CME: 2011 Year of Adjustments for Meat Sector

US - 2011 will go down in the history books as a year of continued adjustments for the US beef, pork and broiler sectors, write Steve Meyer and Len Steiner. All

three were still adjusting to higher feed costs in an effort to restore long

-run profitability. The differing biological characteristics of the three

species, of course, were impacting those adjustment processes.

The

vaunted flexibility that the chicken’s short reproductive cycle provides

to the broiler industry proved to be both a blessing (can react quickly)

and a curse (quick reactions leave you open to unexpected reversals).

The curse of a long reproductive cycle prevented the beef industry

from going for the “head fake” of lower corn prices in 2009 and early

2010. Mother Nature, of course, made sure that the beef industry did

not launch itself into a premature expansion by severely impacting

grazing conditions in some major beef cattle regions. Meanwhile, the

pork industry appears, for the moment, to have made a painful reduction and, perhaps, learned its lesson from quick output reversals of the

past that led to severe price pressure.

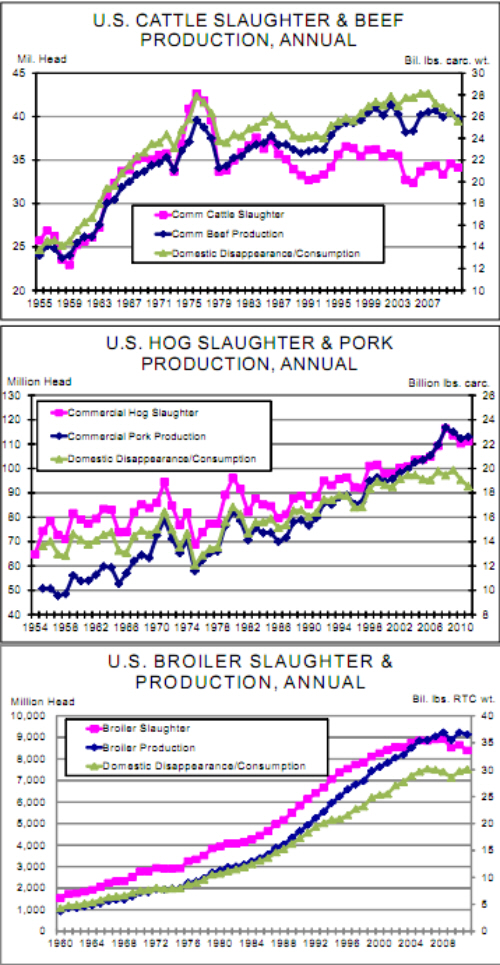

The charts at right show annual data for slaughter and production for the three major species. The overall trends and patterns

are, we think, very telling. Among the lessons are:

Each species has relied upon heavier slaughter weights to increase output. The practice began with hogs in the ‘60s when

some major improvements in leanness and, consequently, feed

efficiency, began. Cattle followed in the ‘70s and chickens joined

the trend to higher weights in the ‘80s.

This trend is not over — at

least for cattle and hogs. Feedlots, hog buildings and packing

plants are all denominated in HEAD. Products are still sold by the

POUND. Increasing POUNDS PER HEAD is an obvious and

easy way to increase revenue per unit of physical plant.

The only

limit will be the size of cuts but new processing techniques will, we

believe, solve most problems that arise there. The chicken sector

may be different because its weight increases are driven by, in

essence, a separate boneless/skinless breast business — which

has NOT performed well of late.

There was, for many, many years, no such thing as a chicken

cycle. The primary reason, of course, is that chicken demand

increased steadily and, due to that reproductive cycle, companies

could respond quickly. The growth pattern has obviously been

slowing, though, and some cyclical characteristics are appearing

in the annual data. Will they continue?

There was, for many, many years, a pronounced hog cycle that

has virtually disappeared. Take away the 2007-2008 output surge

driven by circorvirus vaccines and hog slaughter and pork production have steadily risen since output finally settled after the 1998-

1999 bloodletting in the production sector.

Even the cattle cycle (historically eight to 10 years in length) has waned.

Has it fallen by the wayside, too? Or has it ust lengthened and

flattened? The slaughter and production dip of 2004-2005 was

caused primarily by fewer Canadian cattle in the wake of their first

BSE case in 2003. Take away that reduction and cattle slaughter

and beef prod have declined in a very steady manner since 1996

and 2002, respectively.