2021 IPPE: CoBank Livestock Outlook for 2021

CoBank says the global poultry industry will continue to see supply and demand challenges amid rising feed prices.Part of Series:

< Previous Article in Series Next Article in Series >

Will Sawyer, lead animal protein economists at CoBank, spoke at the 2021 IPPE event, sharing key drivers in 2020 that shaped where we are headed over the next few years.

A quick look back at 2020

Following the 2020 IPPE, the industry saw a historic shift in consumer and food consumption around the world.

“It's a shift that we never thought the industry, whether it's poultry, protein or food, would be able to manage as well as they did,” said Sawyer. “Because in the midst of that shift in consumption, we also saw a historic contraction in the global economy. Both of those drivers really affected demand for poultry, protein and food in general.”

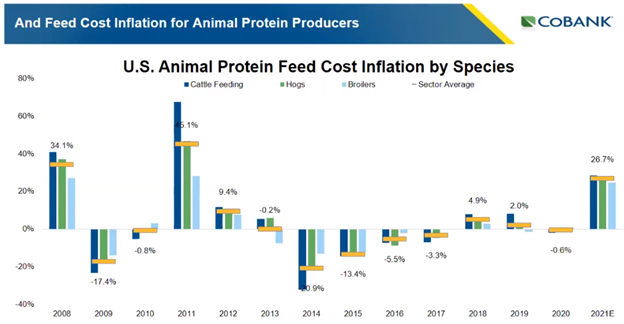

Over the last few months driven by weather and changes in demand for animal protein and feed, corn prices have moved from $3 to $4 to $5/bushel in a short timeframe. This indicates an implication for feed cost inflation which is significant, according to Sawyer.

In 2020, there were a few firsts: not only the shift in food consumption, but there was a shift in poultry becoming the #1 most produced and consumed protein around the world. African swine fever was the obvious driver of that, but it was also a key driver of making pork the most traded global protein in the world.

“Despite all this volatility, we were still able to increase supply 1.1% [in global chicken production] may not sound like very much, and it isn't much given the level of supply growth we've seen in the last five or six years,” he said. “But we think that's a real testament to the workers, to the processors, to the growers in poultry around the world.”

