Weekly global protein digest: supply crunch for holiday dinners?

Market analyst Jim Wyckoff shares highlights from this week's activities in the global protein market.

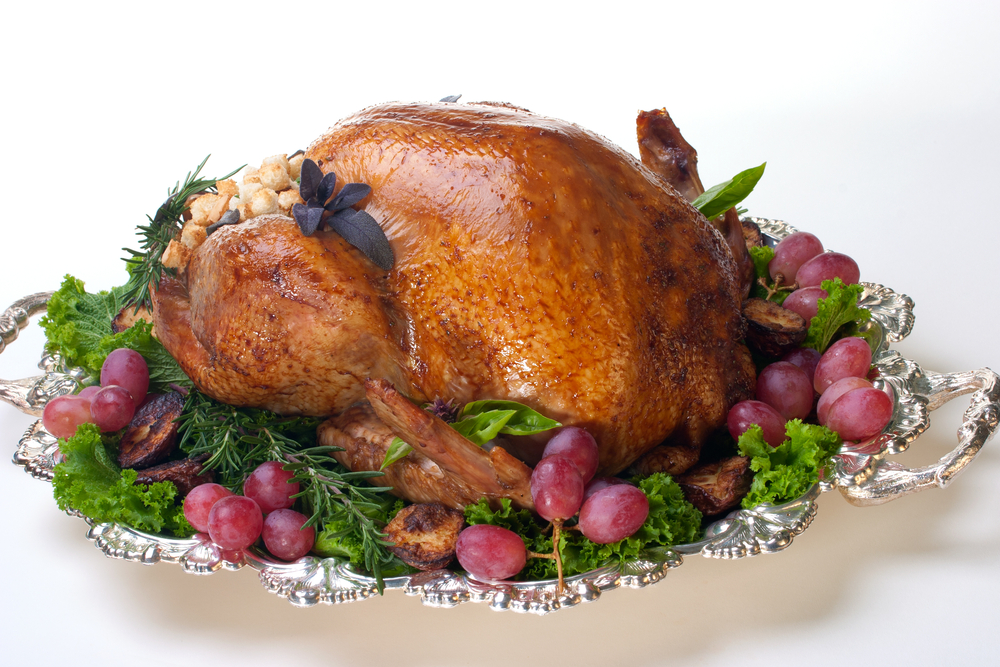

Supply crunch hits US Thanksgiving dinner

Supplies of food and household items are 11% lower than normal as of Oct. 31, according to data from market-research firm IRI. That figure isn’t far from the bare shelves of March 2020, when supplies were down 13%. Turkeys are especially low in stock amid labor and supply challenges. Many other holiday essentials — including cranberry sauce and pies — are already in short supply. For grocery shoppers this holiday season, it means that someone with a 20-item list would be out of luck on two of them. According to the Farm Bureau, the average cost of preparing Thanksgiving dinner in 2020 was about $47, and it’s expected to cost up to 5% more this year.

China’s meat imports drop to 20-month low in October

China imported 664,000 MT of meat in October, down 12.8% from last year and the lowest monthly total since February 2020, as building domestic pork production dropped prices and reduced demand for foreign supplies. Through the first 10 months of this year, China’s meat imports totaled 8.1 MMT, down 1.5% from the same period last year.

Avian flu found in Poland

The Polish Chief Veterinary Officer confirmed two outbreaks of highly pathogenic avian influenza (HPAI) of subtype H5N1?in commercial farms of fattening turkeys in central Poland. On infected farms, the Veterinary Inspectorate implements all disease control measures in accordance with the Commission Delegated Regulation (EU) 2020/687, including culling animals, cleaning and disinfection on the farm, and designating protection and surveillance zones. The two outbreaks change the HPAI status of the country and will influence export possibilities for Polish poultry meat and products to non-EU countries.

USDA announces faster line-speed trial program for US pork plants

USDA said Wednesday nine U.S. pork plants can apply to operate faster processing-line speeds under a one-year trial, after a federal judge in March struck down a Trump-era rule that removed line speed limits. In the pilot program, plants will implement worker safety measures under agreements with labor unions or worker safety committees. Plants will collect data on how line speeds affect workers and share it with OSHA and the data could be used to make future rules for the industry, USDA said. Pork companies lost 2.5% of their slaughtering capacity following the March court decision, according to the National Pork Producers Council.

