CME: Daily Livestock Report

US - Higher input costs and lower selling prices for your product are never a good combination, write Steve Meyer and Len Steiner.Broiler producers resisted for sometime the signals coming from the market, intent on preserving market share and hoping to be the last man standing in an increasingly expensive game of ‘who blinks first’.

Many analysts and market participants, however, thought that eventually the industry had to respond and get their supplies in line with demand.

The latest ‘Broiler Hatchery’ report offered some evidence that cutbacks are coming. The broiler hatchery report covers broiler growers in 19 states who account for about 97 per cent of overall production.

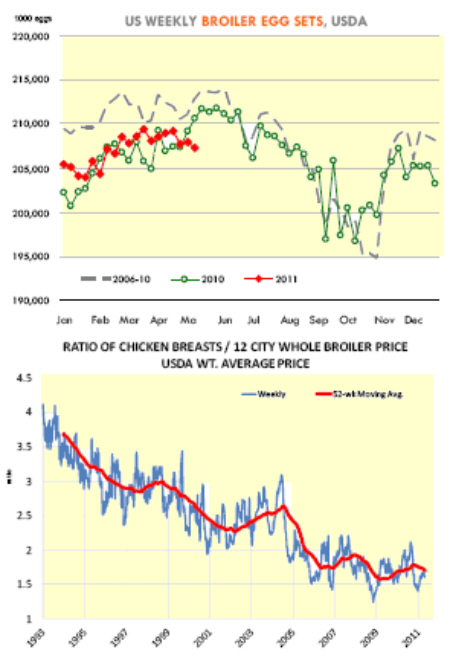

For the week ending May 14, broiler-type eggs set in incubators in these 19 states were estimated at 207.3 million, 1.56 per cent lower than a year ago and 2.6 per cent lower than the five year average. It was the biggest year over year decline in egg sets since January 2010.

As the top chart shows, egg sets have been drifting lower in the last few weeks when seasonally this is the time of year that producers accelerate production. Will lower egg sets translate in lower production levels in Q3? Normally that would be the case although much will depend on whether the year over year decline in egg sets is sustained through the summer months. Since the beginning of the year, chick placements have increased 1.1 per cent from the comparable time a year ago.

When lagging by four weeks, egg sets for the comparable time frame were only 0.6 per cent higher than the previous year. So there is not a 1:1 relationship between egg sets and placements; improvements in productivity could limit some of the impact from lower egg sets.

Also critical will be the weight of birds coming to market. So far this year, total broiler slaughter is estimated at 2.873 billion head, 0.3 per cent lower than the comparable period a year ago.

However, total broiler meat production (ready to cook basis) is estimated at 11.926 billion pounds, 2.2 per cent higher than a year ago. The industry continues to bring heavier birds to market.

Many of these birds are bred to produce copious amounts of breast meat and, as a result, breast meat supplies have continued to climb even though, at first look, we are not slaughtering more birds than we did a year ago.

In recent statements, industry leaders have noted that they are selling more dark meat (legs, thighs, trim) in the domestic market. While this should help support overall broiler prices, it is likely not enough to make up for the increase in input costs and tighter margins.

The industry needs to figure out a way to put more money on breast meat and one way to do that is to curb the steady growth in breast meat production. We think the market for chicken breast meat reached a saturation point a few years ago and demand has been leaking for sometime.

The top chart above shows the ratio of breast meat to whole bird prices has gone from a multiple of 4 to around 1.5. In 2009 and early 2010, sharply higher wing prices offset the weakness in breast prices. But wings have also pulled back sharply and it will be difficult for leg quarters to support the whole bird carcass on their own. High feed costs are here to stay and chicken producers, like it or not, can no longer afford to sell $0.8/lb. wings and $1.20/lb. chicken breasts.