© Will Sawyer, CoBank

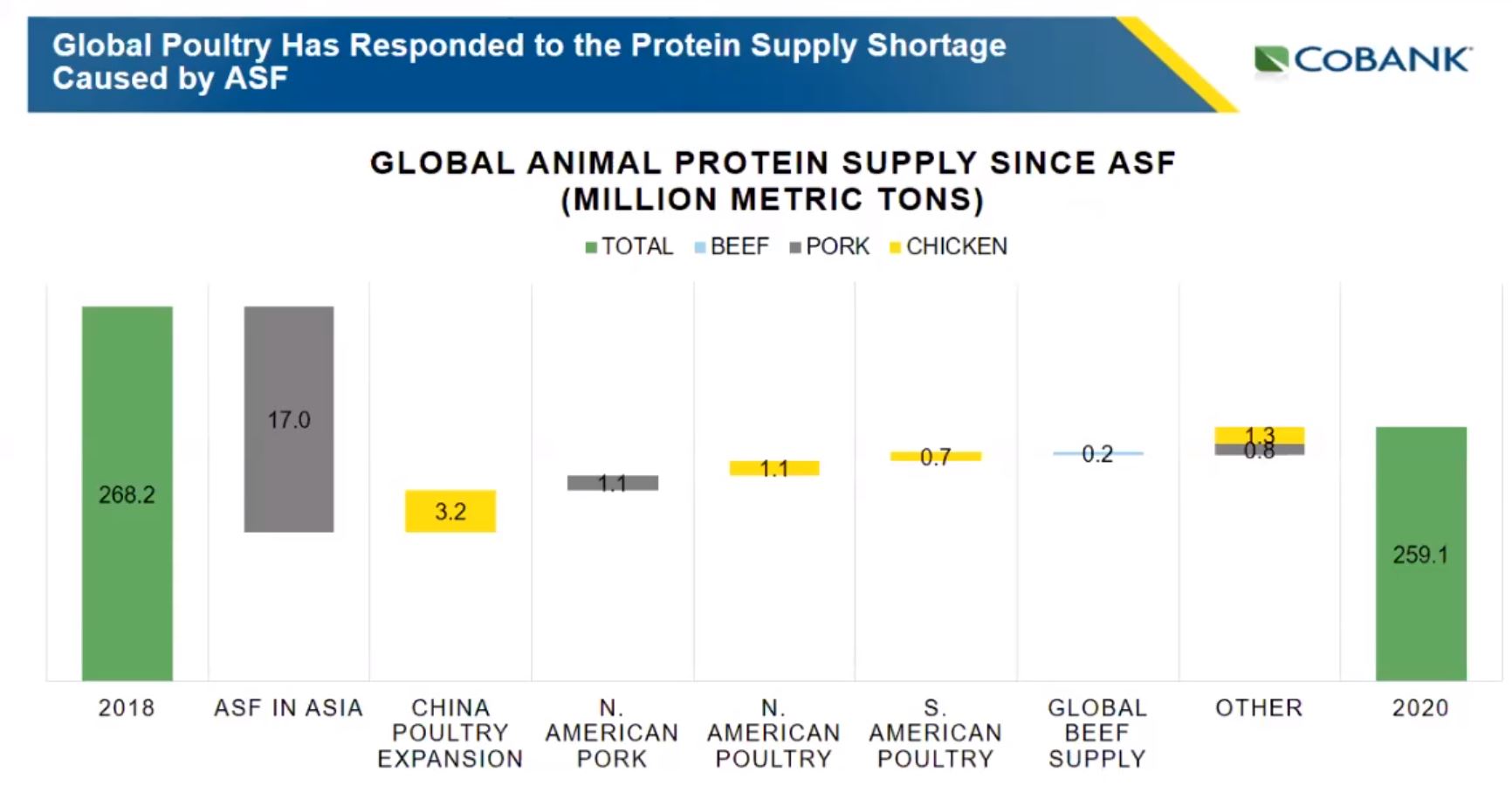

Looking back further in 2018, the protein supply has been driven by the spread of African swine fever, not just for the pork sector, but for poultry and beef as well. The discovery of ASF in the fall of 2018 in China was a real step change. The swine industry saw the loss of about 17 million tons of pork production primarily in China.

“It's hard to believe that in 2019/2020, we saw back-to-back years of lower protein production - only during the early 1990s and changes in the former Soviet Union did we ever see a year-over-year decline in the last 70 years of protein supply,” Sawyer noted. “We've seen that in the last two, another historic situation. The yellow columns are indicating a supply expansion for poultry in China and North America and South America, and of course, in other markets as well, we've seen the attempt to try to fill that hole. Comparing 2018 to 2020 protein supplies, they are still far below where they were prior to African swine fever.”

