US Consumer Meat Demand Continues to Rise

US - Domestic, consumer-level demand for meat and poultry continued to rise in August but the pace of increase appears to be slowing, write analysts Steve Meyer and Len Steiner.That would be our conclusion based on the per capita disappearance and retail prices published by USDA which we use to calculate real per capita expenditures (RPCE).

RPCE uses the exact same data as the demand indexes developed many years ago by Professor Glenn Grimes with one exception: RPCE does not use a specified elasticity of demand but simply allows the negative relationship between price and quantity to be reflected in the product (ie. multiplication) of those two variables.

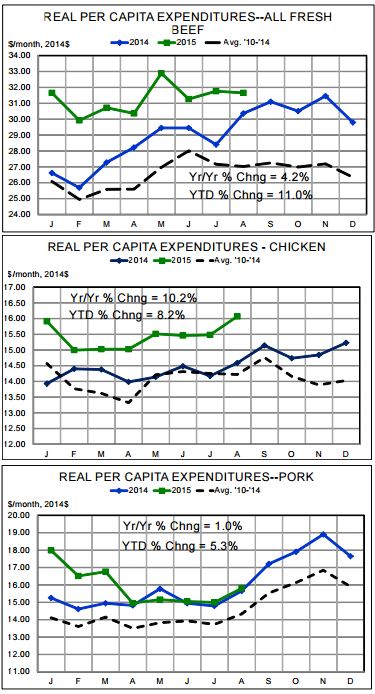

Monthly RPCE’s for beef, chicken and pork appear in the chart.

We do not calculate an RPCE for turkey because the only retail turkey price published by USDA is for whole birds. That price does not reflect modern demand for turkey parts.

Total RPCE for the beef, pork and chicken continued to grow in August relative to 2014 with the total of $64.82 (year 2014 dollars) exceeding last year by 3 per cent. The YTD total of $512.96 is 7.7 per cent higher than last year and still leads the 5-year average by 14 per cent.

These figures represent, in essence, the year-to-year change of an “aggregate” demand for the three species. Three?species RPCE has exceeded year-ago levels for 19 straight months but August’s gain was the smallest since July 2014.

We believe a primary driver of this increase has been a change of consumer preferences for meat and poultry as desires for high quality dietary protein have increased and fears of saturated fat intake have waned. The positive impacts of these preference changes are, however, getting smaller over time.

Of the three species measured, chicken RPCE is performing best so far in 2015. The primary driver of August RPCE for chicken was an 11 per cent year-on-year increase in per capita disappearance/consumption. That kind of increase would be expected to push retail prices significantly lower if demand is stable.

Nominal and deflated (real) retail chicken prices in August were only 0.5 per cent and 0.7 per cent lower, respectively, than one year ago implying significantly higher demand for chicken.

We do note that the use of “disappearance” in this calculation could be pushing our expenditures figure higher than it actually is. Several anecdotal reports indicated that some amount - and we think it was reasonably significant - of leg quarters were rendered this past summer due to very low prices caused by HPAI-related export bans.

Those volumes are still included in per capita disappearance even though they were not purchased or consumed.

We doubt that the removal of this quantity from our calculation would have pushed chicken RPCE back to year-ago levels, but the robust gains of May through August would almost certainly have been smaller. This is simply one hazard of using computed “consumption” instead of consumption based on consumer surveys of actual consumption.

Beef RPCE growth is getting smaller as the year progresses but continued strong retail prices have kept year-to-date growth at 11 per cent.

Pork RPCE growth has come to a halt since March but the YTD gain of 5.3 per cent follows gains of 5.5 per cent and 7.6 per cent the past two years.