairy exports posted some not so welcome figures, as total dairy export volumes declined 25 percent, compared to a year ago.

SOUTH AMERICA: Reports show mixed milk output in Brazil during the first quarter of the year, but Argentine and Uruguayan reports are a little more steady month to month. Clearly, the long and persistent drought, which has eased despite contacts continuing to report some relative recent dryness, has played a part in keeping milk output in check. That said, near- and mid-term expectations are starkly different from those of previous years from regional contacts in regard to later winter/early spring milk output. Farmgate milk prices have increased due to the volatility/limits of milk production. Feed prices are still notably higher, compared to pre-drought years, due to crop limitations brought on by drought conditions until the past few months. Brazil continues to be a prime destination for dairy commodity exporters in Argentina, Uruguay and Chile. That said, as Brazil's milk production expectations have garnered strength, there are tell-tale signs that their winter/spring purchasing will ebb. Prices of dairy powders are beginning to fall in line with globally bearish values.

NATIONAL RETAIL REPORT: Total conventional ads declined by 12 percent in this week’s survey, and total organic ads declined by 41 percent. Despite appearing in 19 percent fewer ads than last week, ice cream in 48-64-ounce containers remained the most advertised conventional dairy product for week 27. The weighted average advertised price for this item declined by 29 cents to $3.59. Organic ice cream in 48-64-ounce containers appeared in 172 percent more ads in this week’s survey and had a weighted average advertised price of $7.99. The organic premium for ice cream in 48-64-ounce containers is $4.40.