© Will Sawyer, CoBank

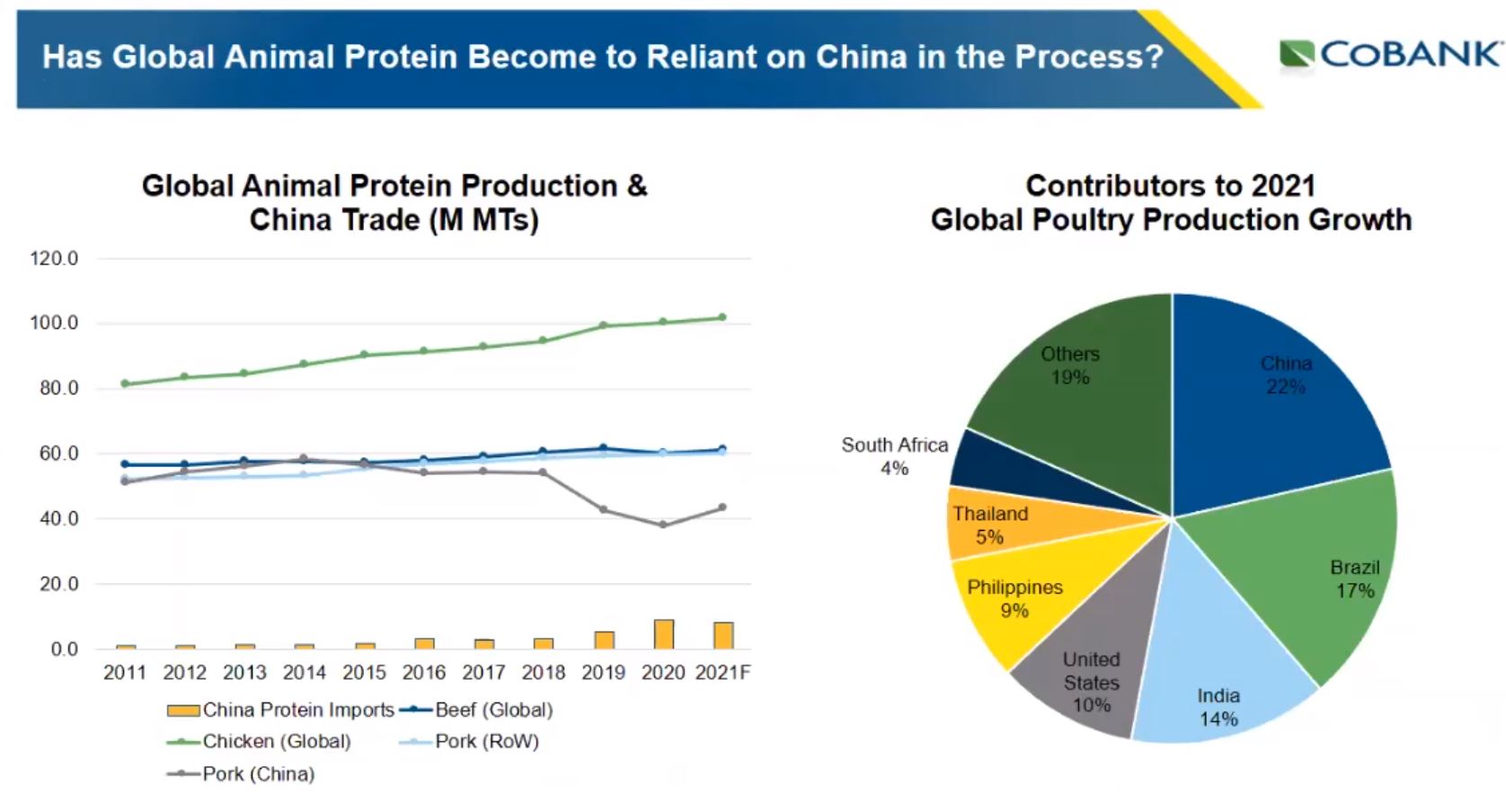

Looking forward, CoBank sees a real change in the dynamic for poultry trade and for protein due to the expansion and rebuilding of China's hog herd over the next three to four years. This will cause a significant disruption in protein trade.

Today, around one in three pounds of protein that is shipped around the world finds its way into the Chinese market. The US and other countries have become very reliant on the Chinese market. Despite the COVID-19 disruption, the Chinese market has still experienced economic growth in 2020, and that growth is expected to accelerate in 2021 and 2022. Expect to continue to see poultry supply growth and the rebuilding of the hog herd in China and other parts of Asia that have been very hard hit by African swine fever.

