GLOBAL POULTRY TRENDS: Europe Helps Double World Shell Exports

Europe, as a region, accounts for much of the global increase in the trade in shell eggs over the first decade of the millennium, according to industry watcher, Terry Evans. The greater part of this trade is between European Union member states.Globally, exports of hen eggs in shell doubled in the decade to 2010 from just under one million tonnes to a little over two million tonnes (Table 1). Two-thirds of this increase can be attributed to the expansion of some 710,000 tonnes in exports by European countries as this region's total rose from 641,000 tonnes to 1.35 million tonnes. Thus, in 2010, Europe's contribution to the world total exports was 67 per cent.

Because of the difficulties in transporting shell eggs long-distance, virtually all the European trade is with European countries and in fact, close examination of the data reveals that almost all the business is conducted between member countries of the European Union (EU).

So, within Europe the quantities of eggs exported by non-EU member countries is small, never amounting to more than 100,000 tonnes a year, while the volume traded by EU member states has expanded from around 584,000 tonnes in 2000 to 1.28 million tonnes in 2010.

Virtually all the shell eggs exported by EU countries are purchased by neighbouring countries. In 2010, for example, of the total of 1.28 million tonnes, only 103,000 tonnes went to non-members. Indeed, the European Commission estimates that in 2010, EU exports of all eggs, shell plus products converted to shell egg equivalents, but excluding hatching eggs to third countries amounted to 182,0000 tonnes, rising to 217,000 tonnes in 2011 but falling back substantially - around 15 per cent - in 2012.

The Commission's equivalent estimates for imports from third countries were 31,000 tonnes in 2010, contracting to 19,000 tonnes in 2011, while the latest figures for 2012 point to a massive 80 per cent plus rise, primarily as a result of a large increase from the US and a substantial rise in shipments from Argentina of egg products. Imports of shell eggs for consumption in to the EU is almost impossible as few exporting countries can comply with the EU regulations for Salmonella prevention. That Ukraine is now permitted to trade eggs with the EU; it is anticipated that shell eggs will be sold to the EU for breaking for the production of egg products.

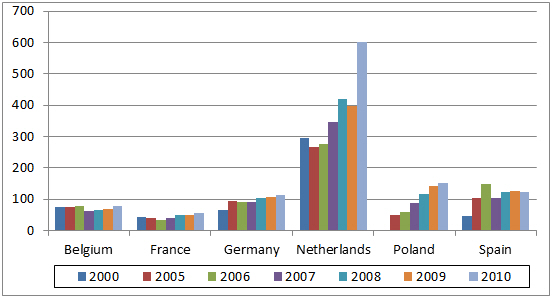

In 2010, just six countries combined accounted for 1.1 million tonnes of exports or about 88 per cent of the EU total. They were the Netherlands, Poland, Spain, Germany, Belgium and France (Table 1 and Figure 1).

The Netherlands was easily the leading exporter, trading more than 600,000 tonnes in 2010 or almost half the EU total. This figure includes hatching eggs. The main recipients of Dutch eggs were Germany taking almost 490,000 tonnes, followed by Belgium (27,000 tonnes) and Italy (13,000 tonnes), while some 12,000 tonnes were sold to the non-EU member, Switzerland. Dutch exports (shell eggs plus products) slipped by two per cent in 2011 because of a reduction in purchases by Germany although this was partly offset via sales to Belgium, the UK and Switzerland.

The second major exporter in the EU in 2010 was Poland shipping some 153,000 tonnes of shell eggs. This country's trade has escalated rapidly from only 272 tonnes back in 2000. Having joined the EU in 2004, sales have risen annually, the bulk going to Germany (63,000 tonnes in 2010), the Netherlands (26,000 tonnes), the Czech Republic (18,000 tonnes) and Romania and Slovakia (each taking around 9,000 tonnes). The latest figures point to a further increase in Polish exports toward 170,000 tonnes in 2011.

Third largest exporter is Spain although the quantity shipped in 2010 at 123,000 tonnes was, according to the FAO data, marginally below the previous year's level. France with 45,000 tonnes, Germany (29,000 tonnes), Italy (11,000 tonnes), Portugal (10,000 tonnes) and the UK (9,000 tonnes) accounted for 85 per cent of the total. However, another series of figures, while showing a similar trend, puts Spain's shell egg exports in 2010 at around 143,000 tonnes, rising to almost 150,000 tonnes in 2011. Should production decline as anticipated, this will likely be reflected in the level of exports in 2012 and 2013.