Americans cutting back on eating steaks

Rising US grocery prices are squeezing consumer spending. Supermarkets say shoppers are buying more store-brand meat products and trading down from beef to less-expensive alternatives such as chicken or pork, after prices for products such as rib-eye climbed about 40% from a year ago, according to research firm IRI. Food makers ranging from Mondelez International to Kraft Heinz have been raising prices in recent months to offset escalating costs in labor, raw materials and transportation.

USDA’s monthly livestock, dairy poultry report: higher US production forecast

USDA’s forecast for 2021 total US red meat and poultry production has been raised from last month.

- US beef production is raised from the previous month on higher expected slaughter of fed cattle and heavier carcass weights.

- The pork production forecast is raised slightly as heavier carcass weights more than offset lower expected slaughter in the fourth quarter.

- The broiler production forecast is raised on recent hatchery and slaughter data.

- Turkey production is raised on September production data; no change is made to the fourth quarter production forecast.

- The egg production forecast is raised on recent production data and higher expected table egg production in the fourth quarter.

For 2022, the total red meat and poultry forecast is raised slightly from last month. Beef and turkey production forecasts are raised, while the pork and broiler production forecasts are unchanged from last month. The egg production forecast is raised from last month.

The 2021 and 2022 beef import forecasts are raised from last month on robust domestic demand for beef. The 2021 beef export forecast is raised on recent trade data and continued strong demand from top trading partners. No change is made to the 2022 beef export forecast.

Pork exports are reduced on September trade data; no change is made to the forecasts for outlying periods.

Broiler export forecasts for 2021 and 2022 are raised on stronger expected demand. The 2021 and 2022 turkey export forecasts are raised modestly from last month. Cattle price forecasts for 2021 and 2022 are raised on continued firm demand.

The hog price forecast is reduced for fourth-quarter 2021 on recent price weakness. This weakness is expected to carry into first-quarter 2022, and the annual price forecast is lowered.

The 2021 and 2022 broiler and turkey price forecasts are raised from the previous month on current prices and expected strength in demand.

The milk production forecasts for 2021 and 2022 are reduced from the previous month on lower expected dairy cow numbers and slower growth in milk per cow. Fat basis import forecasts for 2021 and 2022 are reduced on lower expected imports of butterfat products. Fat basis export forecasts for 2021 and 2022 are raised on higher expected exports of cheese and butterfat products. The skim-solids basis import forecast for 2021 is raised while 2022 imports are unchanged from last month. The 2021 and 2022 skim-solids basis export forecasts are unchanged from last month. Butter, nonfat dry milk (NDM), and whey price forecasts for 2021 are raised from last month on strength in demand and lower expected production.

The cheese price forecast for 2021 is reduced on current prices and continued large supplies. The 2021 Class III price forecast is reduced from last month as the lower forecast cheese price more than offsets the higher whey price. The Class IV price forecast is raised on higher NDM and butter prices. The 2021 all milk price forecast is raised to $18.50 per cwt. For 2022, cheese, butter, NDM, and whey price forecasts are raised on strength in demand and lower expected milk supplies. The 2021 Class III and Class IV price forecasts are raised WASDE-618-5 on higher forecast dairy product prices. The all milk price for 2022 is raised to $20.25 per cwt.

Hong Kong authorities detect COVID-19 virus on imported frozen cuttlefish from Malaysia

On November 3, the Hong Kong Center for Food Safety (CFS) announced testing results for samples of imported frozen cuttlefish slice surface and its inner packaging as positive for COVID-19. The positive samples were among the 12 samples collected at the point of entry on November 2, 2021, from a sea shipment imported from Malaysia. The shipment had 390 boxes of frozen cuttlefish slice weighing 3,100 kg. As part of its precautionary testing program, the CFS is applying hold and test measures by which shipments are detained until test results are available. Thus, the Malaysian shipment has been kept in the importer’s warehouse and has not yet been released for distribution.