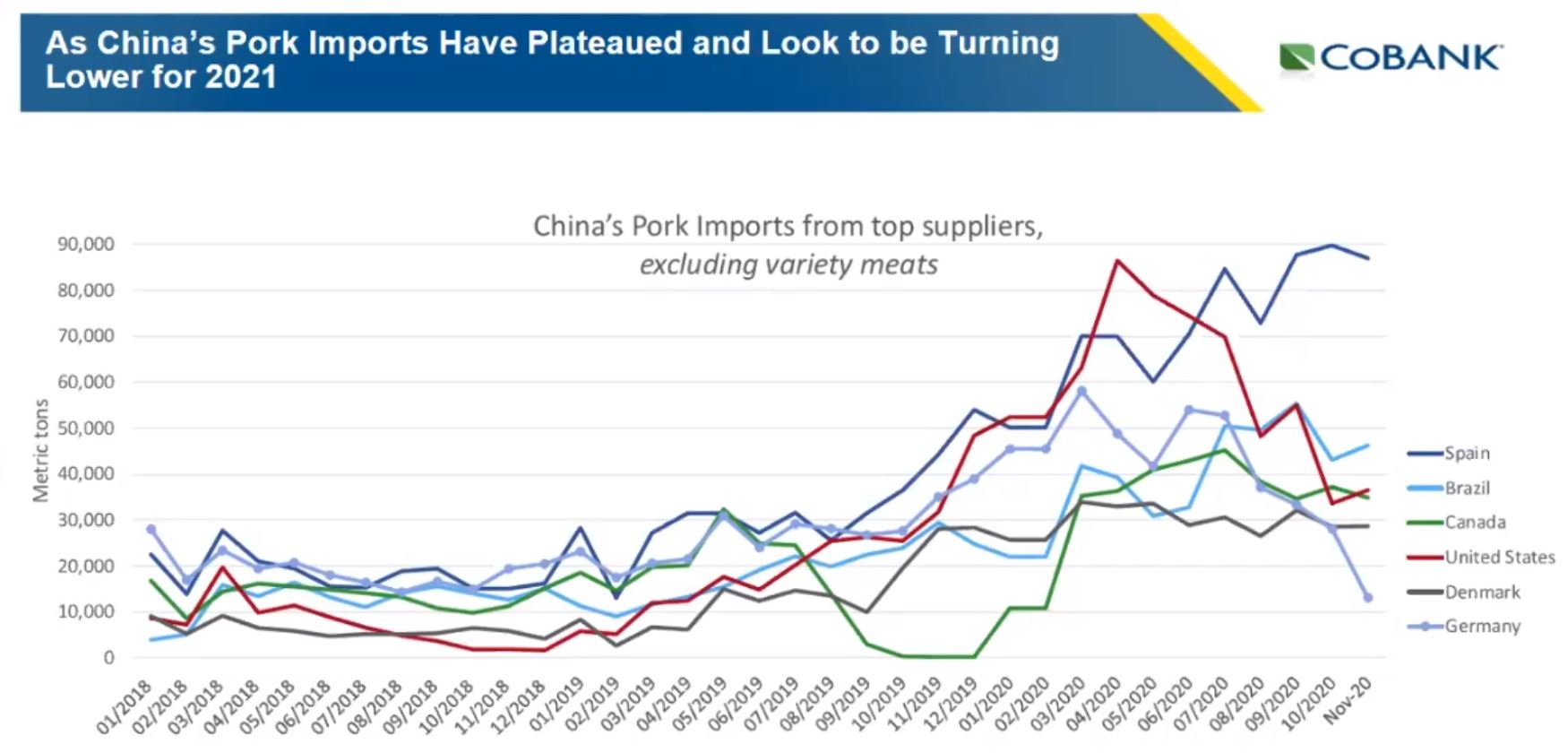

“As China rebuilds, we do wonder what the protein trade is going to look like in the years to come,” he said. “The indicators we're seeing the last 12 months show that when it comes to pork, and to some degree, maybe other proteins, we've seen that the best times are somewhat behind us. In the spring of 2020, we saw somewhat of a peak in US pork shipments into the China region and a contraction since then.”

There was a possibility of ASF in Germany and the loss of that market in the global pork trade would give the US somewhat of a boost, but it’s not going be enough to offset the rebuilding expected in China's hog herd. Some markets have taken advantage of Germany's losses, but CoBank expects a contraction in the years to come in pork shipments into China and to some degree poultry as well.

© Will Sawyer, CoBank

Feed prices boosted higher by demand

The conversation is now shifting toward feed expansion and feed demand growth and away from animal protein.

“We see many folks in the investment community looking at feed and China's demand growth for feed as they rebuild their hog herd as the new investment opportunity, and it’s one that we think is going to drive feed costs higher,” he explained. “We're already seeing that in the last few months, but I don't think that story is over because it's a pig herd that will take many, many months, if not the next three to four years, to get back to pre-ASF levels.”

With the feed cost inflation, it’s starting to impact global prices, not just for cereals but for overall feed costs. It will likely take several years, not just months, for animal protein producers around the world to really get these feed costs under their belt, according to Sawyer.

© Will Sawyer, CoBank

For the U.S. market, CoBank has expectations for feed cost inflation in 2021 of 27%. Not only is it a significant number, it's the largest year-over-year increase in feed cost inflation that US beef, pork and chicken producers have experienced in over a decade.

“We've all watched as feed costs have been largely a tailwind for meat producers across the species for a number of years now. That's helped keep profit margins in a positive territory. It's allowed some deflation in the meat case over the last decade and allowed many producers to continue to expand supply and build new facilities.”

CoBank’s estimated 27% feed cost inflation considers the higher feed costs the industry has seen since the WASDE report release in mid-January. It’s significant, but not unheard of. Right now, economists are still talking about corn at $5 per bushel, not $6-$7/bushel, but Sawyer says higher prices are possible and the industry should be prepared.

“The bad news is that the worst of the feed cost inflation is really still on the horizon. It's going to be in the summer of 2021 where feed cost inflation for beef, pork, and chicken producers climbs above that 20% to 25% level and into the 30% to 40% level - that's a significant amount of feed cost inflation,” he said.

The good news for the US industry, and for many producers around the world, is that they're already experiencing this feed cost inflation. Thus, the industry has already started to adjust on the poultry supply side to manage through what will be a challenging period. One thing is very certain - feed costs are going to be significantly higher than in years past.

“What's also going to be a factor is that we're seeing expansion in protein supplies around the world slow outside of the regions that have been hit by African swine fever,” he said. “That's good news because the enemy to higher meat prices is supply growth, and to see supply growth slow as much as we think it will in 2021, and most likely in 2022 as well, will make offsetting those feed costs really important.”

Impact of COVID on poultry demand

The demand environment is still a wild card. COVID-19 is not expected to really be behind us until very late into 2021. In that time, demand for protein and especially the demand for food away from home is going to be hit hard.

