CME: When Will Consumers Feel Effects of Higher Feed Prices?

US - How quickly will this year’s higher feed prices be felt by consumers in the form of higher meat and poultry prices? The answer is “That depends on what you are buying”, write Steve Meyer and Len Steiner.The reaction times

of the different species are far different. The broiler industry can go

from deciding to put another hen in the hatchery supply flock to having

a dressed bird to sell in as little as 30 weeks. Turkeys mature slower,

have a longer incubation period and are grown much longer than are

broilers so they can go from setting an egg to expand the supply flock

to finished bird in about a year. For hogs, it depends on where you

start counting. From farrowing a gilt to add to the herd to getting pigs

to market from her will be at least 18 months. That figure is 12 months

if one starts counting from the time a gilt is selected at 6-7 months of

age but that assumes sufficient numbers of gilts are available from

breeders. Cattle take forever to change the supply — at least comparatively speaking. Heifers are usually readily available so one does

not have to back all the way up to the decision to breed cows to produce heifers. Even at that, though, it will take 9 months to get a calf

and another 15-18 months for that calf to reach market weight.

Reducing supplies takes less time since hatching eggs can

be destroyed and sows or cows can be culled early in their pregnancy.

But you get the gist — things do not start and stop on a dime when it

comes to meat and poultry production so the impacts of cost shifts are

not felt for awhile by consumers. That fact makes it difficult to get consumers engaged in any debate on the drought’s impacts.

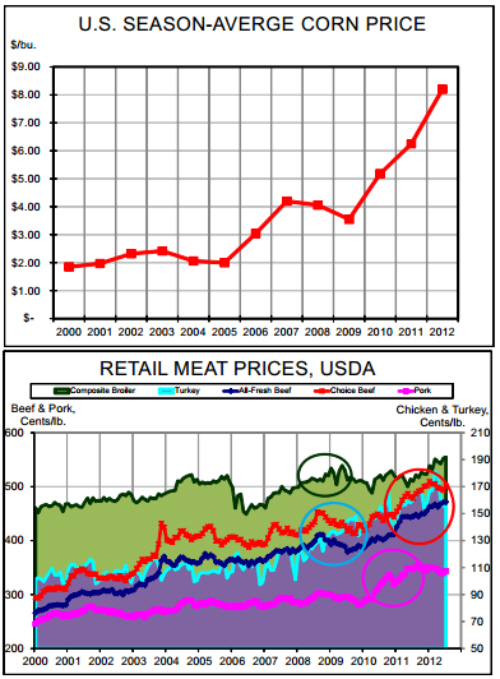

The corn price run-up of ‘06-’07 is a perfect example. Compare the retail price increases for the four major species (price increase periods are circled) to the increase in corn prices. The lags

vary depending on the species with retail pork prices not rising for

about 3 years and retail beef prices not rising significantly for nearly 4

years! The turkey price increase period is longer for that of chicken

primarily due to the strong seasonal pattern for turkey prices which

carried them to then-record highs in the fall of 2009.

What is truly shocking is to compare the magnitude of this

year’s corn price surge to that of ‘06-’07 and to consider the cost increases of the past two years when crops were far more normal in

size. We contend that this year is, at least for now, a short crop cost

surge that, if normal weather returns in 2013, will be rectified. But

even if it is not “permanent” like to ‘06-’07 shift, the impacts will eventually be felt by consumers, very likely for the next 3-5 years.

A clarification on one aspect of yesterday’s discussion of wholesale pork price reporting . . . One DLR reader rightfully pointed out via e-mail yesterday that we shouldn’t conclude that prices are reported on only 3-4% of the total pork products TRADED at the wholesale level. The 3-4% of total production and is indeed a large percentage of the total amount of cuts that are traded since “packers” are also “processors” of a large share of some cuts. Hams comprise about 25% of a pork carcass and many fresh or “green” hams (where those terms refer to un-cured or un-smoked meats) are cured or smoked by the same company that slaughters the hogs. They are thus never traded as wholesale hams and move from those companies only as a wide variety of finished hams. The same is true of most bellies which comprise another 16% of the carcass and are sold as finished bacon. This also holds to a slightly lesser degree for picnics (the lower portion of the pig’s shoulder and front leg). Some of those are smoked in-house and many of them are boned and used for grinding product, primarily in sausage. The important implications of this are a) the percentage of “traded” cuts is much higher, perhaps double the percentage in yesterday’s chart and b) this factor will not change with the advent of mandatory wholesale pork reporting. The new mandatory system will not captures anywhere near 100% of the pork produced. But there is little doubt that the mandatory system will significantly increase the volume of cuts for which prices are reported. It just won’t be very close to 100%.