CME: Feed Costs to Remain Low

US - The latest USDA WASDE report once again surprised grain market traders with yields that were much higher than private estimates, write Steve Meyer and Len Steiner.Predictably corn and soybean futures traded sharply lower but still some doubts continue to linger about the final potential of the US corn and soybean crops.

Coming into the report analysts were expecting yields to be around 164 to 165 bushels per acre. This was based on private estimates of crop conditions as well as projections that excess moisture earlier in the planting season had irreversibly damaged some of the crop.

The USDA yield estimate, however, came in at 168.8 bushels per acre, 2 bushels higher than the earlier forecast and about 4 bushels higher than analysts were expecting.

USDA also did not change its harvested acres number even as some analysts still think the number may eventually be revised lower.

USDA did made a modest revision to its feed use number, pegging it at 5.3 billion bushels, about the same as in 2014-15.

Interestingly, USDA still projects significant expansion in beef and chicken supplies, which ultimately may require a larger feed demand component.

The report certainly was welcome news for livestock producers, promising that feed costs will remain relatively low well into next year and help support the expansion in beef, pork and chicken supplies currently under way.

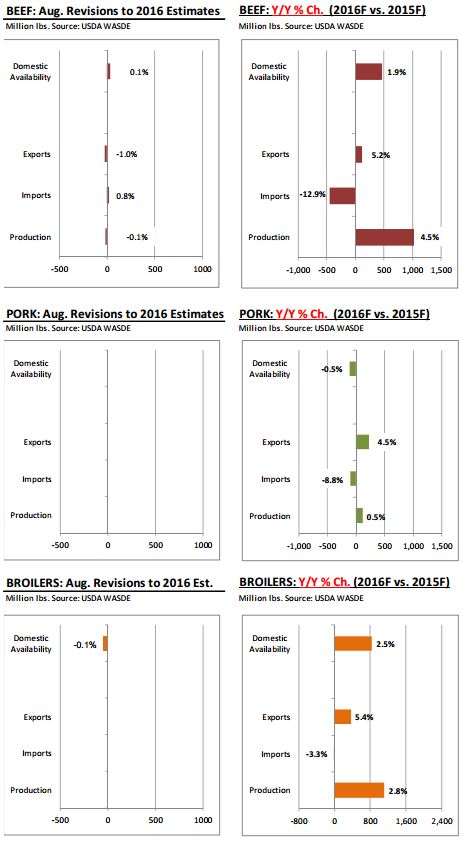

The USDA revisions to its estimates for 2015 and 2016 meat supply/demand were relatively small.

Beef numbers were revised slightly to account for the lower than expected pace of slaughter so far this year. Beef production for 2015 is now forecast at 23.824 billion pounds, 65 million pounds lower than the previous forecast and 2 per cent lower than a year ago.

USDA slightly lowered its estimate for production in 2016 by 15 million pounds but the key number is that it still expects beef output next year to increase by a little over 1 billion pounds (+4.5 per cent).

The increase is quite significant and would imply a notable decline in fed cattle prices for next year. Clearly the USDA numbers reflect the effect of a larger calf crop in the last 18 months, larger slaughter numbers and continuing gains in fed cattle weights.

But the big growth in beef production could hit a snag should heifer retention that has been particularly strong in recent months, continues unabated in 2016.

Pasture conditions and weather remain key risk factors that could either continue to slow down the flow of cattle into feedlots or, alternatively, cut short herd rebuilding and push more female stock into feedlots.

USDA expects per capita disappearance in 2016 to be 55.1 pounds per person (retail wt.) 1.3 per cent larger than in 2015. Interesting to note that USDA expects beef imports to drop sharply next year, largely reflecting the expected reduction in Australian slaughter.

Resumption of Brazilian beef imports next year could change the equation and further bolster beef supply availability.

As for pork, USDA made no changes to its forecast for 2015 and 2016 production but slightly lowered its forecast for pork exports this year.

China pork demand talk has calmed down a bit and the weekly data reported this morning showed the lowest weekly shipments to China since late February.