© Will Sawyer, CoBank

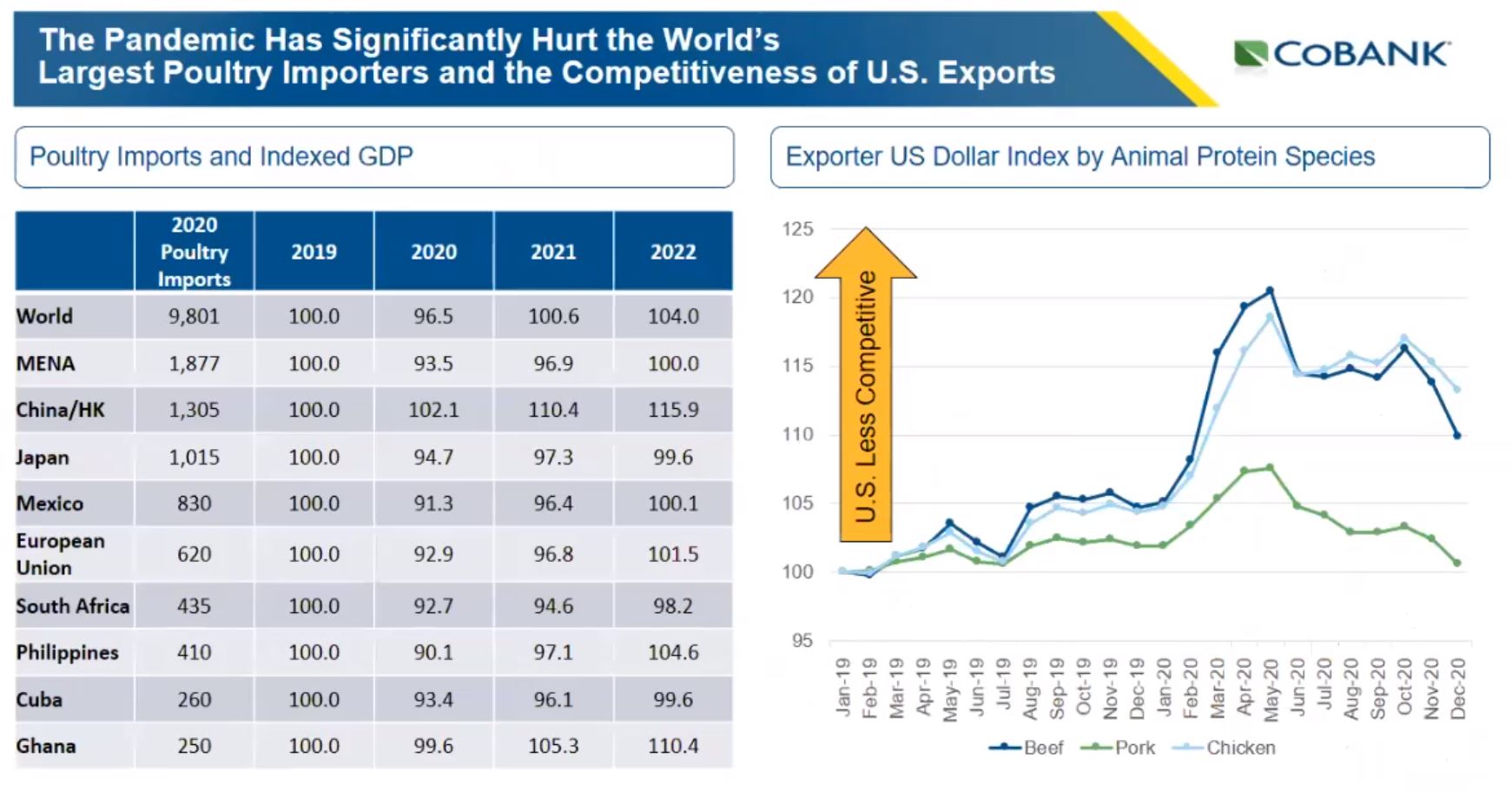

Considering demand and some of the major markets who purchase poultry from overseas, the economic environment for many of these countries is far from where it was prior to the COVID-19 pandemic. Looking at the Middle East and North Africa as a region critical to the global poultry trade, event by the end of 2021, they're still going to be significantly behind 2019. That's also true for customers in Mexico, South Africa and the European Union.

“It’s a common thread that we unfortunately see is the demand challenge. We’ll see better economic conditions in 2021 than in 2020, but still not back at that new normal,” he said. “We're all talking about the new normal, and when it comes to poultry demand, that won't be in '21; it's going to be in '22, and maybe in years after that.”

The other factor that COVID has impacted is competitiveness around the world, not just in feed but also because of currency. While that devaluation of the US Dollar is clear on a global basis, when looking at it on an animal protein species level, US protein competitiveness in beef, pork, and chicken, especially beef and chicken, is still far behind where it was prior to the pandemic. However, since May, some of the important currencies that were major headwinds to US competitiveness have gotten better and the trend is moving more in the US favor in 2021.

“Some of the major chicken companies are already talking about the fact that the competitiveness situation has led to better leg quarter prices in the fall of 2020, and as we are starting to work our way through the first quarter of 2021 which is a critical issue, as leg quarter and dark meat prices are obviously very important to the profitability of the industry,” Sawyer said.

