CME: US Egg Prices Running High, Avian Flu Epidemic on the Wane

US - According to the top US veterinary officer, the worst bird flu outbreak in US history may be over by July, write Steve Meyer and Len Steiner.This would end what has been a devastating event for many US poultry producers as well as the food service and retail operators that rely on this supply.

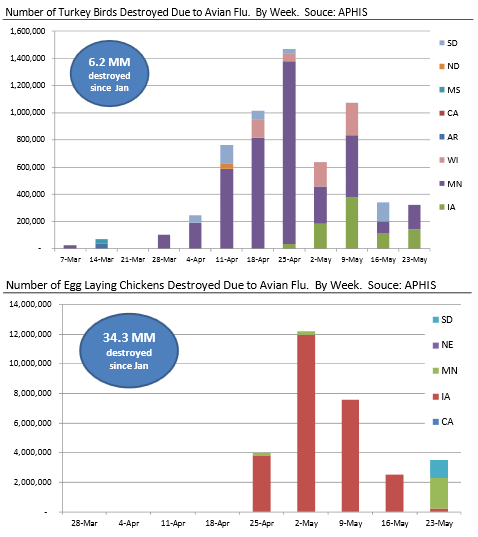

The number of cases and birds affected by the disease has been steadily declining since mid-April, although we are still seeing significant outbreaks among egg laying birds.

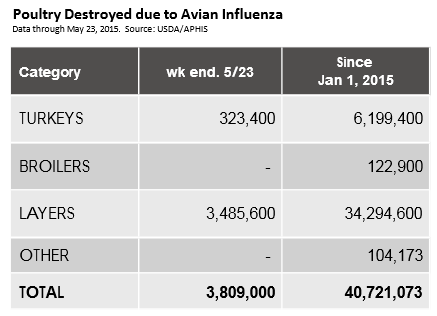

Based on the latest data from the Animal and Plant Health Inspection Service (APHIS), there were 11 cases of bird flu for the week ending May 23, with nine outbreaks in commercial operations.

These new outbreaks affected a combined 3.8 million birds and it is likely the number will be revised higher as the flock size for three operations was still pending.

Since January 1, there have been about 6.2 million turkeys and 34.3 million chickens that have been affected by avian influenza.

Almost all chickens affected produced eggs for human consumption. There have also been two small outbreaks in commercial broiler operations, one in a mixed broiler/duck operation in California and another in a broiler breeding farm in Iowa.

The supply effects have been devastating for turkey and egg producers as a significant portion of the production capacity was lost in a matter of weeks.

The effect has been similar to the PEDv outbreak in hogs last year although we would argue it has been even more severe given the rapid spread of the disease.

Egg production in the US has been hit quite hard, especially the production of eggs that are destined for processing (breaking stock).

This is because the outbreak has been centred in Iowa, which accounts for a large portion of the national breaking stock supply.

Still, the loss will impact the entire egg sector as end users scramble (pardon the pun) to secure supply going into the summer months.

Prices for shell eggs were running around $1.24/dz at the end of April. Currently they are priced at almost $2.40/dz, a 93 per cent increase from a month ago.

The price of liquid eggs, which at the end of last month was quoted at about 70 cents per pound, now is quoted at $1. 78/lb (158 per cent) and it has been moving up every single day for the past four weeks.

Table egg layer inventory as of May 1 was reported by USDA at 295.9 million head, 8.3 million head (-2.7 per cent) lower than a year ago.

The June 1 inventory will likely register a much more significant decline given the large number of birds exposed to avian influenza in the last three weeks.

Turkey prices have also increase d sharply, with turkey breast meat currently priced at $4/lb, up 70 cents (+21 per cent) in the past four weeks and nearing the all time record high levels we saw last year.

So far, the spread of AI in the US has not had an inflationary impact on chicken prices. Indeed, it has had the opposite effect.

A number of countries have imposed partial or complete bans on US chicken products due to the persistence of AI. This has negatively impacted US chicken exports, which account for as much as 19 per cent of total production.

Inventories of leg quarters, a traditional export item, were up almost 80 per cent at the end of April while leg quarter prices are down 41 per cent from a year ago.

High prices for turkey breast may provide some support for pork and beef deli items. However, lower chicken prices generally are bearish for pork, and to a lesser extent, beef going into the summer months.