CME: Broiler Egg Sets Fell

US - Wednesday’s burning question was “What is going on with Lean Hogs futures?” The entire complex sort of exploded near mid-day and every contract finished the day with strong gains, write Steve Meyer and Len Steiner.Nearby

December and February contracts both gained $2.525/cwt. with the

December contract (chart shown at right) hitting its highest level since

July 31.

We, of course, have an explanation for everything. Uh huh.

So, we called several “insiders” who were sure to know what was happening and got several (a matching number, that is) of “I have no idea”

answers. Anyone who dared take a guess basically said “Stuff happens sometimes.” It is not often that futures markets move for no apparent reason but this may be one of them.

Cash may be king but cash hog markets did not push the

futures complex higher today. Three of the four USDA Afternoon

Purchased swine reports (National, Western Cornbelt and Iowa/

Minnesota) showed lower weighted average base prices versus yesterday. The declines ranged from $0.18/cwt. for the National report to

$0.63/cwt for the Iowa/Minnesota report. Only the Eastern Cornbelt

saw higher cash prices with the weighted average base price gainin

$0.63/cwt. to reach $78.40. And the cutout value was down $0.67/

cwt. to $85.97 today. Carry over from yesterday’s cutout? Nope —

yesterday’s cutout was down $1.19/cwt from Monday’s level.

Maybe pig supplies fell sharply, causing a new wave of optimism? Tuesday’s slaughter was estimated to be 435,000 head, up

1,000 from last week and 2,000 from last year. Week-to-date slaughter stands at 1.304 million head, well above the Superstorm Sandyshortened total of 1.279 million last week and 6,000 head larger than

the same week-to-date figure last year.

Maybe there was some big news item about a supply problem in some other country? If there was, we never found it.

Perhaps there was hope of the White House serving more

pork in President Obama’s second term? Okay, we just threw that

one in for fun. We mustn’t take things too seriously, now.

The best explanations we can offer are a) December LH futures were too discounted relative to the cash market, b) a portion of

the sizable short positions decided to take coverage and the positive

impact kicked in some technical buy programs and c) funds moved to

commodities as the stock market suffered through its biggest one-day

loss in a year. All are probably to blame (or credit) to some degree.

The national weighted average NET prices for negotiated sales and

swine/pork market formula sales in Wednesday morning’s Prior Day

Slaughtered Swine report were $81.47/cwt. and $82.51/cwt., respectively — well above the Tuesday’s Dec LH close of $77.575. The net

prices from the Slaughtered Swine report are the most relevant because they are the two prices that are weighted over a two-day period

by the number and weight of hogs purchased on each price to arrive

at each day’s CME Lean Hog Index. That Index, of course, will be

used to settle open positions when the contract expires on December

14. But that is 29 trading sessions down the road and one would not

think a wide basis would put that much pressure on futures now..

We won’t know about the second two points until CFTC publishes its weekly positions of traders report. So let’s blame the computers. Thank goodness they came along to take some of the heat off

us economists.

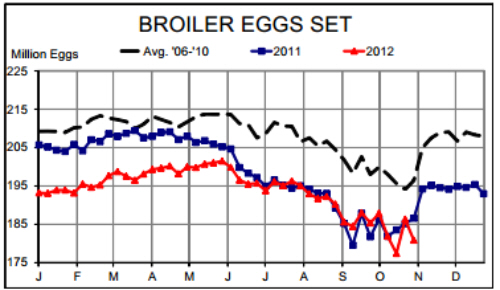

After a one week “recovery,” broiler egg sets fell by 5.5

million last week to just 180.84 million. That figure is 3.1% lower

than one year ago and marks the second lowest weekly total (second

only to two weeks ago) since September 1997. Chick placements

were 5.71 million lower than the week prior but were still 1.3% larger

than one year ago. We expect them to fall below ‘11 levels soon.