Historic shift in food consumption

© Will Sawyer, CoBank

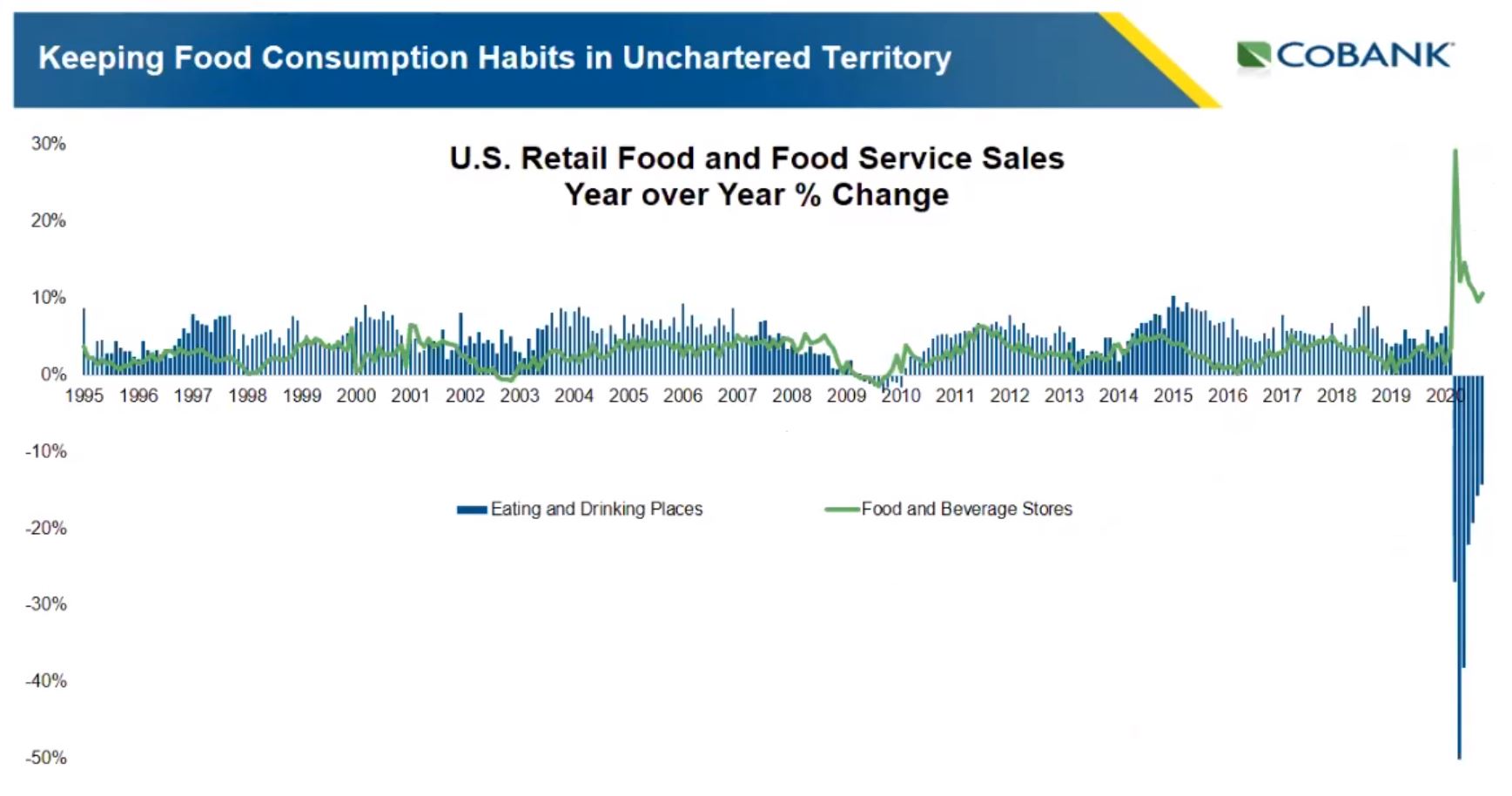

The food industry saw a historic shift in food consumption in the spring of 2020.

US food consumption, at home and away from home, has been relatively quiet year after year, with very few periods when food consumption away from home falls into negative territory. Even during the great recession of 2009, food away from home sales didn't fall by more than 5% or 6%.

“In 2020, especially in the spring, those food away from home sales fell by 20%, 30%, 40%, almost 50% in a couple of months,” he explained. “While it was quite a difficult period, it showed how the industry and our supply chains were able to respond quite quickly to what was a really unheard-of situation for us.”

By April 2020, only one-third of all food consumption in the US was consumed away from home, and two-thirds was consumed at home. The US hasn’t seen data like that since the early to mid-1980s.

“To think we've lost decades of food service sales during the spring of 2020, it really encapsulates what was such an uncertain and volatile period, but the volatility isn't over,” he said. “By spring of the coming year, we may have lost one-quarter of the restaurants in the US, and that's going to leave a hole in demand that's going to take time for the food service industry to rebuild.”

Poultry demand in the US and many markets around the world has been lost, but it’s not going away forever. Convenience and the consumers' demand for convenience is as strong as ever. Sawyer says the restaurant industry will climb out of this period, but it's going to take time.

