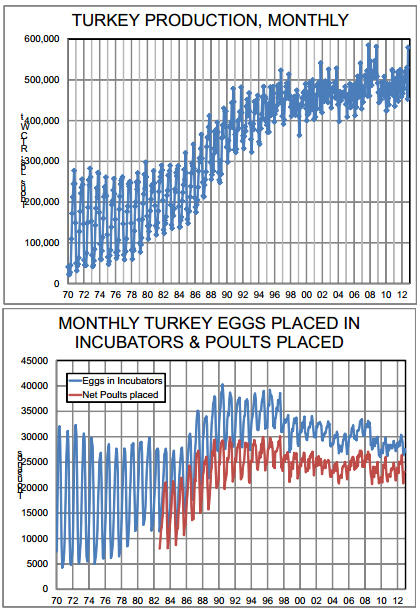

CME: Have Rising Feed Costs Affected Turkey Production?

US - As is the case for virtually every other US agricultural enterprise, the US turkey business is a picture of growing productivity, writes Steve Meyer and Len Steiner.More product from fewer animals applies to this sector

just as it does to beef, pork and chicken. But the business is in a bit of

a defensive mode these days as placements of both eggs and poultry

moderate from last year in response to high feed costs and challenging operating margins.

The turkey business is also very akin to the chicken and pork

sectors in another manner: Declining seasonality.

It is clear from the

charts at right that, though still extremely seasonal given the place of

honor turkey holds at U.S. Thanksgiving Day (and, to a lesser degree,

Christmas) celebrations, the within-year variation of egg placements,

poultry placements and production has been reduced dramatically.

This reduction is, of course, a testament to aggressive product development which has seen turkey become a major player in the processed meats sector and improved turkey usage in the traditional “offseason.” Once non-existent, turkey versions of virtually every lunch

meat and processed product are now widely available. We’re still not

sure about calling any turkey product “ham” or “bacon” but it’s good

business if you can do it and the courts have said turkey companies

can.

At first glace, it appears that October turkey production grew

substantially — and, in fact, it did. The monthly output of 579 million

pounds was the third largest on record and was over 10 per cent larger than

last year. But the October data (and, in fact all three of those huge

months dating back to 2007) contains a trap: It involved 23 slaughter

days.

When we adjust this year’s October output for the 2 extra

slaughter days versus one year ago, output was up only 0.9 per cent.

So what should we expect from the turkey business in 2013?

USDA, in last month’s World Agricultural Supply and Demand Estimates, expects U.S. turkey output to decline by just over 3 per cent next

year. That is very close to our expectation and quite logical given this

year’s cost increases. September’s egg sets of 26.366 million were

the smallest since the 26.223 million of October 2010 and only 1.3 per cent larger than the 26.010 million set in November 2009 — and that was

the lowest monthly total since 1989.

September poultry placements of

20.848 million were the smallest since November 2008 and the second smallest monthly total since the fall of 1990.

All of this, of course, is driven by higher feed costs and a

portion of the reduction in numbers will be made up for, we believe,

by ever-increasing bird weights. It is difficult to change the size of

whole birds sold for holiday usage but the size of the bird that producers processing product is strictly a matter of efficiency and more

pounds spreads fixed and quasi-fixed costs at both the farm and processing plant level.