CME: Chicken Producers Benefit from Low Feed Costs, Export Improvements

US - Despite (some) lower chicken prices, don’t expect a significant slowdown, let alone a decline in chicken production anytime soon, write Steve Meyer and Len Steiner.Low feed costs and a notable improvement in export volumes has offset some of the impact from lower prices for key items, such as chicken breasts.

USDA quoted the weighted average price for boneless/skinless chicken breasts last night at $117.60/cwt, 23 per cent lower than the same time last year.

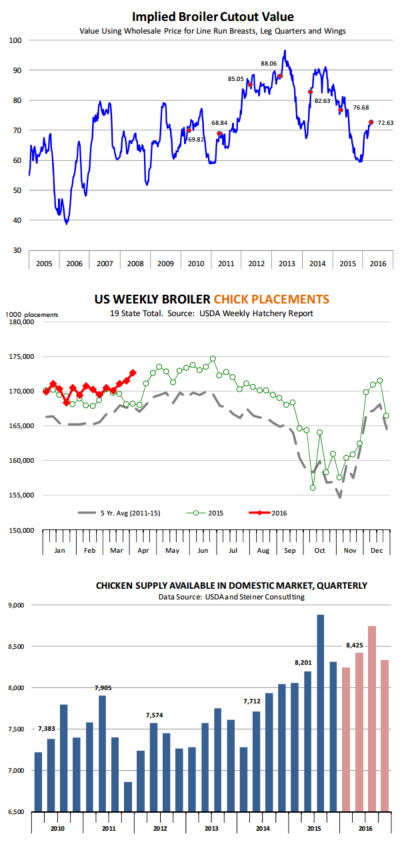

Line run breasts, which is the component we use to calculate the implied cutout value, were quoted at $91.02/cwt, 14.4 per cent lower than last year. But this is only one component of the broiler carcass, other products are faring much better.

The price of leg quarters was last quoted at $34.19/cwt, 7.4 per cent higher than a year ago while the price of wings at $178.06 was 3.4 per cent higher than a year ago.

Before we go much further, take a look again at the numbers, wings are now price almost double the price of line in breasts and 50 per cent above the price of boneless skinless breast meat, it tells you where demand is these days, it is for fat and flavour.

You can see this in the price of pork bellies (bacon) or the price of butter, for that matter. But we digress. The point is that we think the broiler industry continues to be profitable, albeit not at the same level as a couple of years ago. This in turn should continue to support chicken supply growth. It brings some context to the number of chicken processing plants being built at this time.

Based on the USDA weekly hatchery report issued yesterday, broiler chick placements for week ending April 9 were up 2.4 per cent from the same period a year ago.

For the last six reported weeks chick placements were up 2 per cent. This should continue to support weekly slaughter numbers in May. In addition, producers continue to bring ever larger birds to market.

The supply of birds sold whole is relatively stable given a saturated retail channel. Much of the growth in the industry in the last 30 years has come from the further processed sector and the key there is not size but yield. Larger birds yield better, which in turn improves overall profitability.

According to the National Chicken Council, in 1990 the further processed segment of the industry accounted for about 28 per cent of the overall volume of chicken marketed in the US. Today, further processed chicken is about half of the entire volume, while whole birds are just 11-12 per cent.

Larger slaughter and heavier birds imply a significant net gain in US domestic availability. The chart to the right shows our calculation of the amount of chicken available to the US consumer by quarter.

This is basically total ready-to-cook production (quarterly) minus exports plus minimal imports and adjusted for ending stocks. For the period 2010-2013 quarterly available volume averaged 7.455 billion pounds. In 2016, the average quarterly volume available is projected at 8.437 billion.

And we are counting on a much more aggressive export volume than USDA. This is an additional billion pounds of chicken each quarter compared to the levels we saw in 2010-13. Given current prices, we don’t think we have a demand problem with chicken.

But what the concern for livestock producers should be is how much the extra chicken supply is crowding out beef and pork.