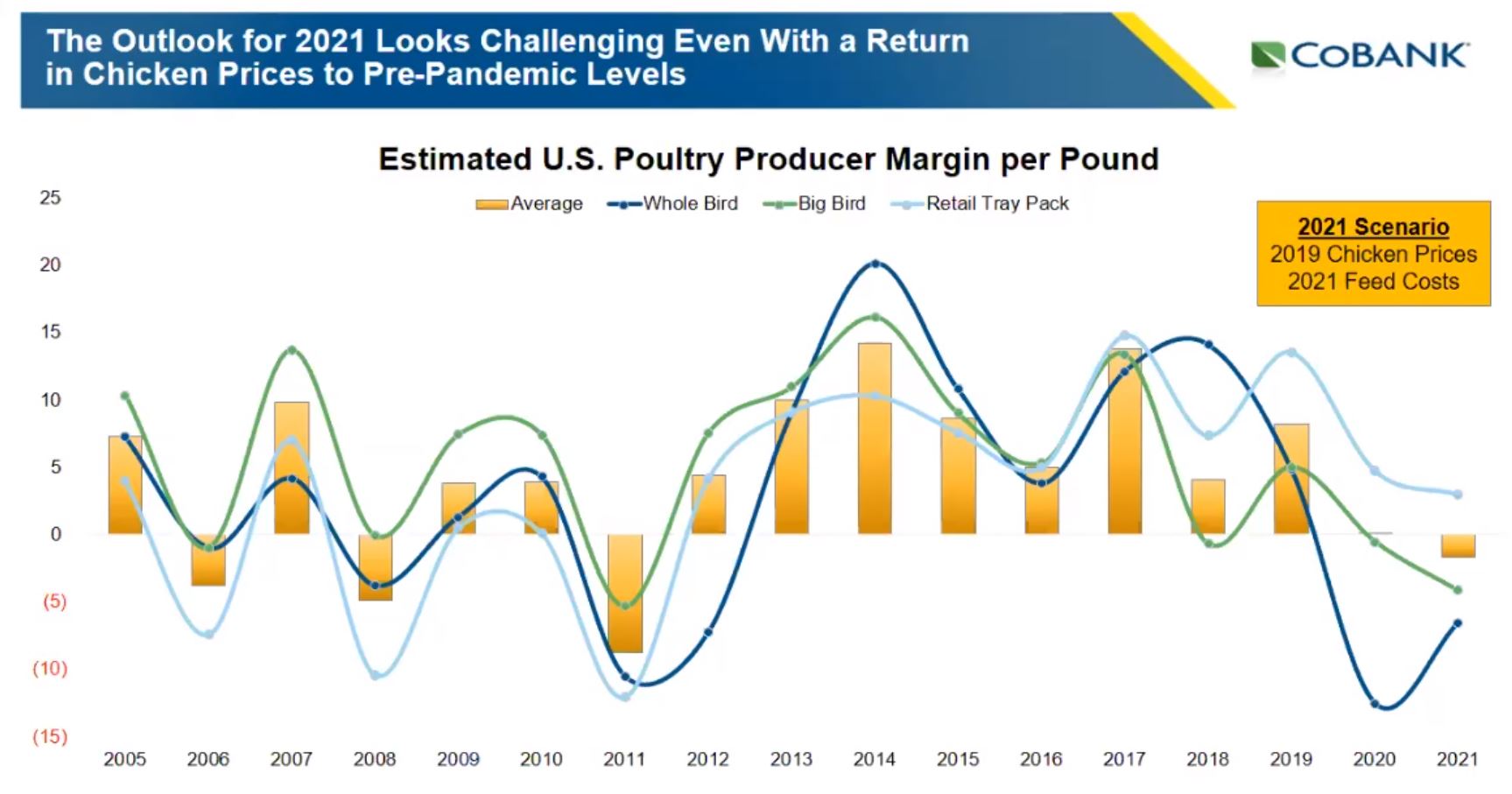

© Will Sawyer, CoBank

“We think it's going to be 2022 or 2023 before food service sales can get back to prior to pandemic levels,” he said. “When we think about profitability in poultry, 2020 may have been a breakeven year. We all know 2020 was a very difficult year, and I don't have a forecast for 2021 profitability or 2021 chicken prices. But when I think about a possible scenario, feed costs are going to be a major headwind and that's quite clear. If I think about a scenario where demand and prices for chicken in the US go back to pre-pandemic levels of 2019, you can still see that the industry's profitability is far from being back to positive levels. And that's a real challenge as the industry has seen strong margins since 2011, the last time we saw significant inflation in feed costs.”

This evolution for poultry industry profitability isn't as poor as what it was in 2011, but it's still negative. The big bird side of the sector will continue to be especially stressed and whole bird as well. CoBank’s outlook is not based on today's prices, but a scenario with an assumption of 2019 prices.

Sustainability will be 2021 driver

Many customers and consumers around the world are focused on sustainability and sustainable practices. Businesses are considering how to evolve their business and supply chain to try to capture improvements in a way that can positively impact the environment.

“It's an issue that's getting a lot of attention, and we think rightly so,” he noted. “At CoBank, we're going to be spending more time in the year to come to talk about and think about how sustainability fits into our outlook for US animal protein. What's the industry doing today to help improve the sustainability of their business? Because we know that's always been a part of their business model, but it's becoming an increasing priority.”