Although, in recent years, annual exports from Germany have exceeded 100,000 tonnes, nearly half of this went to the Netherlands; this country is far more important as an importer of shell eggs.

Shell egg exports from both Belgium and France have changed little over the past 10 years or so, their main customers being the Netherlands and Germany.

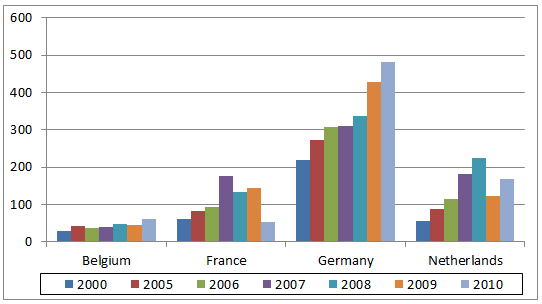

The overall picture of shell egg imports is almost identical to that for exports, with EU countries accounting for 94 per cent of the total for Europe (Table 2 and Figure 2). As with exports, almost all the trade is with fellow EU member states.

Germany is the major importer, accounting for the best part of 500,000 tonnes or almost half the EU total in 2010. As German production declined over the period 2000 to 2010, so imports escalated. In 2010, the Netherlands supplied nearly 340,000 tonnes, while Poland sent some 42,000 tonnes and more than 25,000 tonnes were bought from both Belgium and Spain. However, Germany's industry started to recover in 2011 and consequently imports fell to around 400,000 tonnes.

Since peaking at around 225,000 tonnes in 2008, imports into the Netherlands contracted to less than 170,000 tonnes in 2010, while the latest figures point to a further decline to around 130,000 tonnes in 2011, as a consequence of higher domestic production, which brought about lower prices and hence a greater reliance on imports. A noticeable feature of this trade has been how purchases from Poland have risen from less than 7,000 tonnes in 2007 to more than 23,000 tonnes in 2010.

Belgium is also a significant importer purchasing more than 60,000 tonnes a year, most of which are supplied by the Netherlands.

Imports to France slumped from 143,000 tonnes in 2009 to 54,000 tonnes in 2010, primarily as the result of smaller purchases from Spain, the Netherlands and Belgium.

Trade in Egg Products

The trade in egg products in Europe mirrors that for shell eggs, with most of the business being conducted between EU member countries and only small quantities being exported from or imported to the Community. However, increases in production costs - which have pushed up the prices at which EU processors can sell yolk - has meant that the quota at which imports can come in at reduced levies, is no longer a barrier and this has been reflected in increased receipts from both the US and Argentina. Also, a reduction in the EU export refunds to zero on yolk and whole egg, and by 50 per cent on albumen, have severely restricted the possibility of trade. In particular, the reduction on albumen refunds has made it virtually impossible to export to the Far East, principally Japan.

Within Europe, more than 90 per cent of both egg product exports and imports are conducted by the EU.

Regarding dried egg, unfortunately the trade data supplied by the FAO does not include albumen. Exports from Europe during the latter part of the last decade, at around 29,000 tonnes a year, represented about half of the world total of some 60,000 tonnes (Tables 3/7 and 4/8).

For exports of dried whole egg or yolks, the main countries involved are the Netherlands, France, Germany, Belgium and to a lesser extent, Italy. However, as with shell eggs, Poland has become increasingly important, exports having escalated from a mere 120 tonnes back in 2000 to more than 1,236 tonnes in 2010.

Germany and the UK were the main recipients of dried egg products from the Netherlands in 2010, while sales from France were mainly targeted at Germany, Spain and the UK. However, both Germany and the UK also purchased significant quantities from the US.

One of the biggest purchasers of dried whole egg/yolks in 2010 was Denmark taking about 5,500 tonnes, of which nearly 1,800 tonnes came from Germany, 1,600 tonnes from the US, almost 900 tonnes from India and 537 tonnes from Bulgaria.

Europe is the major region for the trade in liquid egg, accounting for 238,000 tonnes (87 per cent) of the global total of some 273,000 tonnes in 2010. As with the other sectors, almost all the Europe trade is conducted within the European Community, with the Netherlands shipping more than half, France, Germany, Belgium and Spain being the other significant traders.

On the import side of the trade balance sheet, Germany, France, the UK, Belgium, Spain, the Netherlands and Denmark were all key recipients in 2010.

April 2013