CME: US Holiday Turkey Consumption Forecast Lower Than Last Year

US - The turkey market is moving into the home stretch for getting product through the distribution system and in place for the Thanksgiving holiday, according to the latest Daily Livestock Report by Steiner Consulting Group.The Thanksgiving and Christmas holiday calendar quarter has traditionally been the peak turkey consumption time.

Consumption set a record of 6.4 pounds per person for a three month period in 1992 during the October-December period. Since that time, fall quarter consumption has receded along a gradual, and sometimes irregular path.

Consumption during the last quarter of 2015 was 4.9 pounds per person. The lowest holiday quarter consumption since 1992 was in 2013, when consumption dropped to 4.8 pounds.

Turkey consumption for the last three months of this year is forecast by the Livestock Marketing Information Center (LMIC) to come in slightly below the low mark of 2013, probably by 0.03-0.04 pounds per person.

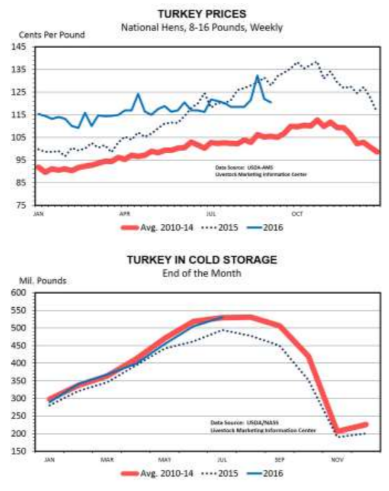

Wholesale turkey prices were at record-high prices during the first half of the year, as grocery store meat managers were laying out marketing strategies for the year.

Meanwhile, wholesale ham prices (the primary competing meat product for turkeys at the holidays) during the first quarter of the year were at the lowest values since 2009.

These price relationships should provide some support for ham consumption at the expense of turkeys during the holiday season, whether that be Thanksgiving or Christmas. Also, grocery store retail sales growth has been weakening as the year has progressed, starting out at a 2.9 per cent increase from a year earlier during the first quarter of 2016, moderating back to a 1.9 per cent increase in the spring quarter and the second half of the year is on track to show only a 1.0 per cent increase.

The projected decline in holiday turkey consumption is not dramatic, but it is in line with long-term secular trends and external market influences.

Ironically, turkey consumption during the first nine months of this year will post some impressive gains in the wake of industry challenges flowing from the Avian Influenza outbreak of 2015.

Even with production being curtailed last year, consumption will still able to increase 1 per cent from 2014. All of the increase came in the first half of the year, before the disease affected production.

Turkey consumption during the first quarter of this year was up 2 per cent from a respectable level of consumption during the same quarter of 2015. Turkey consumption during the April-June quarter of this was up 8 per cent from a year earlier.

Turkey breast meat prices have been sacrificed to induce the additional consumption, however, with breast meat prices falling 30 per cent from the last quarter of 2015 to the first quarter of 2016. Spring quarter breast meat prices fell another 40 per cent, which lays the groundwork for another impressive gain in consumption this summer.

Last summer’s consumption was limited by production constraints, so year-over-year consumption comparisons will look gaudy in the range of 10-15 per cent increases. July consumption was up 8 per cent.

The turkey industry in recent years has focused on managing frozen inventories at the end of the year to be close to 200 million pounds (relative to annual production of 5.5-5.8 billion pounds). Of this 200 million pounds, whole bird inventories usually amount to 50-60 million pounds.

At the end of July, frozen turkey inventory was up 7 per cent from a year earlier, but whole bird inventories were 7 per cent less. Reduced frozen whole bird supplies going into the holiday season provides another logistical concern that could limit consumption during the final quarter of the year.