Final thoughts

© Will Sawyer, CoBank

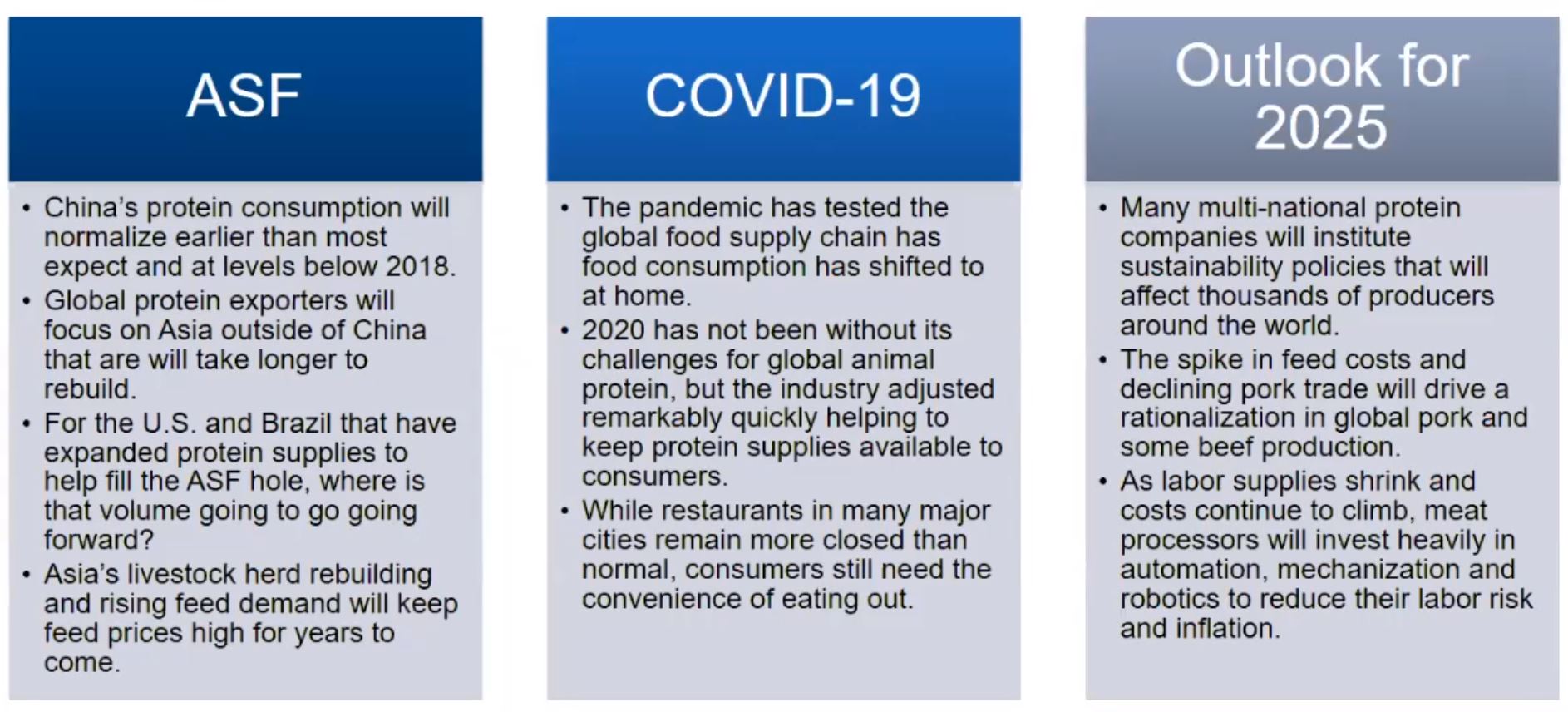

- ASF and COVID-19 issues go hand in hand, driving many significant shifts and volatility.

- 2020 was a significant step change which has created shifts in global demand growth for protein around the world, but it should plateau.

- Individual countries, individual companies, and producers will need to think more critically about their market share and their competitiveness around the world, which comes in many shapes and sizes. It's not all about feed conversion ratio and cost of production. There are other variables, such as ethics and politics. Many of these things are outside of our individual control, but we can see significant change from them.

- As China and other parts of Asia rebuild their protein supplies, those who have expanded supplies around the world, including the US and many parts of South America, will need to think about how to build more strategic relationships with our customers. Trade is and always will be critical to our growth, but we need to think critically in the next few years as these supply and demand markets evolve.

- CoBank’s outlook for 2025 includes expectations for many companies to invest in sustainability, including best practices that try to reduce the environmental impact of their businesses. This is seen as being an important part of the outlook for the agriculture industry.

- Higher feed costs will drive some producers and processors toward consolidation around the world.

- While the protein supply chains around the world responded amazingly fast over the course of Spring 2020, we know that our human impact in our processing plants is not something that we can take for granted. The industry has invested heavily in the last year to help reduce the risk of COVID-19, and this will continue. An area of investment will be increased automation and mechanization.