Daily US grain report: grain bulls work to stabilise bleeding markets

Bulls are trying to stabilise the bleeding from recent strong selling pressure that has driven the markets to multi-month lows.US grain futures prices were mixed to weaker in overnight trading. Corn was down 2 to 3 cents, soybeans around 1 cent higher and wheat down about 3 to 5 cents.

News late Monday (5 August) that the US labelled China a currency manipulator initially pushed world stock markets still lower, following Monday's steep losses. Grain markets worldwide also felt selling pressure. However, China's central bank then set its currency, the yuan, exchange rate with the US dollar at 6.9683, which was 0.7 percent down from Monday's fixing.

The yuan depreciated to an 11-year low against the US dollar Monday, at 7.1087 to the dollar. The move on Monday led to ideas China has thrown in the towel on any trade agreement with the US coming anytime soon. However, Tuesday's yuan fixing below 7 gave pause to those thinking the Chinese government will let the yuan continue to depreciate against the US dollar. Also, China's central bank knows the downside of letting the yuan fall in value - one being flight of capital out of China, which has very likely already been occurring. Grain traders are wondering if China has "blinked." However, China this week has confirmed it will suspend its purchases of US agricultural products. With grain prices seeing such strong selling pressure recently, it could be that futures prices have factored in a worst-case scenario for trade war - at least for the intermediate term.

© Jim Wyckoff

Weather in the US Corn Belt remains mostly non-threatening to the US corn and soybean crops, albeit a bit dry in some areas.

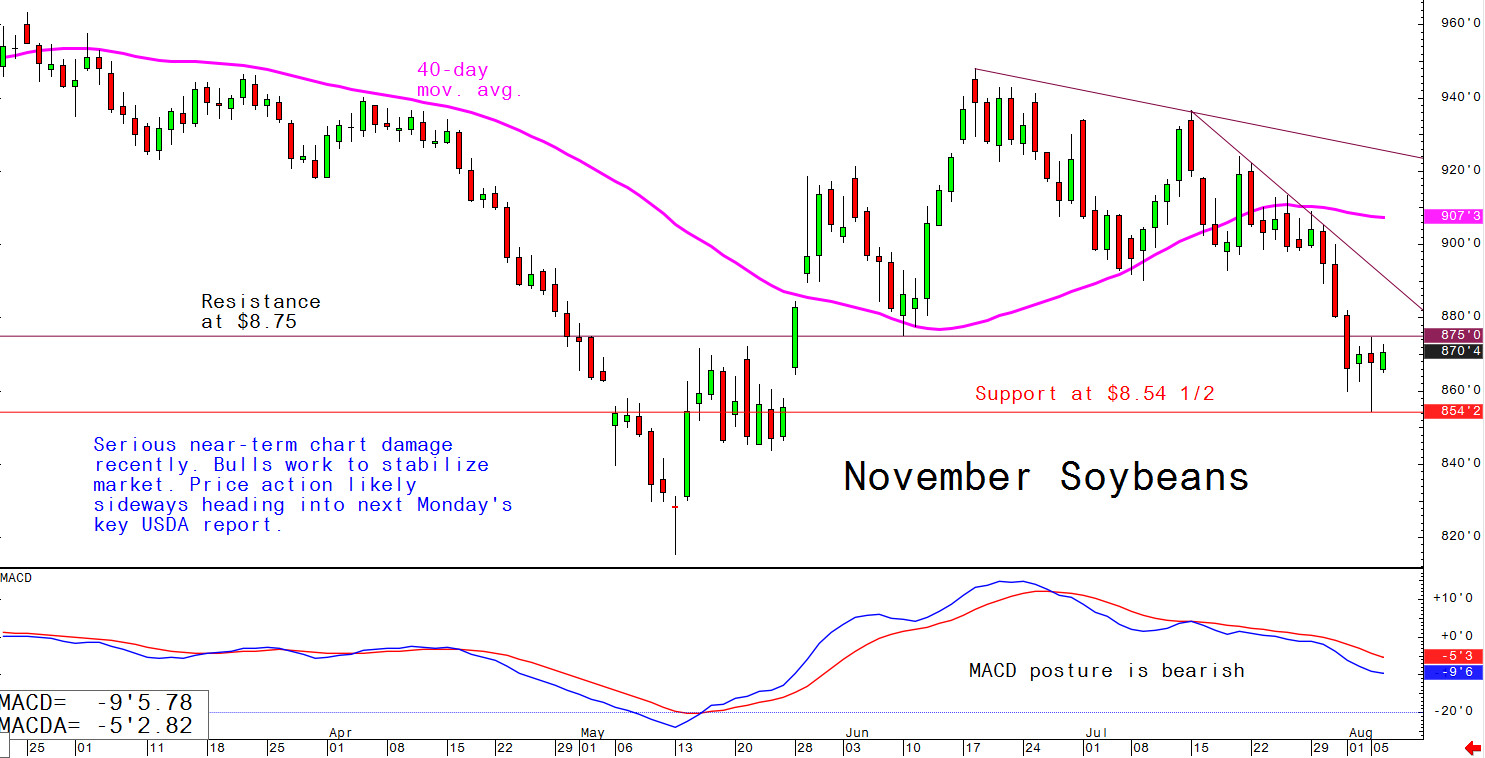

Technically, serious chart damage has been inflicted on the grains the past two weeks. This has prompted the technical-based bears and the big speculative "fund" traders to jump on the short side of the US grain futures markets.

© Jim Wyckoff

Trading in the US grain futures markets is now likely to be choppy and sideways ahead of next Monday's key USDA monthly supply and demand report, which will include estimates of the size of the US crops and the updated US corn-soybean acreage mix that is so much in question at present.